Club financial analysis: Sporting CP 2023/24

Game State's analysis of Sporting CP's 2023/24 financial results.

Note: A Portuguese translation of this article can be found here/Uma tradução portuguesa deste artigo pode ser encontrada aqui.

Sporting Clube de Portugal, or Sporting CP for short, enjoyed a stellar 2023/24 season, winning their 20th Primeira Liga title and only their second since 2002. Along the way they broke club records for the most points earned (90) and most wins (29) in a domestic season and won all 17 of their home league games, another club first. On an individual level, new signing Viktor Gyökeres ended the season with 29 league goals, one shy of becoming just the eighth player in Sporting history to notch 30 in a single season.

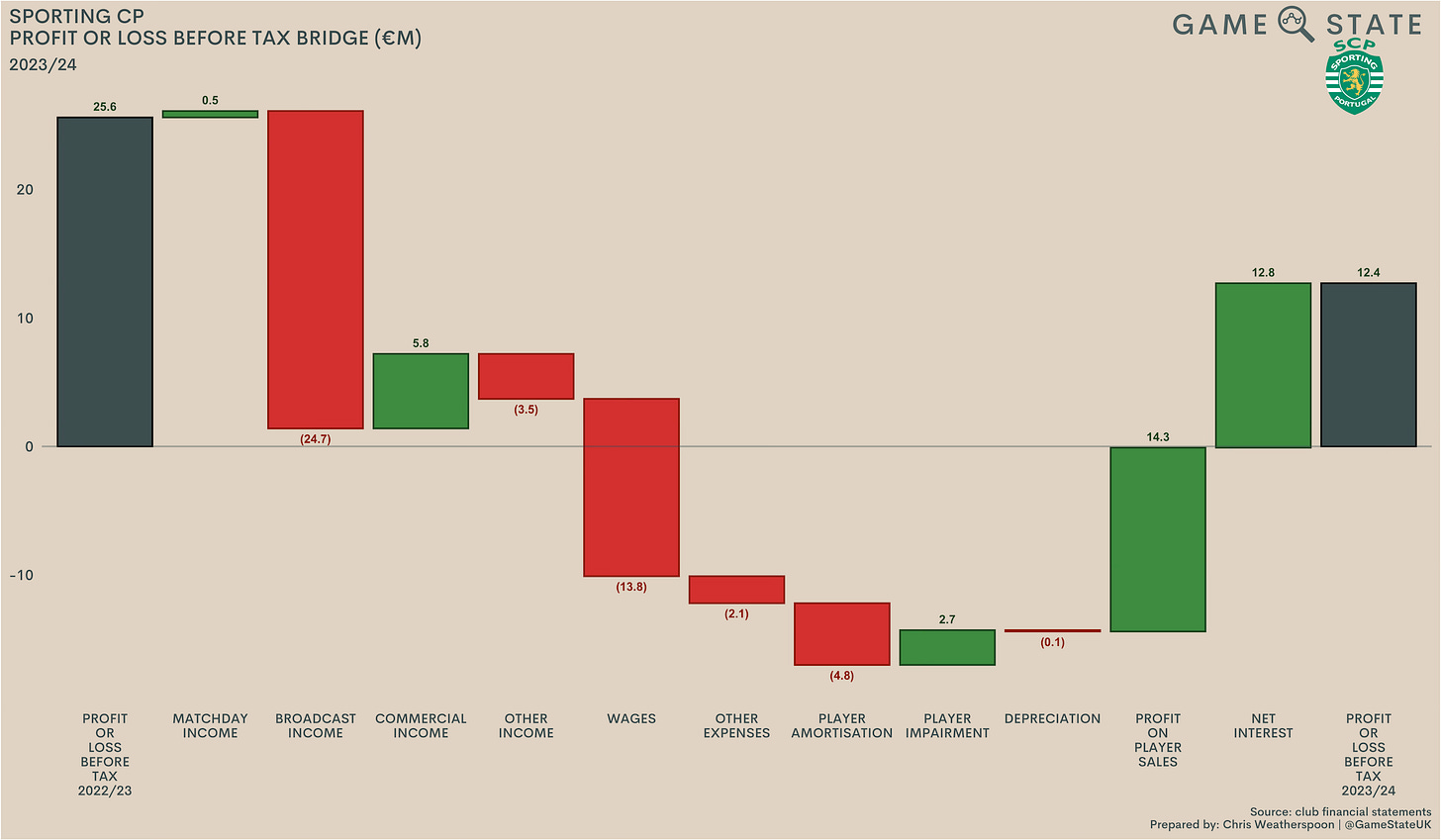

Sporting’s return to Portugal’s peak was accompanied by another positive year off the field, as the club recorded their fourth profit in five seasons. That came in spite of them missing out on Champions League football, which was the key contributing factor in the club’s €12 million surplus being half as much as they earned in 2023.

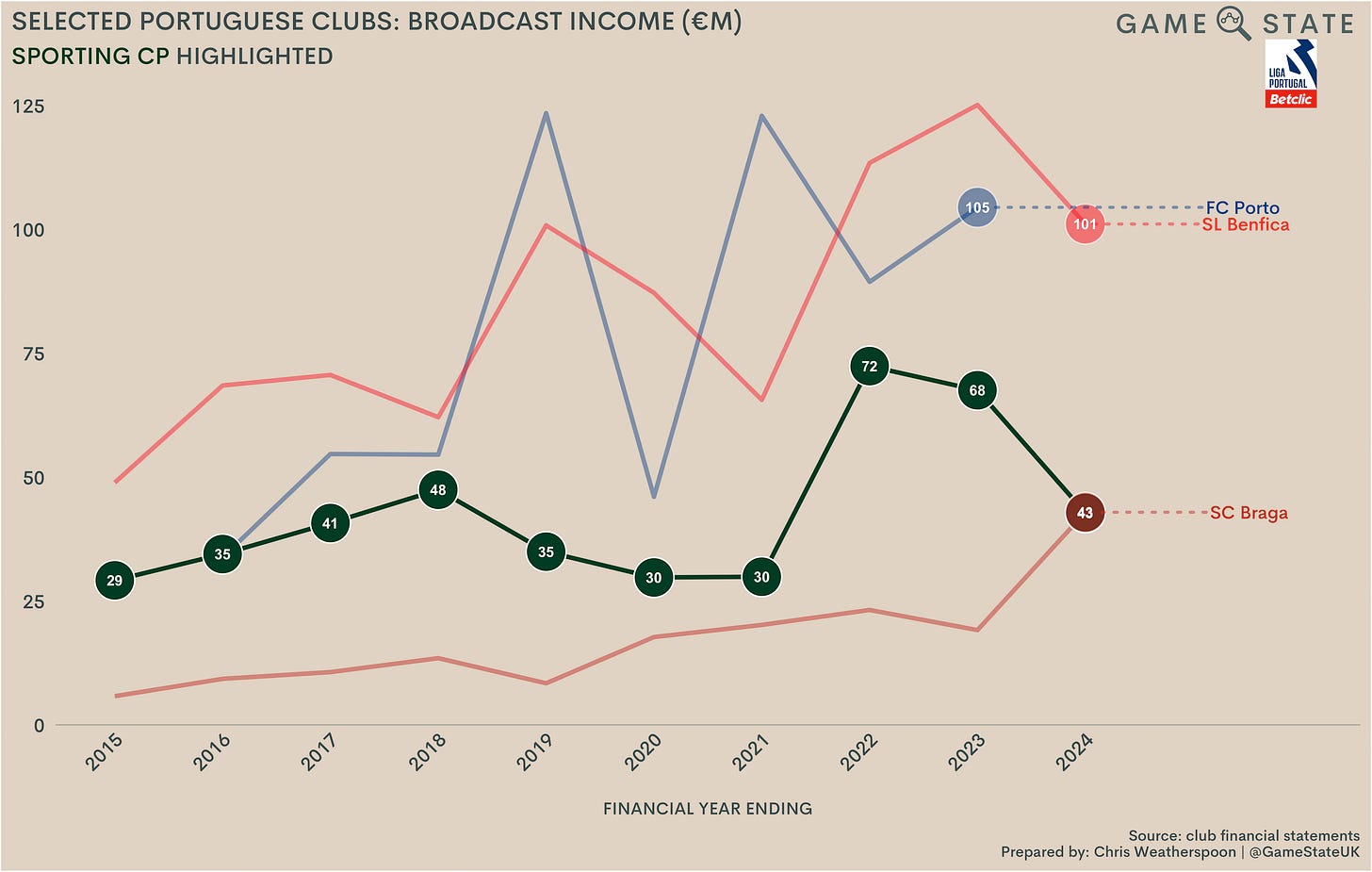

Alongside a €25 million fall in broadcast revenues, Sporting saw player costs increase too, eating into their profitability. Wages were up €14 million (18 per cent) and player amortisation increased €5 million to €36 million, reflecting a record €77 million spend on new players last season.

In turn, that was offset by €14 million (17 per cent) extra in player sale profits, as the bumper sales of Manuel Ugarte (€60 million to Paris Saint-Germain) and Pedro Porro (€43 million to Tottenham Hotspur) helped generate nearly €100 million in trading profit. Even so, the extent of the loss European income was such that those profits only got Sporting back to break-even; the club’s €12 million surplus was made possible by a €13 million favourable swing in net finance costs, arising from gains that crystallised upon the club restructuring its debts in December 2023.

Profit and loss account

Sporting have now booked a profit in six of the last 10 seasons, though some chunky losses in the other four years reduced the last decade’s net profit to €37 million. Still, save for a hefty loss in the Covid-hit 2020/21 season, Sporting have performed well off the field - and especially so given the relative lack of riches in Portuguese football.

Sporting are the third Primeira Liga club to release 2023/24 financials, alongside SC Braga and SL Benfica. Their €12 million profit was edged by Braga’s own €14 million surplus last season, but did represent a €43 million bettering of Benfica’s €31 million loss last season.

Using the most recently released figures from Primeira Liga clubs also pits Sporting second in terms of best financial results, something which is likely the case even were we to uncover the numbers for the six clubs who haven’t released their accounts publicly. Outside of Sporting, Braga, Benfica and FC Porto, clubs in Portugal work to far smaller budgets, which in turn gives rise to profits and losses within a fairly narrow range.

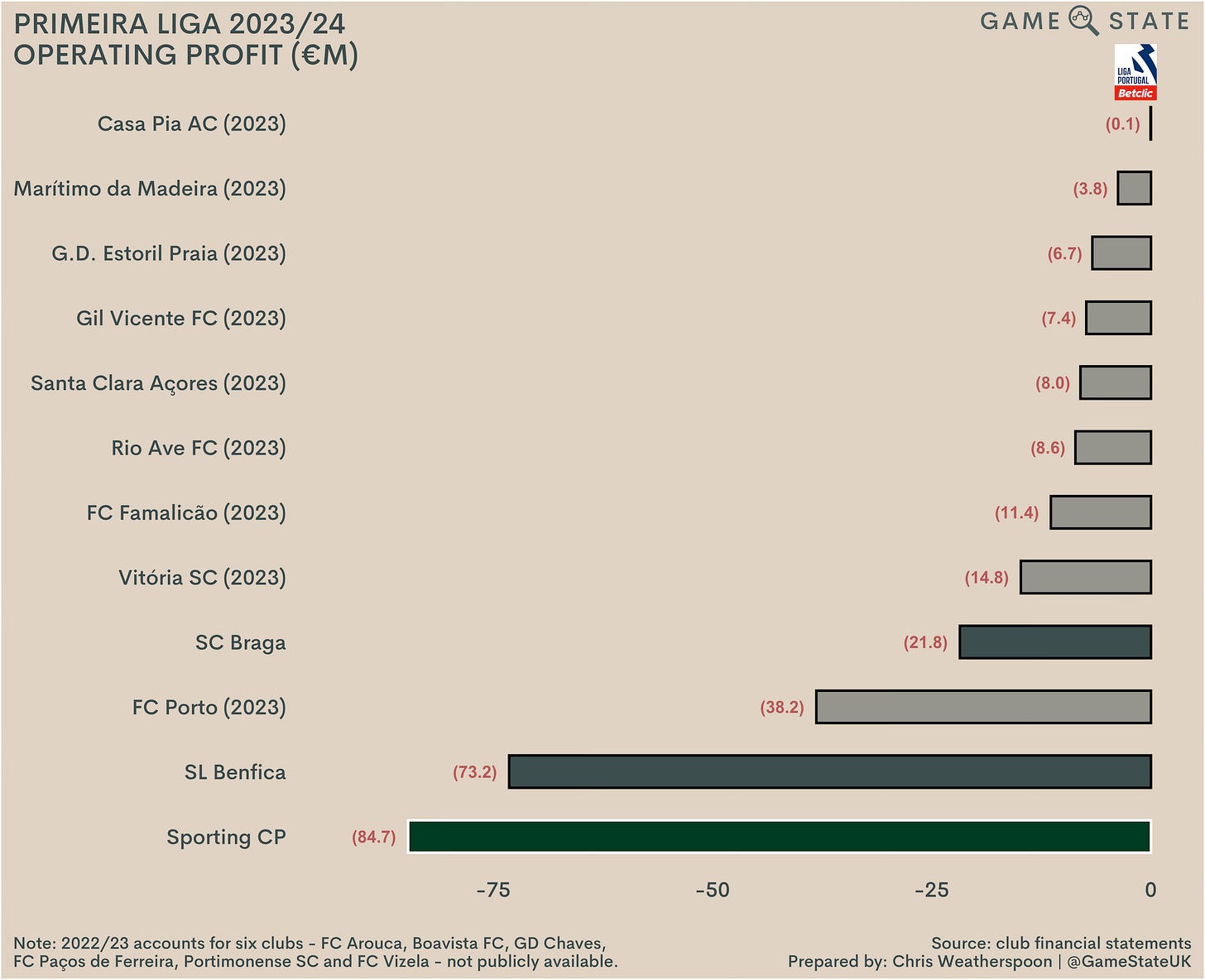

Despite that overall profit, Sporting’s result at the operating level - i.e. before player sales - was the worst in club history. An €85 million operating loss represented a near doubling of a year earlier, as increased wages and transfer spend combined with falling TV income to push the club’s day-to-day losses to new highs (or lows).

Booking an operating loss is common for a lot of football clubs nowadays, and especially so in Portugal. Even so, last year’s €85 million deficit takes Sporting’s losses in the last decade to a chunky €422 million. In other words: without the monies reaped from player sales, the club would be insolvent.

Sporting’s operating loss is the worst of any Portuguese club’s most recent results, albeit with Porto’s 2023/24 accounts still to be released. Of the 12 top tier clubs for which we have figures, all 12 booked an operating deficit, with the divisional loss across those clubs currently standing at €279 million, or €23 million per club.

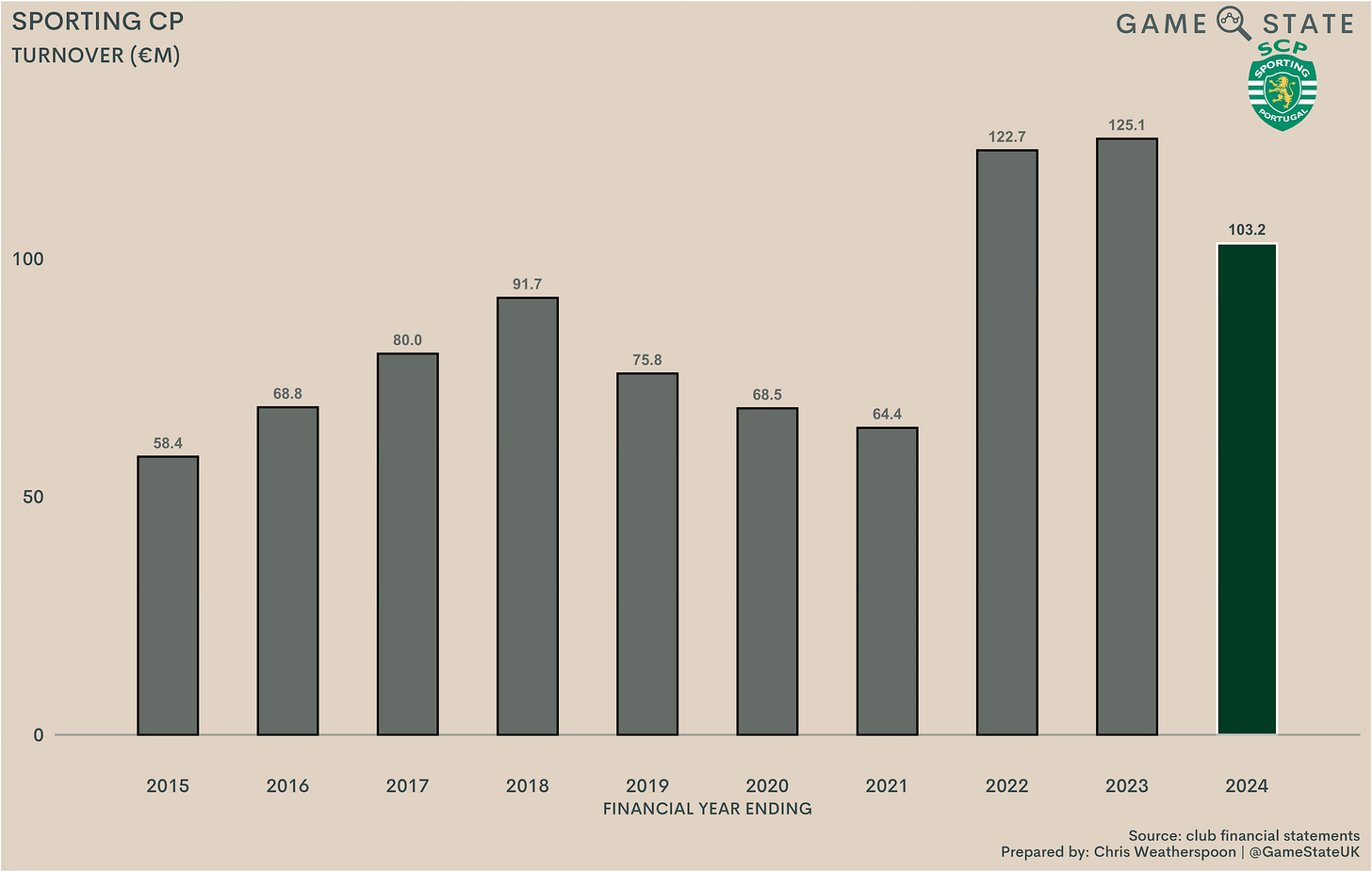

Turnover

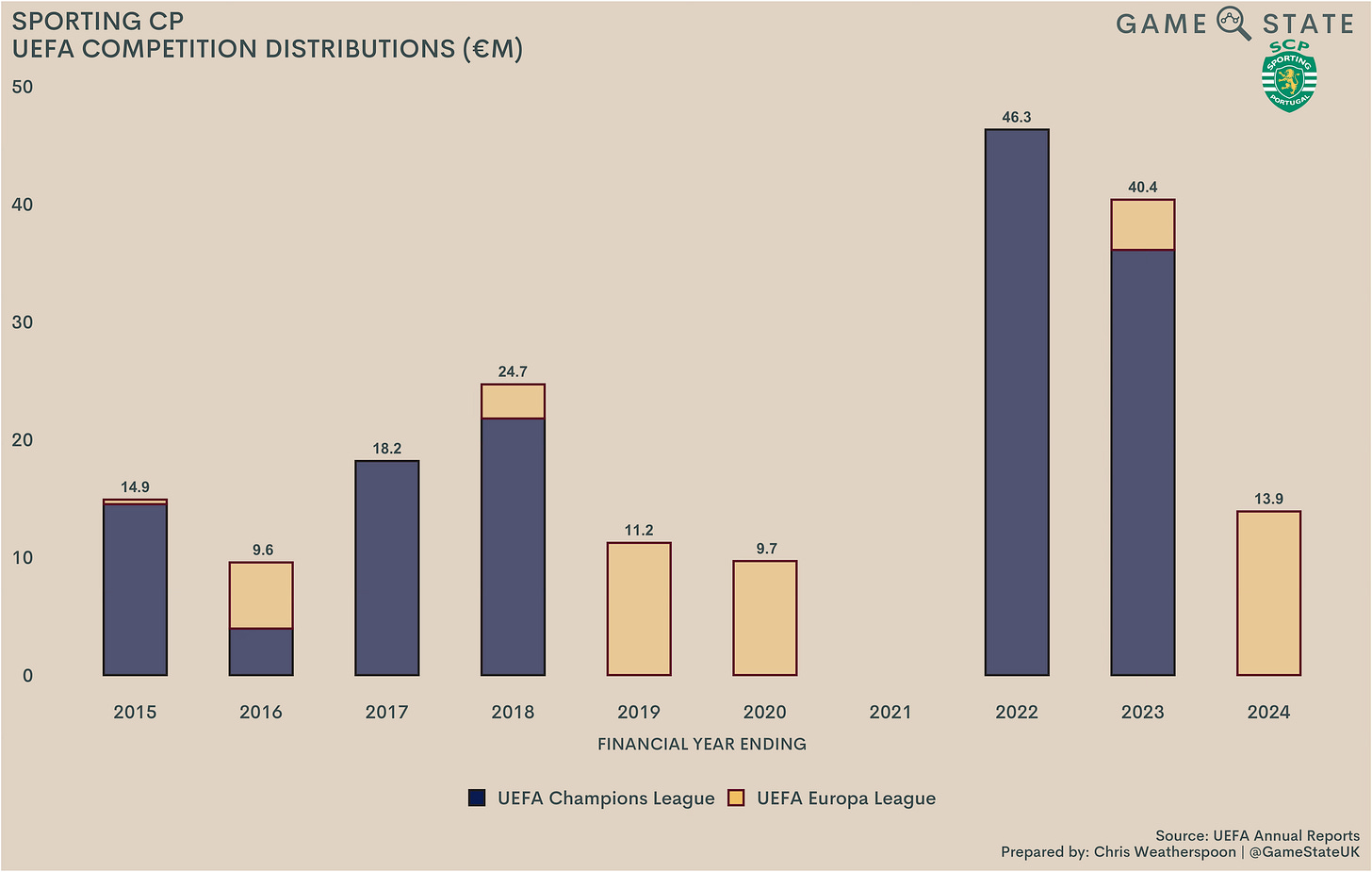

After club record turnover in 2023, Sporting’s revenue drooped last season, down €22 million (18 per cent) to a shade over €100 million. That was still only the third time the club has booked nine-figure income, and the fall was entirely down to the lack of Champions League football, as European broadcast revenues fell from €40 million to €14 million.

Even with the third-highest figure in club history, Sporting’s revenue figures reflect the difficulties even Portugal’s largest clubs have in generating sums from traditional income streams. Sporting were knocked out of last season’s Europa League by eventual winners Atalanta, a club which despite being far from one of Italy’s historic big guns booked around €120 million revenue in 2022/23, €20 million more than Sporting, even without playing in European competition that year.

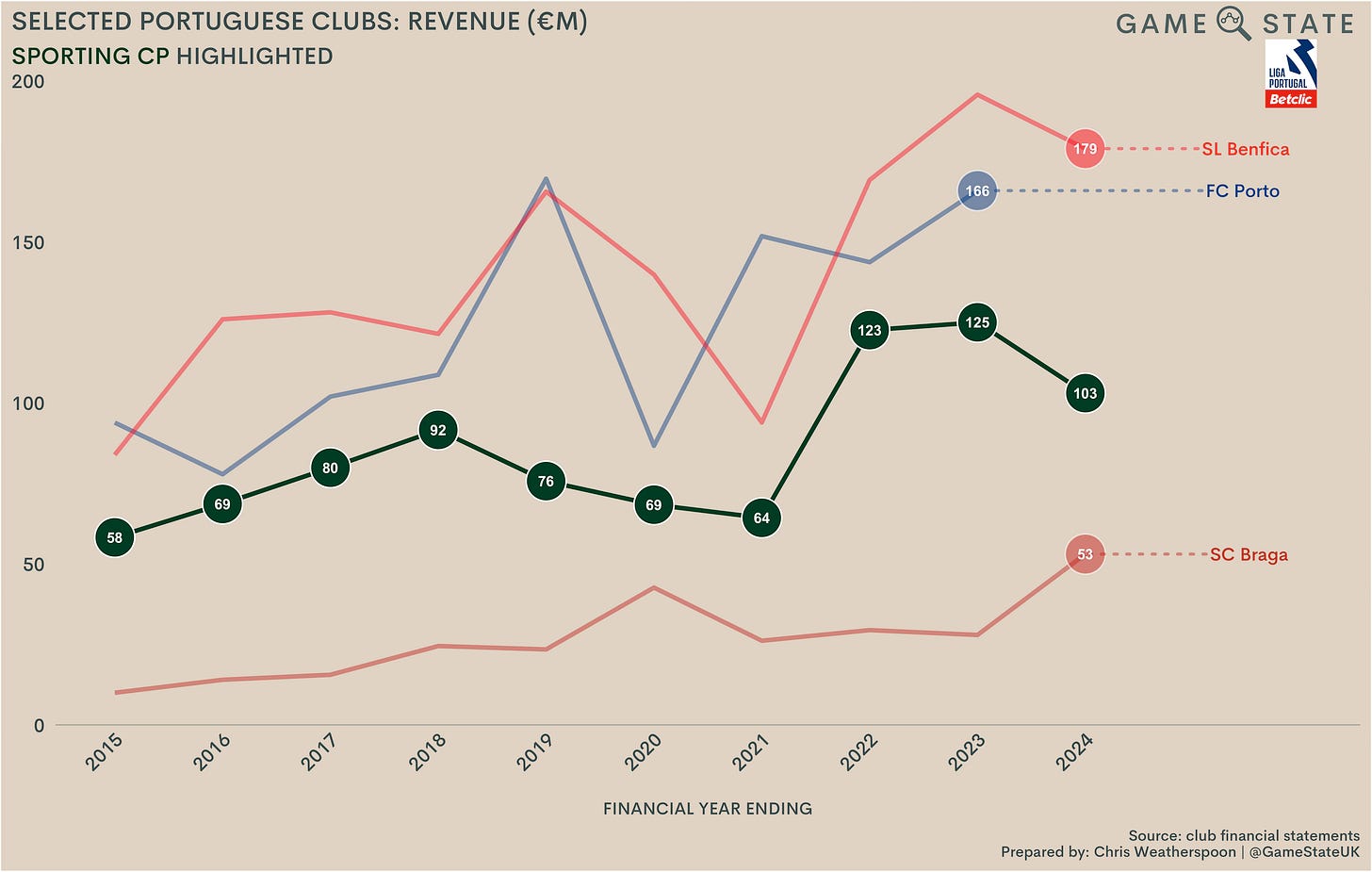

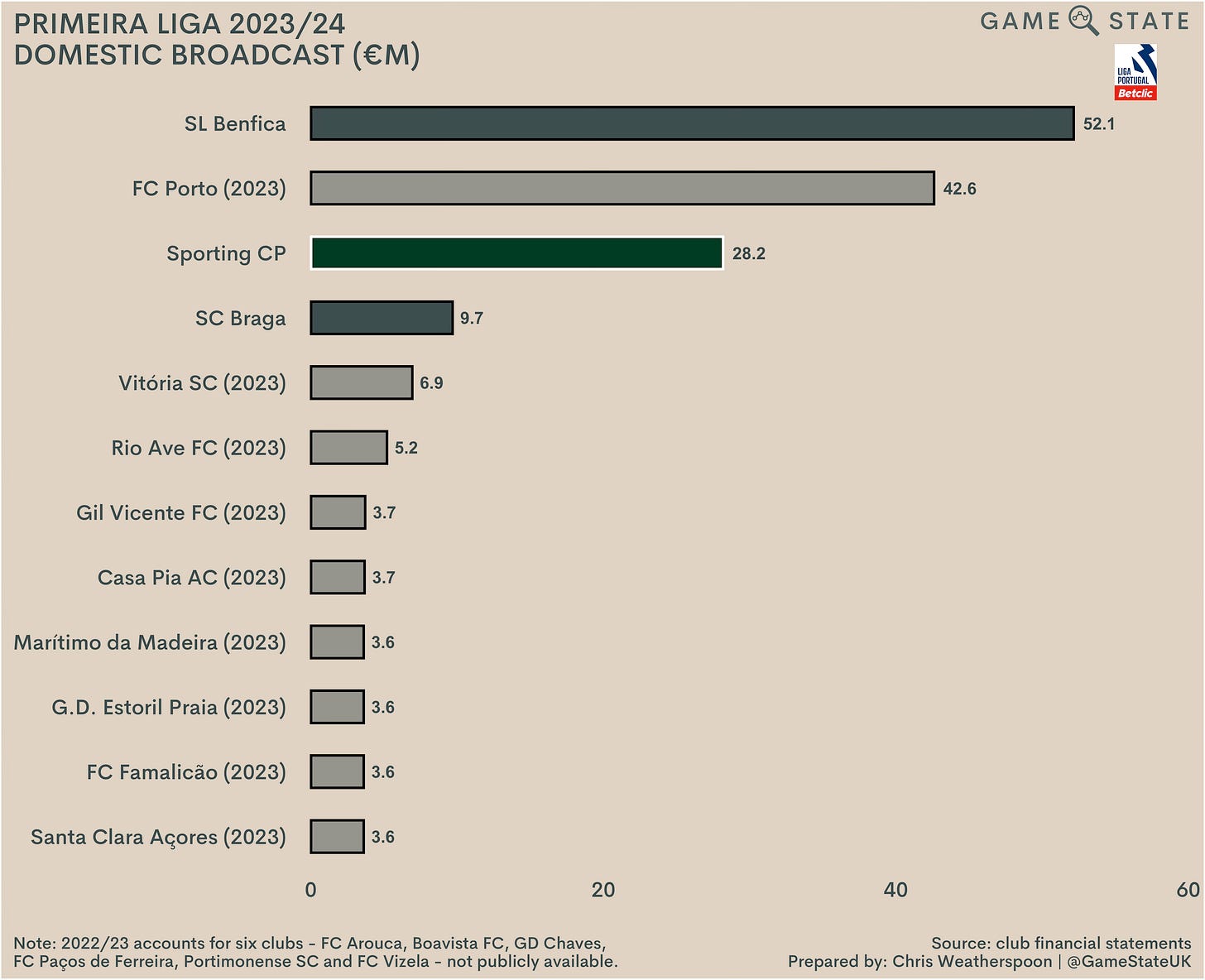

The revenue disparity between the top three Portuguese clubs and the rest is enormous, so Sporting’s drop-off still pits them in third. Yet Benfica booked €76 million more last season, a sizeable competitive advantage for the fellow Lisbon outfit.

Benfica booked €49 million in Champions League income, well ahead of Sporting’s €14 million from competing in the Europa League, but Sporting also trail their neighbours in other, more certain revenue streams. Benfica topped Sporting by €24 million in domestic TV income, and by €15 million in matchday income, both areas Sporting will hope to improve in via good on-field results.

Over the past decade, Sporting have failed to usurp Benfica or Porto in the revenue stakes, consistently staying in that third spot. That said, things may well change this season, with Sporting in the Champions League while Porto have to make do with the Europa League.

Matchday income

After several years of fairly disappointing attendances, not entirely attributable to the pandemic, Sporting’s stadium utilisation (essentially, average attendance as a proportion of stadium capacity) hit 80 per cent in 2023/24, the highest point since 2018.

Sporting’s Estádio José Alvalade home holds some 14,000 fewer spectators than Benfica’s ground, reflected in that lower matchday income. Yet Benfica’s attendance advantage last season was actually even higher than that; Sporting will hope continued good form will see home crowds continue to increase.

Last season did actually represent Sporting’s highest ever gate receipts, so it seems a safe bet that will repeated this year with the added bonus of the Champions League.

Gate income in Portugal is generally pretty small, mirroring the dearth of crowds at the homes of all but the biggest clubs. Sporting’s €20 million in gate receipts is the second-highest in the Primeira Liga, a long way behind Benfica but almost as far ahead of Porto, who booked just €11 million in matchday income in 2023.

In their case it will be worth keeping an eye on: one of Andre Villas-Boas campaign promises in his successful election the club’s presidency earlier this year was to root out graft and corruption, and many observers have long suspected Porto’s hierarchy of giving away cheap or even free tickets to supporter groups in return for loyalty at the ballot box.

Broadcast income

Unsurprisingly, Sporting’s TV revenues fell substantially, down €25 million and 37 per cent from 2023. That was entirely driven by diminished European revenues; matchday, domestic TV and commercial incomes all rose, albeit only modestly in the case of the former two.

Sporting, like their fellow Portuguese clubs, are arguably disproportionately impacted by the lure and lucre of European football. One reason they and the likes of Benfica and Porto carry such high wage bills is in order to remain competitive in the Champions League, but missing out on the latter can leave them in a sticky spot. Player contracts run over a number of years while European revenues can fluctuate year-on-year, leaving clubs reliant on that income stream with potential gaps to plug.

That was the case for Sporting last season, as underlined by their big operating loss. Having said that, it was only in the two seasons prior that the club reaped relatively big sums from Europe, something their presence in this season’s engorged Champions League will see them return to. In all, the club has earned around €186 million from European broadcast income in the last decade, against €240 million domestically.

Based on latest financials, Sporting’s overall broadcast income was the fourth-highest in Portugal, albeit Braga just barely pipped them into third place. Again, the influence of Champions League football is clear to see, with both Porto and Benfica way out in front.

In effect, there are three tiers of broadcast income in the Primeira Liga: clubs in the Champions League, clubs in other European competition, and the rest. Braga’s presence in the Champions League last season offset their otherwise paltry TV money; everyone else other than the ‘big three’ makes very little money from domestic broadcast deals.

Indeed, the majority of top tier clubs make the same amount of around €3.6 million each season from domestic TV rights. Sport TV hold the rights to the home games of 17 of the 18 Primeira Liga clubs (Benfica are the exception), helping to explain why fees are largely uniform.

Having said that, Sporting will doubtless hope to improve their domestic TV contract when the time for renewal comes following the end of the 2028/29 season. Based on most recent figures, their domestic deal trailed Porto by €14 million (51 per cent) and Benfica by €24 million (85 per cent).

One potential impediment to that is the stated aim of Liga Portugal (LP) and the Portuguese Football Federation (FPF) to centralise the sale of Primeira Liga TV rights. With the clear financial advantages currently held by Portugal’s big three clubs, the centralisation plan is aimed at increasing competitiveness and raising the income and profile of the league’s other 15 sides - a scenario Sporting and their illustrious peers will doubtless rebel against when the time comes. In LP and the FPF are successful, Sporting and co. would likely see domestic TV incomes decrease rather than improve.

That’s still a way off in the future, and in the here and now Sporting have generally been stuck in third when it comes to TV income in Portugal. That should change this season amid their qualification for the Champions League and Porto’s failure to do so.

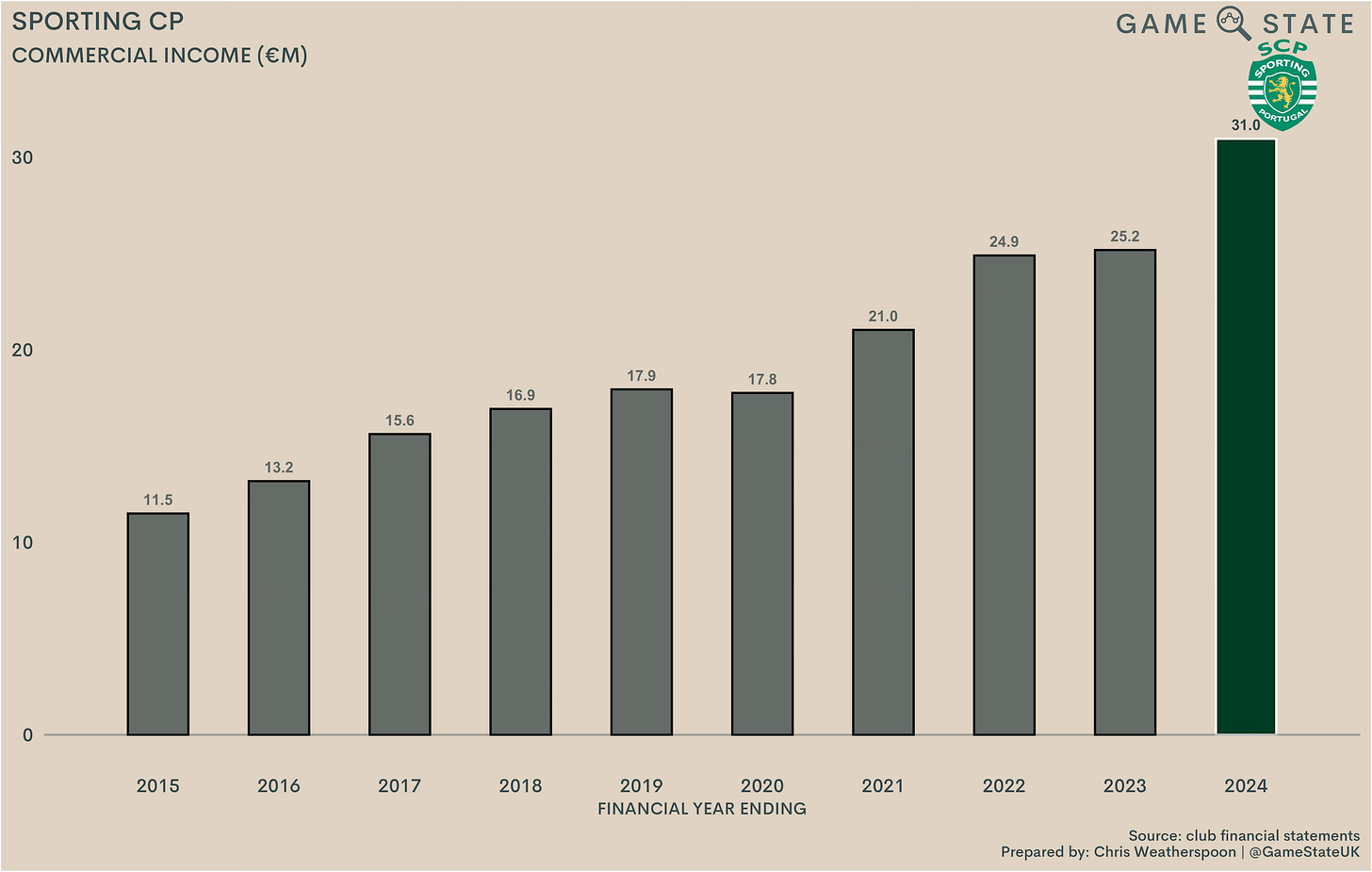

Commercial income

Sporting enjoyed impressive commercial growth of 23 per cent, taking them to a club record €31 million. That was driven entirely by an improvement in their retail offering, as sales of merchandise hit €14 million, another club record and an uplift of 68 per cent on 2023.

Sporting put that down to a ‘cycle of strategic investments’ helping them to develop a strong brand in recent years, citing innovative kit launches and, in particular, the success of the third kit they launched last season to commemorate the anniversary of the club’s 1964 Cup Winners’ Cup victory. It is the happy product of a targeted off-field strategy, though it would be remiss to ignore the fact the club’s on-field successes last season likely played their part too.

As with just about everything in Portugal, there’s a gulf between the big three and the rest commercially. Even so, Sporting currently trail their main rivals by over €10 million, so will again hope good results on the pitch will help them improve from a sponsorship and retail perspective.

Wages

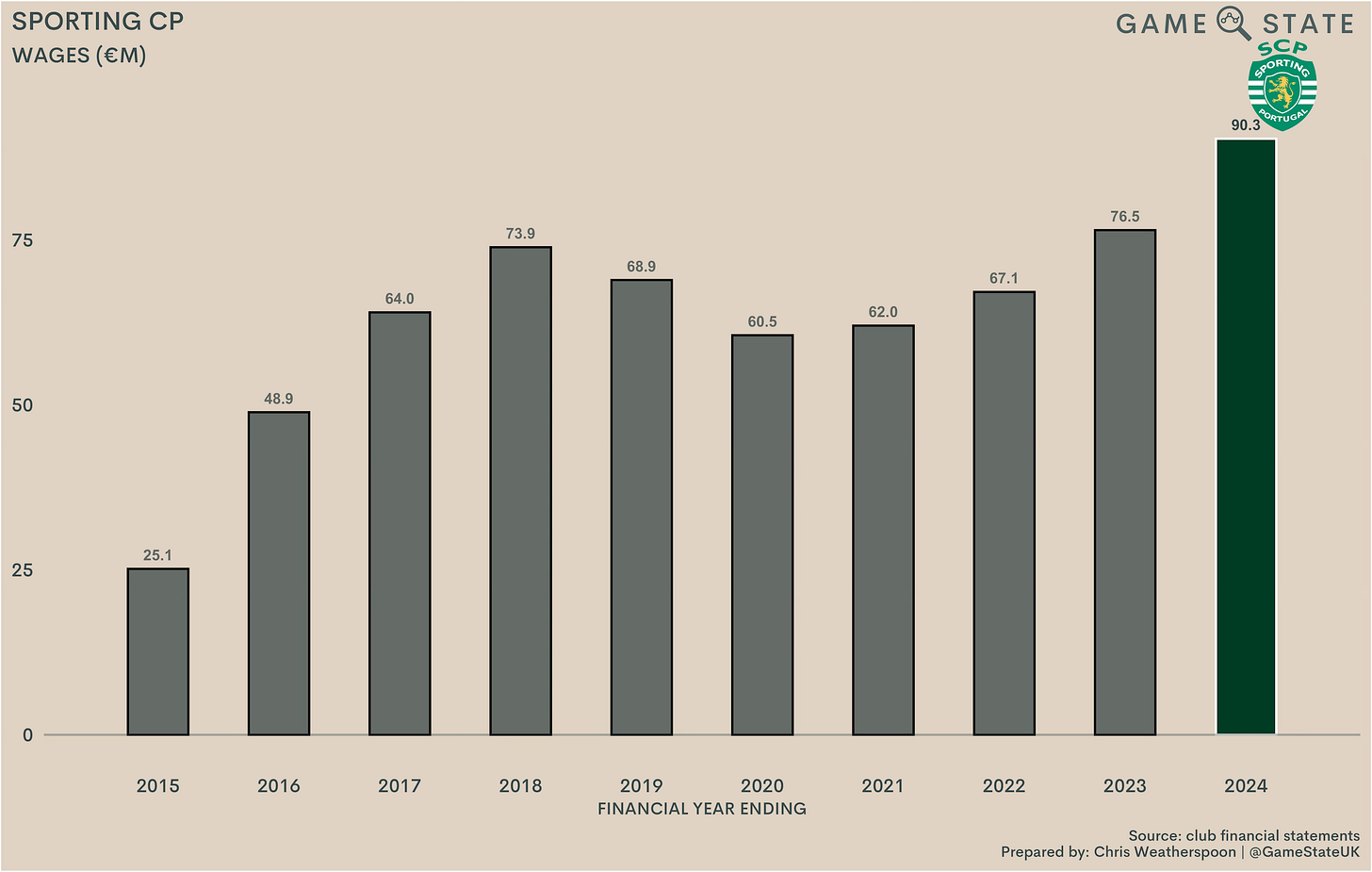

Despite playing in lesser European competition, Sporting’s wage bill hit a club record €90 million, up 18 per cent on 2023. That was driven by both an increase in the underlying wage bill, with the arrival of Gyökeres and the permanent signing of Francisco Trincão meaning the top two highest-paid player spots were newly occupied, as well as €4 million extra in bonuses paid out, principally as a result of the team winning the league.

Sporting’s wage bill has grown 49 per cent in the past five seasons, again reflecting the club’s need to spend to keep up both at home and abroad.

Yet even after that hefty increase, they remain only the third-highest payers in Portugal. As a result, their league win last season was an impressive over-performance, with Sporting finishing 10 points ahead of Benfica despite the latter spending €20 million more in wages.

Third place last season also follows a theme: over the past half-decade Sporting’s €356 million combined spend on wages was again topped by both Porto (€445 million) and Benfica (€521 million).

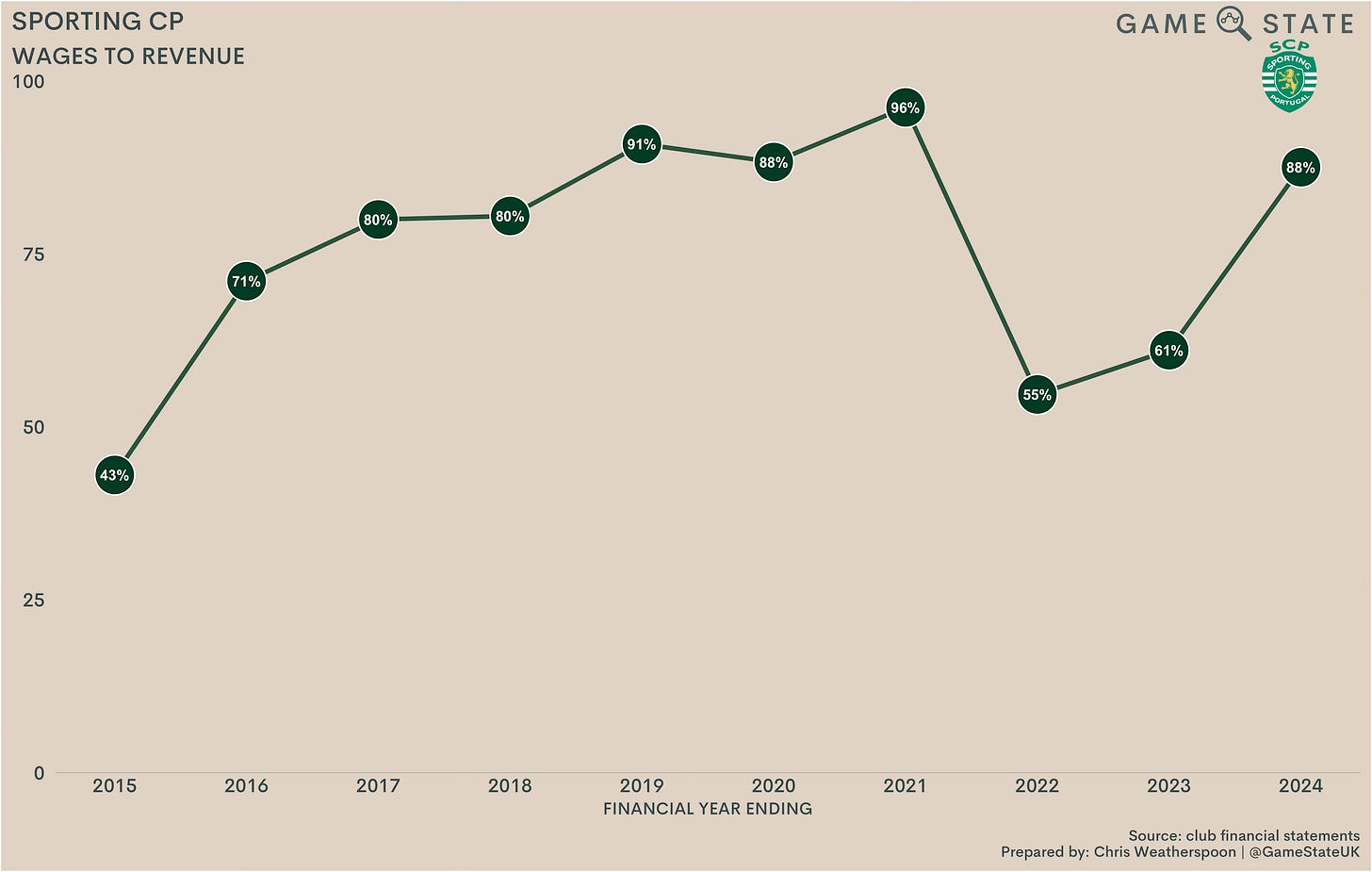

Sporting’s wages to turnover shot up to 88 per cent in 2024, reflecting the 18 per cent wage increase clashing with the same level of income reduction. After two seasons of being comfortably below UEFA’s recommended 70 per cent limit, last year saw the club return to the levels seen during and before the Covid-19 pandemic hit in 2020.

Despite this increase, Sporting’s wages to revenue figure is only the seventh-highest of the 12 Primeira Liga clubs for whom we have recent figures. By far the highest in 2023 were FC Famalicão, who spent double their income on wages, but there were also four others who spent more on staff costs than they recouped in income.

Of course, traditional revenue excludes income from player trading, an activity Portuguese clubs engage in as a key tenet of their operations. That helps explain why, for example, GD Estoril Praia spent nearly one and a half times their income on wages yet were still able to book a small pre-tax profit.

Wages to revenue is an oft-cited metric in football but isn’t necessarily a good litmus test for a club’s financial health. Indeed, it’s probably far less so for Portuguese clubs, who rely more than most on player sales as part of their strategic planning. Sporting last season are a case in point. Were we to include player sale profits in ‘revenue’ for this metric, the club’s percentage would fall from a worrisome 88 per cent to a more than healthy 45 per cent.

Player amortisation

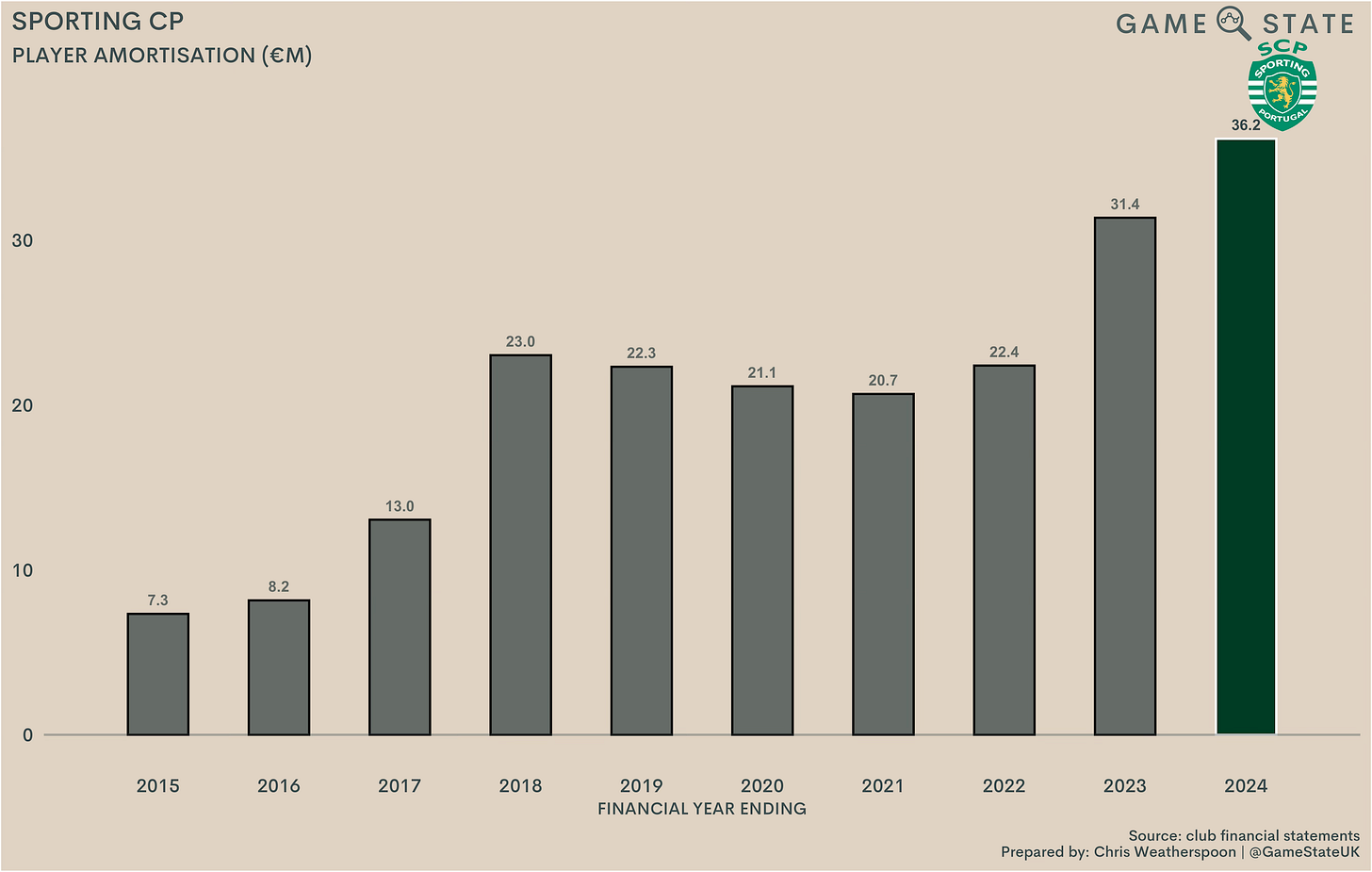

Sporting’s player amortisation, or the annual cost to the club’s P&L via its transfer dealings, hit another club record €36 million, up €5 million from 2023. That was driven by the two big money signings of Gyökeres and Lecce’s Morten Hjulmand.

Correspondingly, Sporting’s player amortisation is the second-highest in Portugal, only behind Benfica (albeit with Porto still to publish 2024 results). The gulf to much of the rest of the division is stark here, as seven of the 12 clubs sampled book less than €2 million per year in amortisation costs.

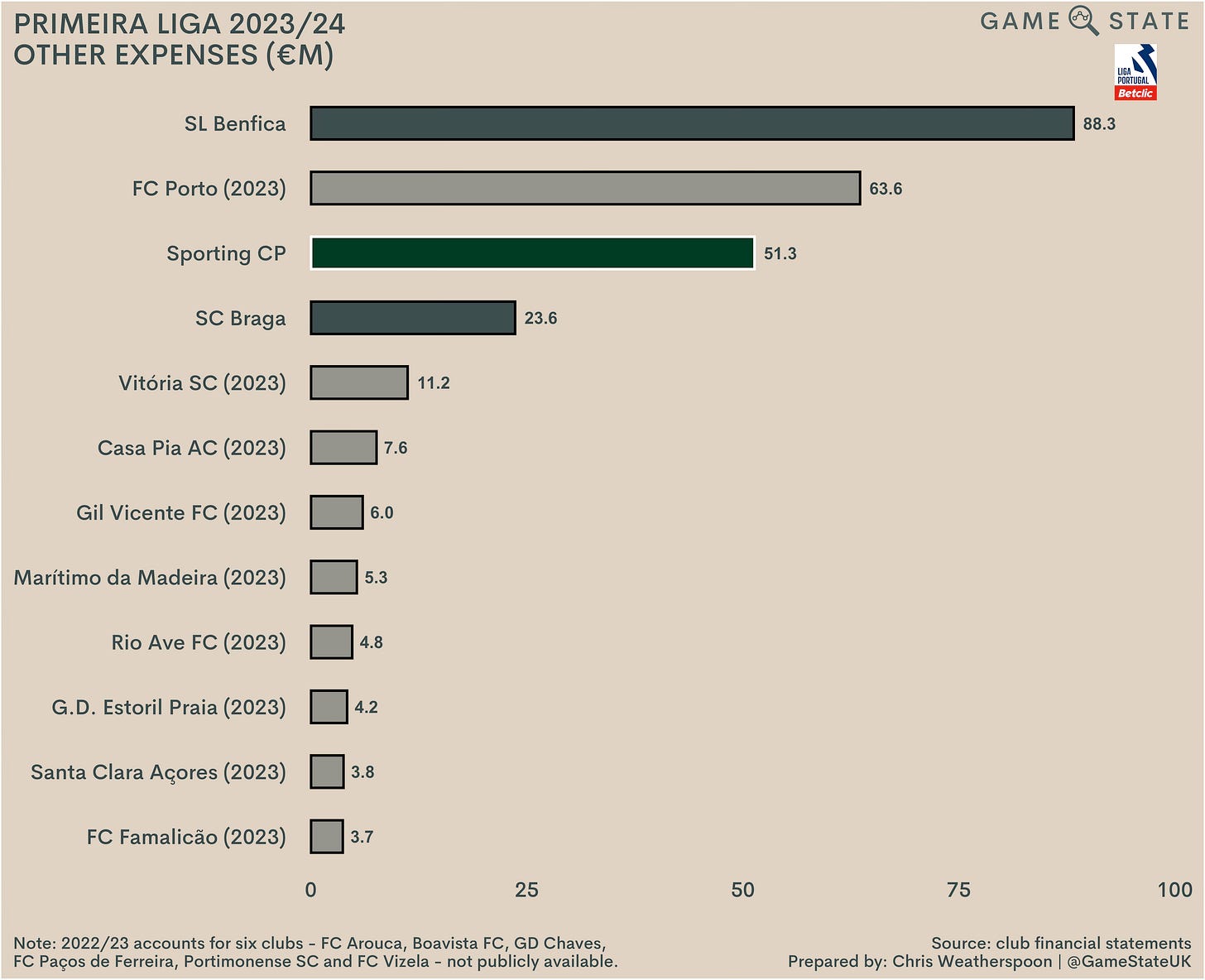

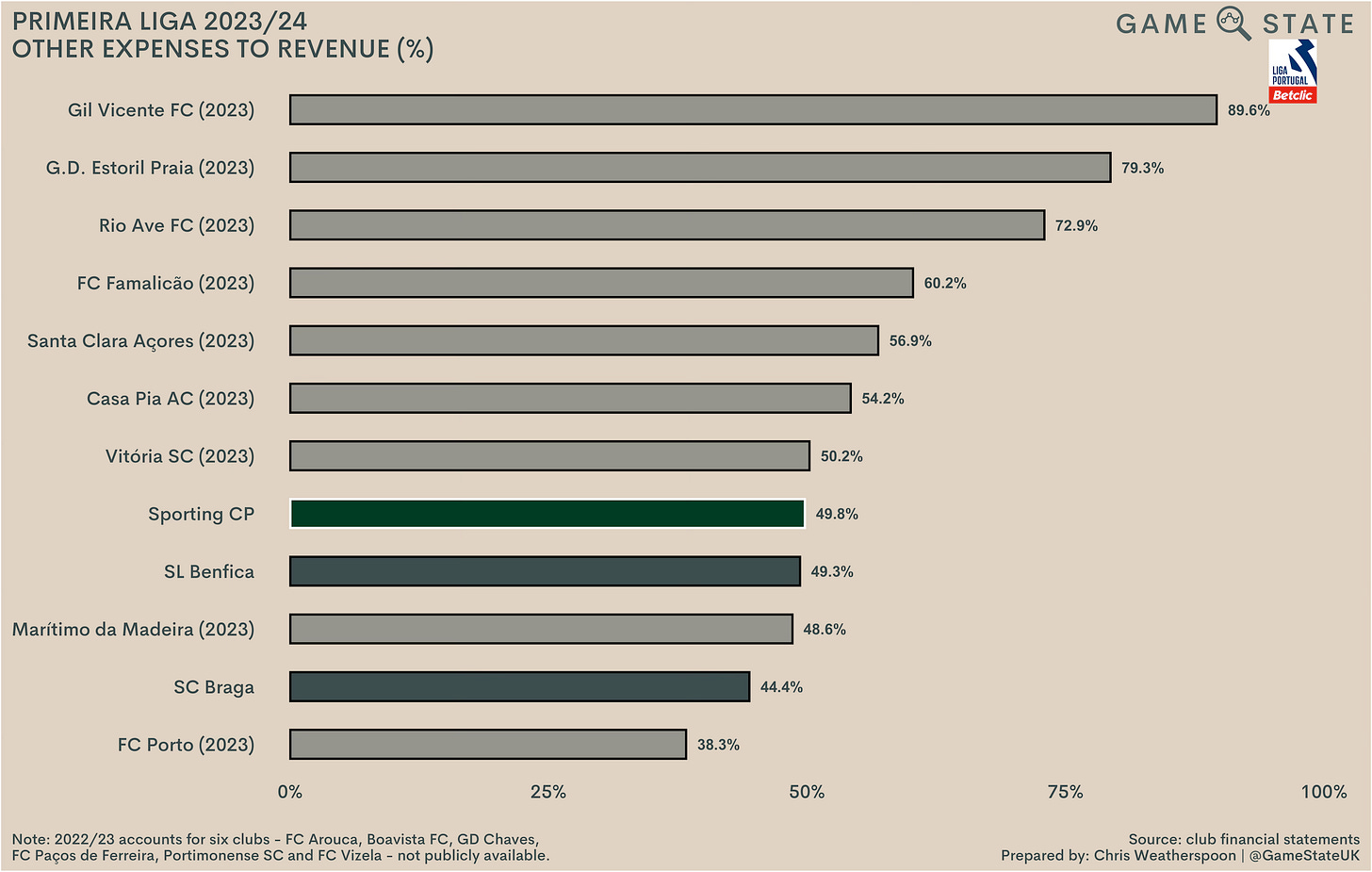

Other expenses

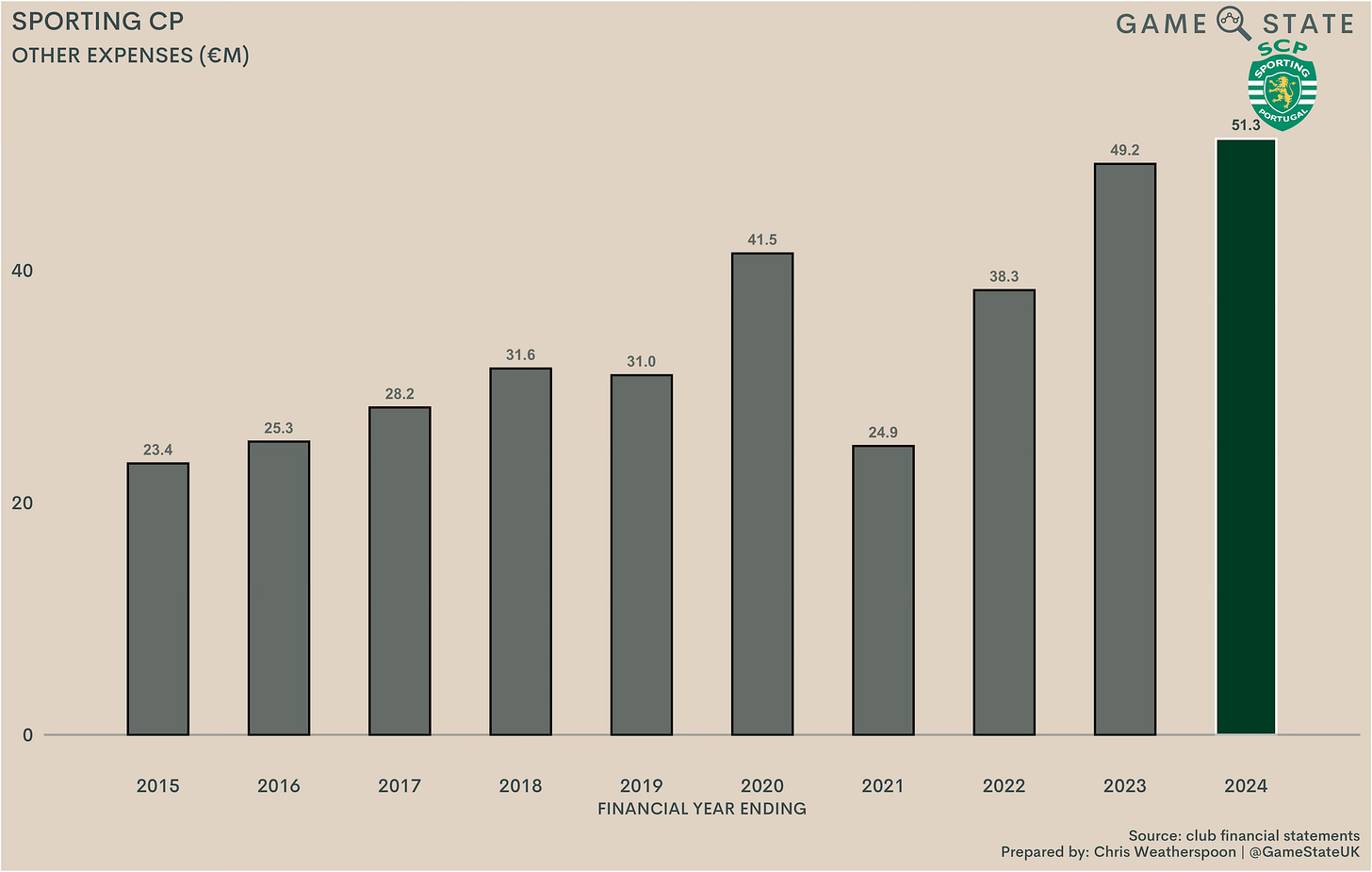

Sporting’s other expenses (effectively, non-staff costs) rose slightly, up to another club record €51 million. The club publishes fairly detailed breakdowns of expenditure, but a comb through of the latest accounts comparative to 2023 reveals no huge swings. Rather the four per cent increase mostly reflects general inflationary uplifts, albeit with some added costs on top.

Again, that pitched Sporting in third, though a fair way behind Benfica’s €88 million. Generally, non-staff costs track to the size of a club’s ground, reflecting the costs of keeping a football club’s biggest piece of infrastructure running. A look at the other expenses of Portuguese clubs largely reflects that.

Of greater concern to clubs is the proportion of income those non-staff and therefore largely fixed costs take up. In Sporting’s case, other expenses were around half of the club’s overall income last season. Combine that with 88 per cent wages to revenue and it’s clear to see why the club needed another income stream - player sales - to get back into the black.

Regardless, that 50 per cent other expenses to revenue was nowhere close to the top end in Portugal. Gil Vicente FC spent fully 90 per cent of income on non-staff costs in 2023, and six others spent a higher proportion than Sporting. Conversely, Porto displayed the lowest percentage, though that will almost certainly increase in 2024/25.

Sporting’s other expenses were a higher proportion of income than was the case for both Porto and Benfica last season, though that generally hasn’t been the case in the last decade, other than in 2019 and 2020.

Player trading

Transfer activity

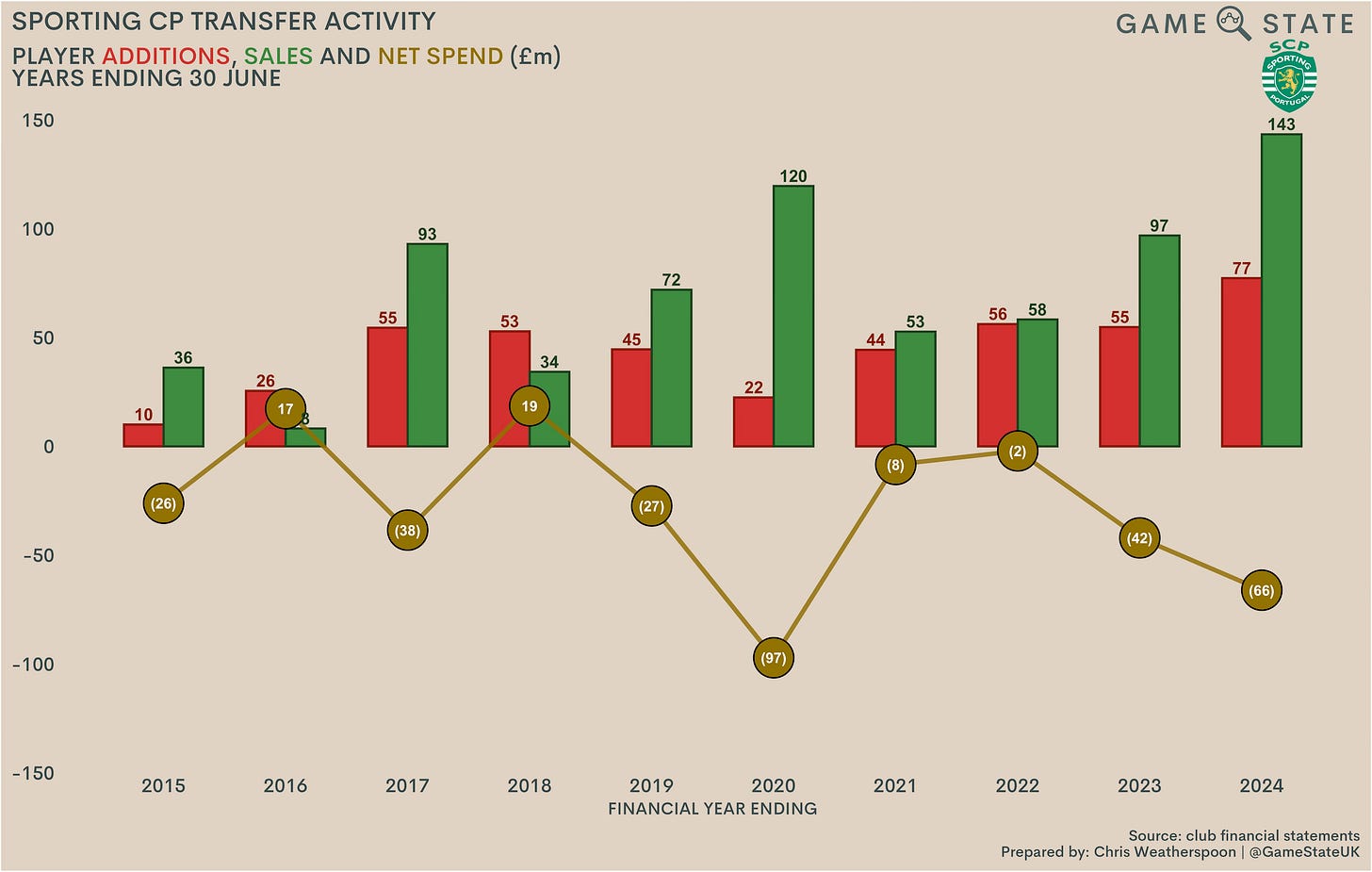

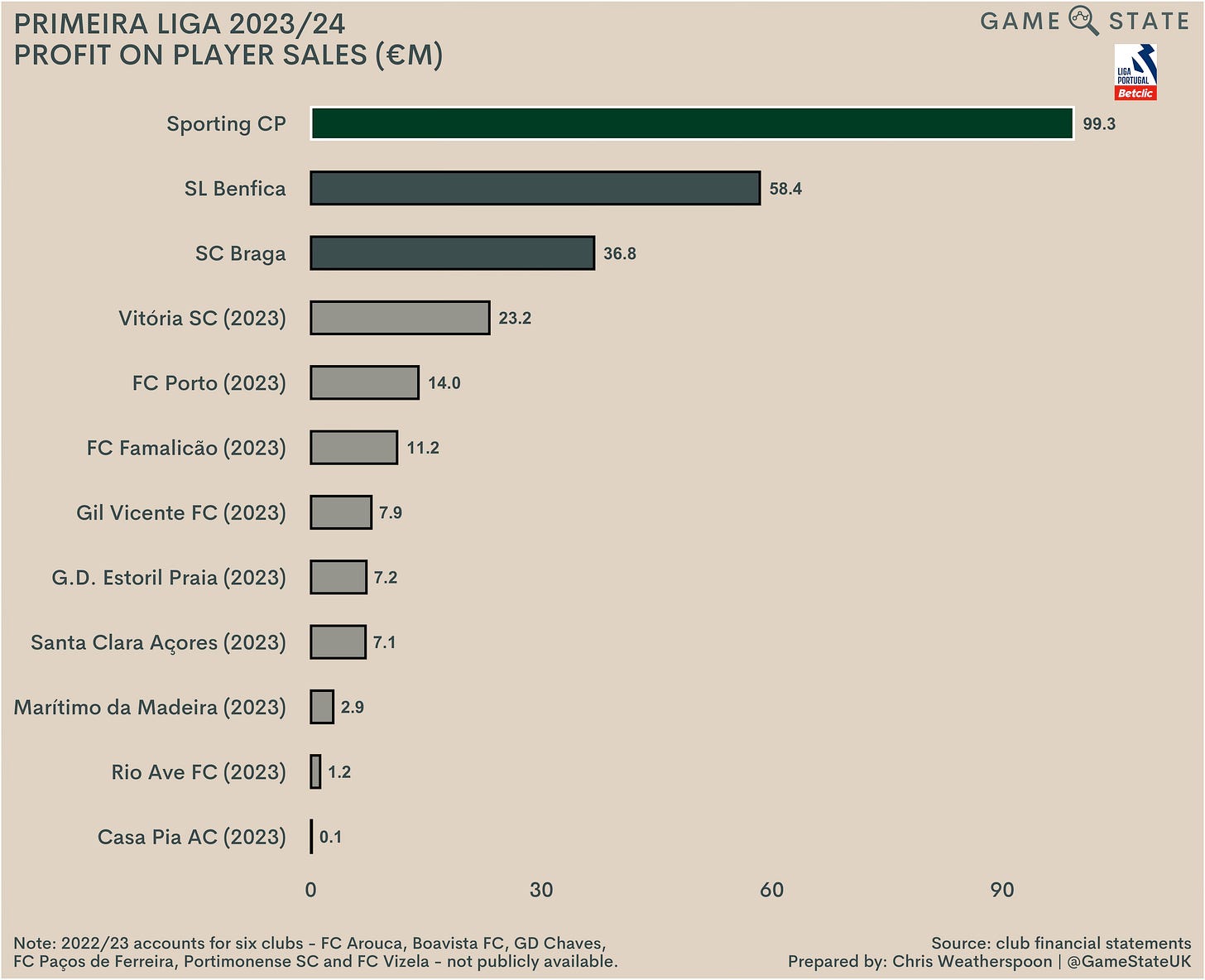

Player trading has formed a huge part of the business model among Portugal’s elite in recent years, as clubs seek to find a way to offset domestic broadcast revenues that are miserly in comparison with Europe’s bigger leagues.

Sporting are no exception, and especially weren’t last season: their €99 million in player sale profits set a new club record. It was hardly a one-off either. 2023/24 was the fourth time in the last eight seasons Sporting have booked €78 million or more in player profits. Across the last decade, the club’s total surplus on player trading stands at €560 million, which is individually more than each of the club’s three main revenue streams. In total, Sporting have booked €714 million in player sales since 2015.

In terms of last year’s transfer activity, Sporting’s net spend was negative for the sixth consecutive year. That was despite the club spending a new single-season high of €77 million on new players, with over half of that going on Gyökeres and Hjulmand. In Gyökeres’ case in particular, it’s hard to argue the money hasn’t been worth it; the initial €20 million spent on the former Coventry City striker has already risen by a further €2 million, as performance-related clauses were hit in his first season at the club (a further €3 million in respect of Gyökeres was spent on associated transfer costs, like agent fees).

In the opposite direction went Ugarte, Porro, Issahaku Fatawy and Chermiti, all for reported fees in excess of €10 million. In all that helped generated the Primeira Liga’s highest player profits, some €41 million ahead of notoriously good sellers Benfica.

2024 looks to be the second year running that Sporting have topped their peers in player profits, having by and large trailed behind Benfica in the past. Where Porto’s player trading has been erratic, and Benfica’s profits have tailed off from the high watermark of 2020 (driven by the sale of João Félix to Atlético Madrid), Sporting have enjoyed steadily increasing surpluses since 2021.

As for which players have driven those chunky profits, Sporting have now sold 12 players for €20 million or more in the last decade. Bruno Fernandes’ €65 million move to Manchester United in January 2020 tops the list - a deal which could still increase by a further €15 million, with Sporting also due 10 per cent of any profit United make on him - and English Premier League clubs account for half of the 20 biggest sales since 2014.

As mentioned, Portuguese clubs, especially those at the top, rely heavily on the transfer market to offset operating deficits. Sporting’s €560 million in player sale profits over the last decade is impressive and the second-highest in Portugal in that time, though Benfica’s reputation in the market is well-earned. They’ve booked €746 million in player profits in the last 10 years, nearly €200 million more than Sporting and almost €300 million more than Porto.

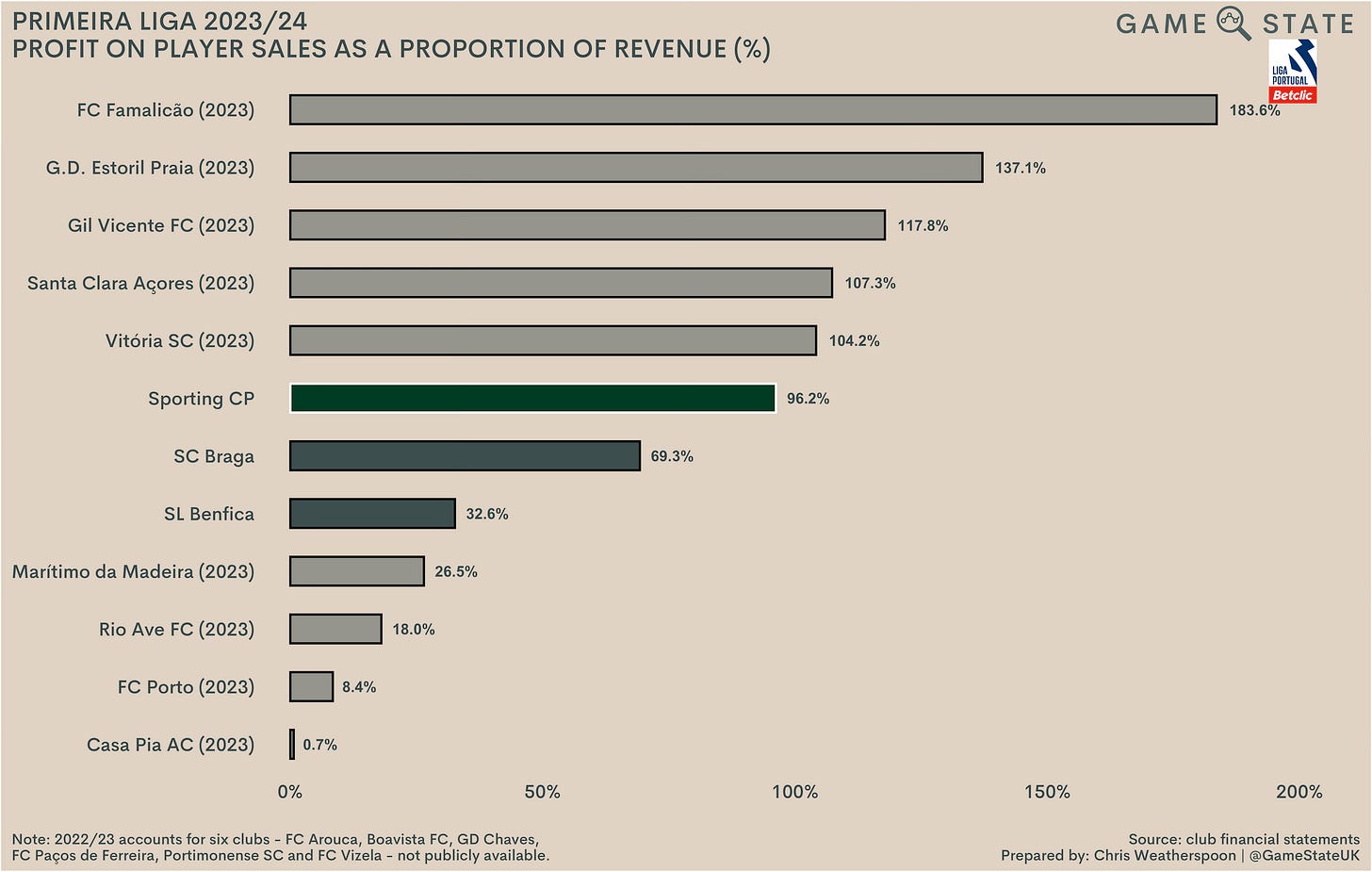

To understand just how much Portugal’s big clubs have used player sales to make up for the constraints on their other income streams, it’s worth looking at player profits as a proportion of traditional revenue.

Doing so pretty clearly highlights Sporting as the club that has most frequently turned to player sales to compliment other revenues: in five of the last 10 seasons, they’ve had higher profits as a proportion of income than both Benfica and Porto, and in four of those five that proportion has exceeded 80 per cent. In 2023/24, Sporting’s player sale profits contributed almost as much to the club’s bottom line as all their other revenue streams combined.

While such a reliance on player sales might initially seem of concern, it is nowhere close to the highest proportion in the Portuguese top tier. That honour goes to FC Famalicão currently, whose €11 million player profits in 2023 amounted to a whopping 184 per cent of the club’s turnover. In total, the latest accounts of five different Primeira Liga clubs showed player sale profits as being higher than revenue, an indicator of just how much the entire league - not just its most famous participants - relies on the transfer market as part of its core business.

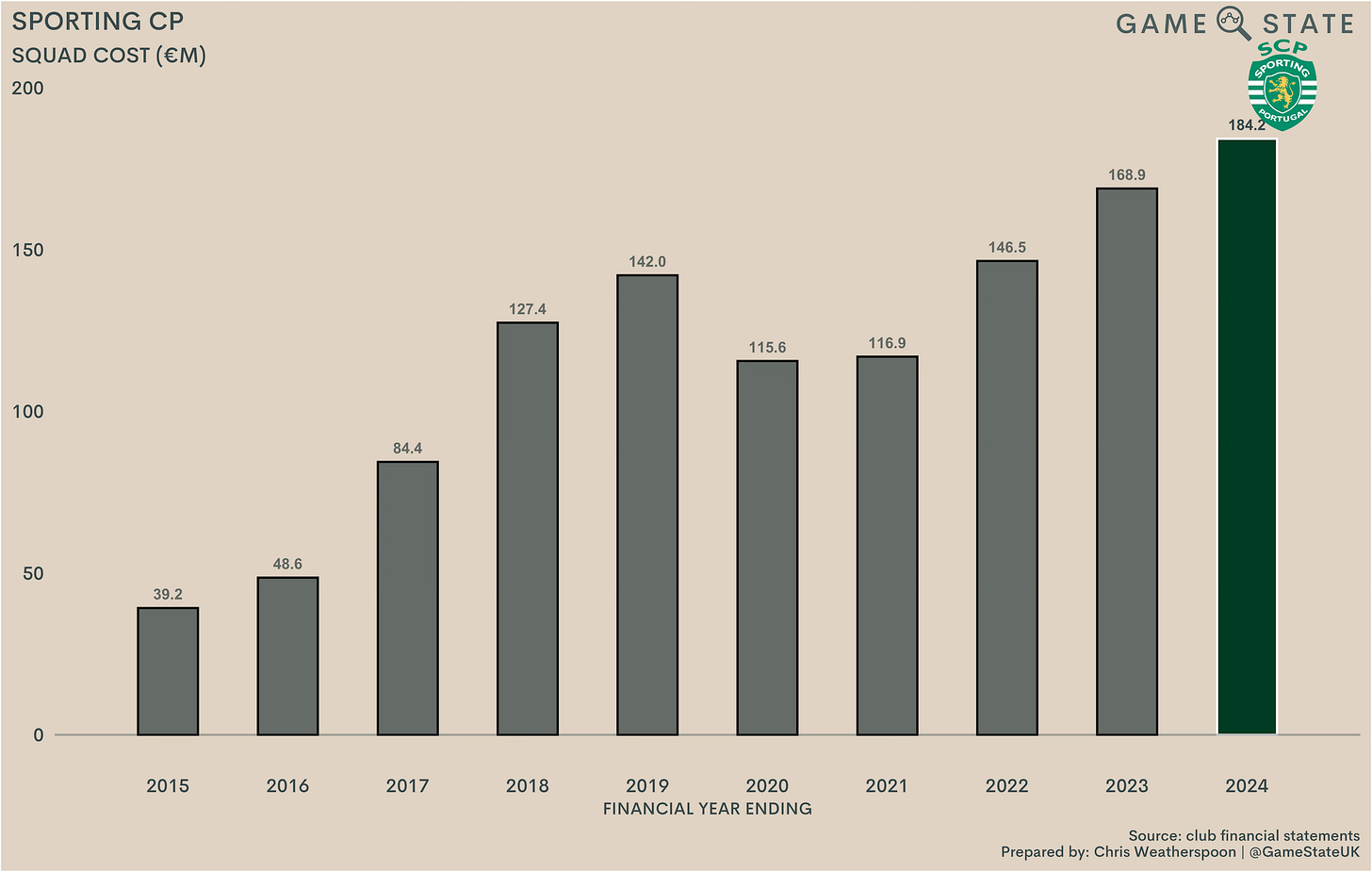

Squad cost

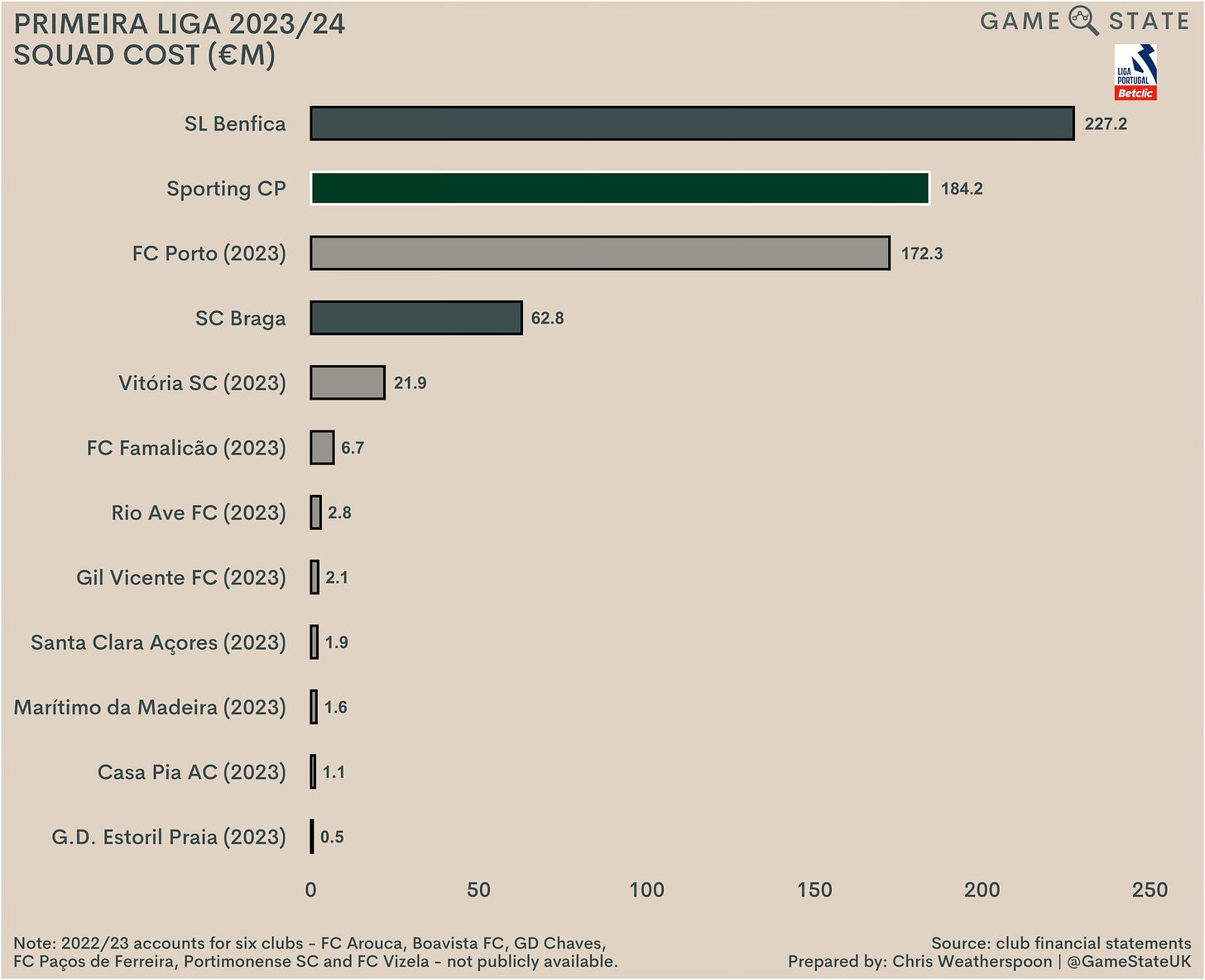

Sporting’s €77 million spend on new players last season saw their squad cost rise to a new high of €184 million, up €15 million on a year prior even with the departures of Ugarte and Porro. In all, Sporting’s squad cost has risen €145 million in the last decade, again highlighting both the need to spend for Portuguese clubs to keep up with European rivals, as well as the increased ability to do so by virtue of that European income.

Based on most recent figures for the 12 available clubs, the combined squad cost in the Primeira Liga was €685 million. Four clubs accounted for a whopping €646 million (94 per cent) of that. Little wonder that the last time a club outside on Benfica, Porto and Sporting won the league was Boavista 23 years ago (and the only other time in Portuguese football history that one of the big three failed to win the league was way back in 1946).

Balance sheet

Debt

Football debt

A curiosity of both Sporting and their domestic rivals concerns their respective transfer balances or, in other words, how much in transfer fees they are owed by or owe to other clubs.

Given such success in selling players for big sums, it might be expected that Sporting are in a healthy transfer debtor position (i.e. other clubs owe them more than Sporting owe out). But that isn’t the case currently, nor has it been since 2019. In fact, Sporting’s net transfer debt has only continued to grow, sitting at €61 million at the end of June 2024.

How is that possible? It comes back to the timings of cash flows in the deals agreed by the club. In essence, Sporting have been receiving money up-front for sold players, while buying players on credit.

Using 2023/24 transfer activity as a representative example, neither Paris Saint-Germain nor Tottenham Hotspur appear on the list of debtors at the end of June, meaning the sums made on the sales of Ugarte and Porro were received in full last season. By contrast, of the €22 million due to Coventry City for Gyökeres, €14 million was unpaid, with €10 million due by the end of June 2025 and a further €4 million thereafter.

All three of Portugal’s most successful clubs had net transfer debts in excess of €50 million at last check, with Benfica just eclipsing Sporting’s total. In effect, probably due to the lack of available cash on hand, and the need to use cash from sales to plug operating losses, the big Portuguese sides have opted for a transfer model whereby players are bought on credit then sold for big up-front sums. Whether those clubs will be able to keep hold of sufficient bargaining power or will have to take a haircut on those sales remains to be seen.

Financial debt

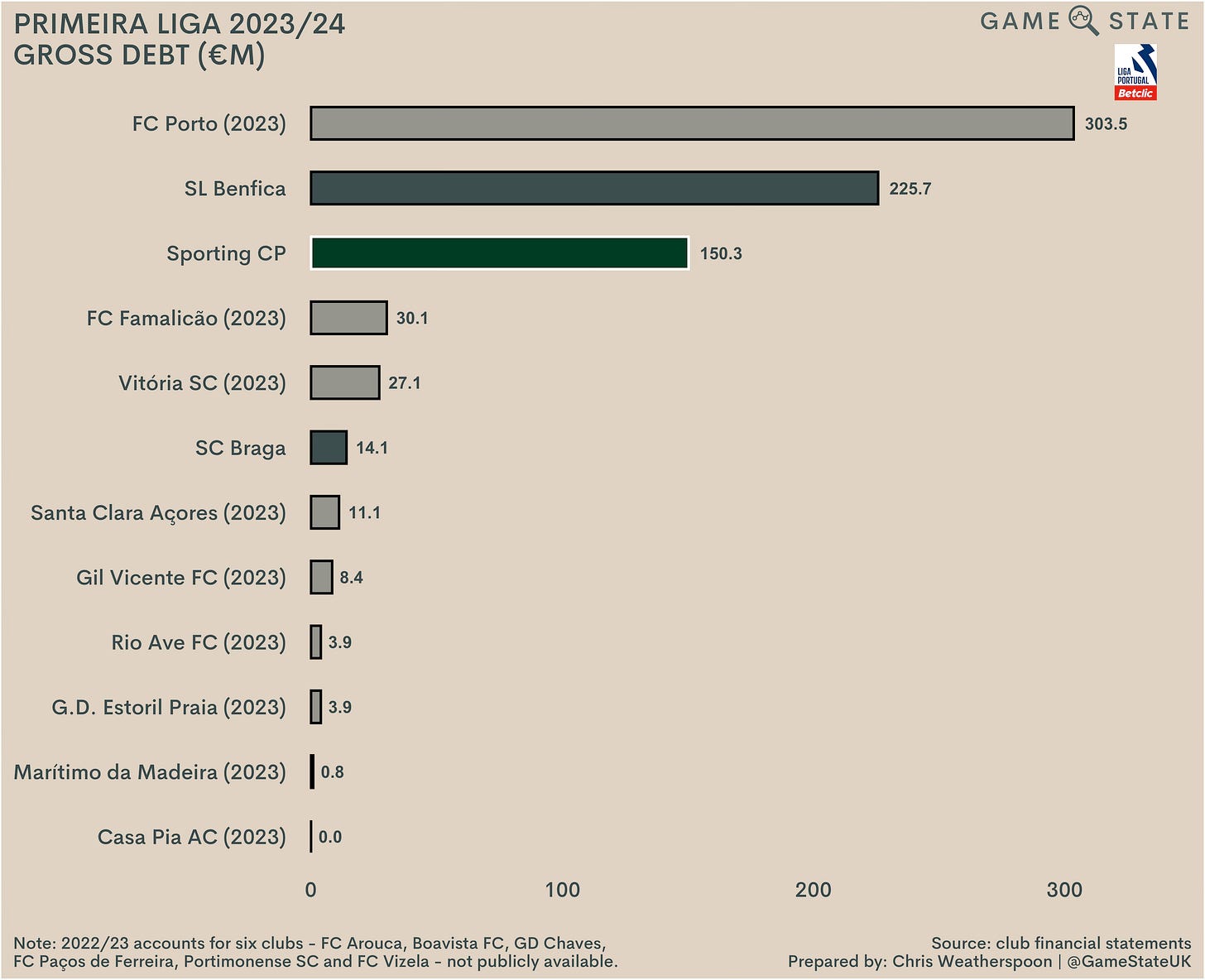

Sporting’s financial debt ticked up a notch to €150 million, though that’s in the ballpark of where the debt has been in the last decade. That €150 million is comprised of two sets of bonds totalling €70 million, plus €80 million in factored future TV rights.

In terms of the bonds, €20 million relates to bonds initially issued in December 2021, which attract interest of 5.75 per cent and are due for repayment on 25 November 2024. The remaining €50 million bonds were issued in March of this year at a slightly lower rate of 5.25 per cent, and fall due in November 2027.

In terms of the factored debt, that arose from a restructuring in December 2023, whereby the club paid off bank debt owed to Novo Banco using funds from Sagasta, a financial institution, secured on those future broadcast rights. That repayment to Novo Banco constituted a buyback of Mandatory Convertible Securities (VMOC), which in turn increased fan-owned Sporting’s ownership of Sporting SAD (the limited company which manages the club) from 83.895 per cent to 87.994 per cent.

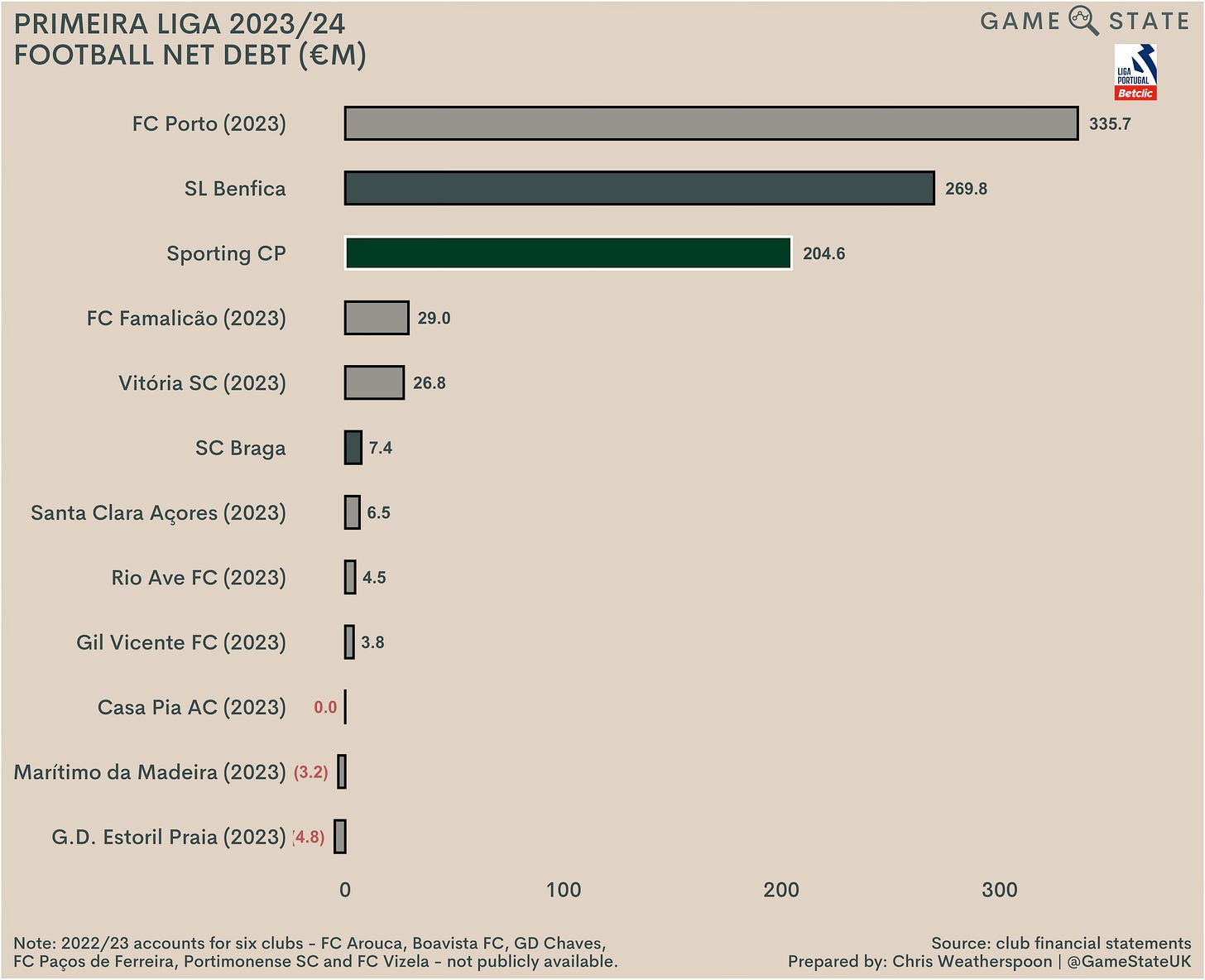

Sporting’s gross debt sits third in Portugal, some way behind both Porto (€304 million) and Benfica (€226 million). Of the €779 million in gross financial debt held by the 12 Primeira Liga clubs for whom we have financials, €679 million (87 per cent) is held by just three clubs.

Debt needn’t be a dirty word, but clubs need to ensure they aren’t in a position where servicing debt proves a competitive disadvantage. In Sporting’s case it doesn’t appear to be, at least domestically. Sporting spent €9 million in cash on interest last season, less than Benfica (€12 million) and way below the €26 million Porto had to part with in 2023.

Comparing the big clubs’ interest paid to revenue highlights just how much financing costs have hindered Porto in recent years, though at eight per cent of income Sporting’s interest fees come in second out of the big four. That’s not a huge amount, but any increase on rivals does mean less money to be spent elsewhere, so Sporting will hope to get this proportion down as income hopefully increases this season and going forward.

An industry-specific metric that doesn’t really add much more here is football net debt (FND), being a club’s net transfer balance, plus financial debt, less cash and cash equivalents. Sporting’s FND is now over €200 million, once again well ahead of most of the rest of the division but well behind Porto and Benfica.

Cash flow

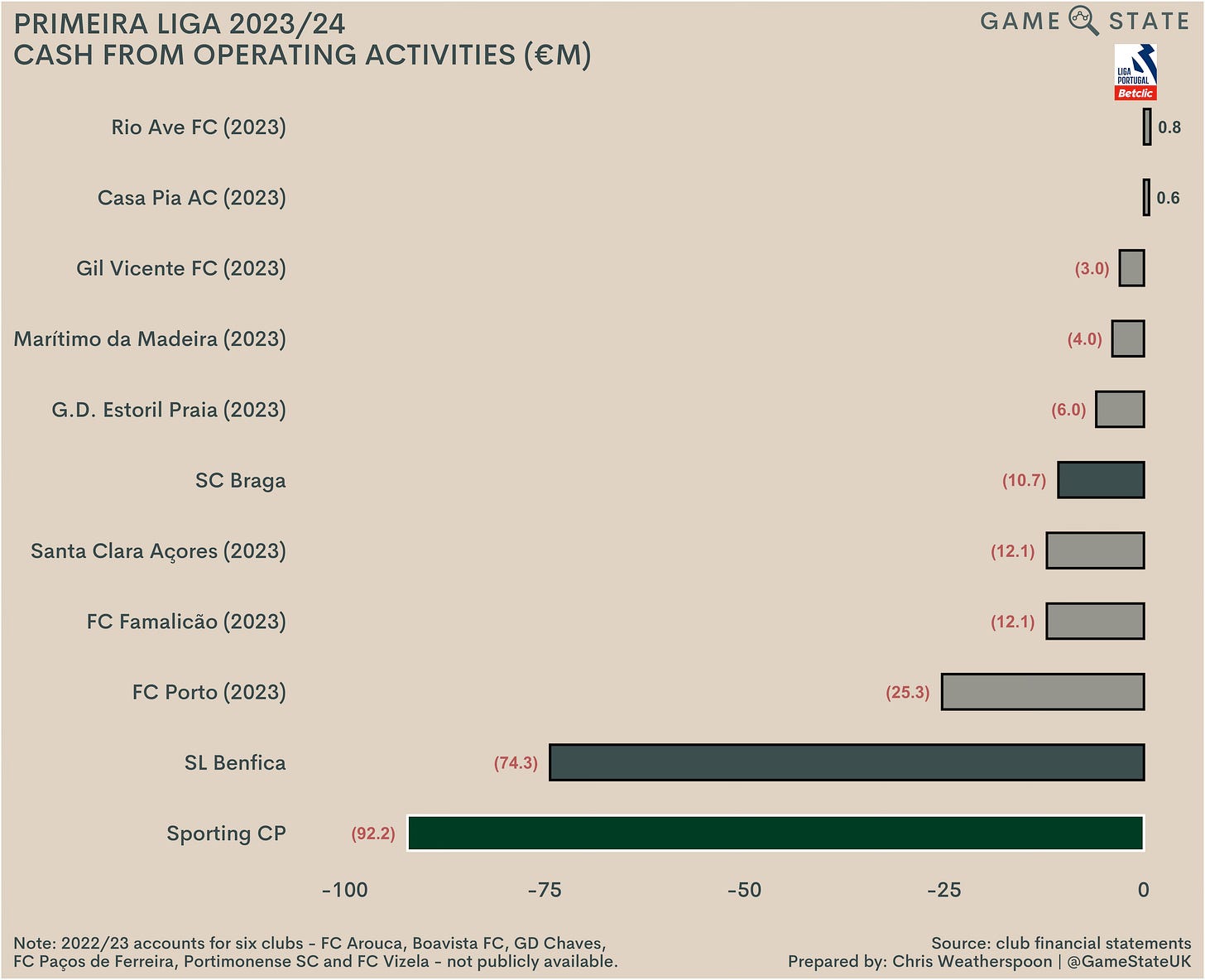

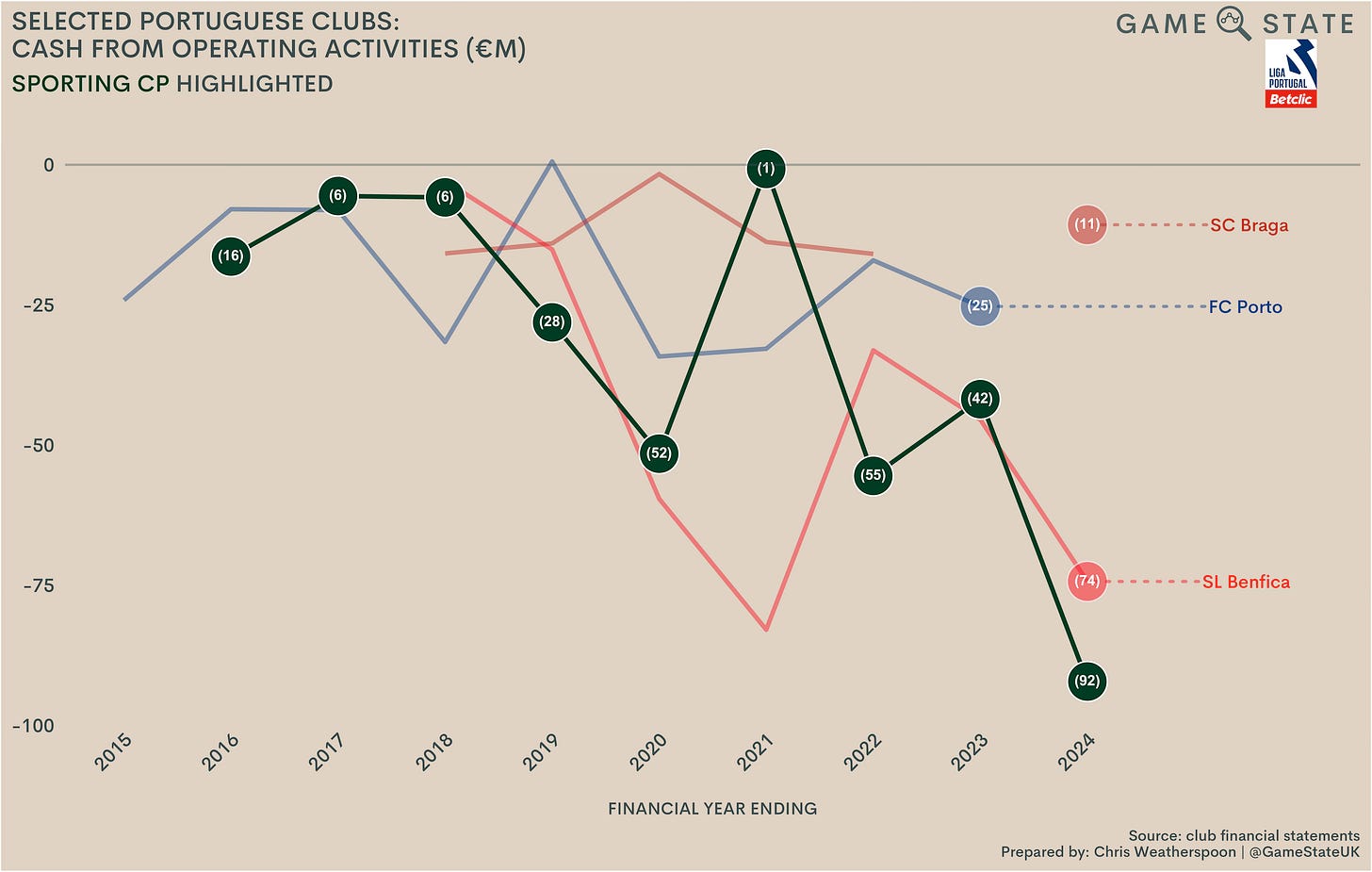

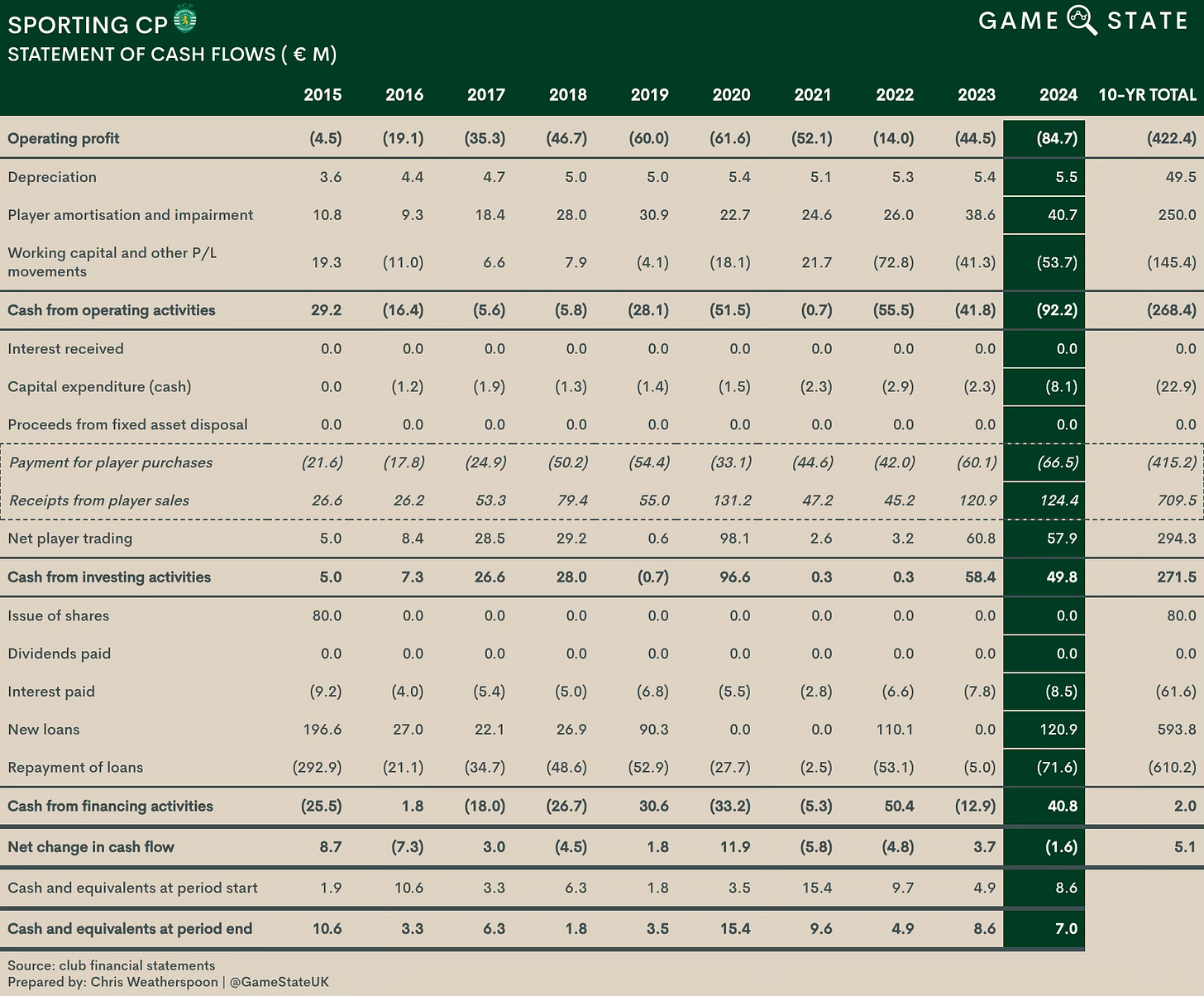

From a cash flow perspective, Sporting’s cash from day-to-day operations nosedived, down to a negative €92 million.

That’s not surprising in the context of what we’ve already considered; rising wage costs and lower TV money was always likely to worsen the club’s operating cash flow. Still, it’s clear that operationally the club is consistently cash-negative. Over the last decade, Sporting have lost nearly €270 million cash on the day-to-day.

What’s more, that operating cash loss is the worst of any Portuguese club, and nearly €20 million worse than Benfica’s €74 million negative cash flow. Of course, the latter played in the Champions League last season, so it will be interesting to see how Sporting shape up in a year’s time. It would be a surprise if operating cash flow hasn’t improved fairly substantially in 2024/25.

Over the last decade, Sporting have enjoyed cash inflows of €374 million, split €294 million net player trading and €80 million in issued shares (a one-off in 2015). In turn, that €374 million has been spent on:

€268 million covering operating losses;

€62 million in interest costs;

€23 million in capital expenditure on infrastructure;

€16 million in net loan repayments; and

€5 million increase in the club’s cash balance.

One area where 2023/24 marked a clear departure from the past in cash terms was in the form of capital spending on infrastructure, where Sporting’s €8 million spend was around as much as the previous three seasons combined.

This went primarily on what the club has termed the ‘Structure’ element of the strategic plan, undertaking investments deemed critical to modernising the club’s stadium. Some examples given in the accounts of work carried out last season were renovations of the stadium facades, bathroom redevelopments, Wi-Fi installation and the commencement of a project to build a business hub.

Given how little money there is to go around for most Portuguese clubs, capital spending isn’t high on the list. As a result, Sporting’s €8 million spend last season was comfortably the most in Portugal based on most recent figures, and was double that of second-placed Braga.

Profit and Sustainability (PSR)

UEFA

In Portugal, the FPF’s regulations around club finances are fairly light-touch, with an emphasis on transparency above all else. Clubs are expected not to run up hefty deficits but, given Sporting’s recent profitability, it’s safe to say the club needn’t have many concerns about complying with any domestic financial rules.

As a relative mainstay in European competition, Sporting do have to comply with UEFA’s separate PSR rules, which are in the process of changing. The European football governing body’s financial regulations comprise two parts: a Squad Cost Ratio (SCR) that is currently tapering down to allowing clubs to spend a maximum of 70 per cent of income on squad-related costs from next season onwards, and a Football Earnings rule that dictates clubs can lose a maximum of €90 million over a particular monitoring period.

In terms of the latter, Sporting should have few concerns. The club turned a €12 million profit last season even before accounting for deductions for any expenditure deemed healthy (e.g. investing in club infrastructure); across the last three years, that profit figure sits at €63 million. With the club back in the Champions League this season, there’s no fear of them suddenly posting a loss so vast that it breaches this element of UEFA’s rules.

Of greater concern is SCR. Last season, clubs were allowed an SCR ratio of up to 90 per cent of relevant income, which, crucially in Sporting’s case, includes profits from player sales. Even while competing in the Europa League, Sporting’s whopping player profits ensured they had no problem complying in 2023/24. Per our model, Sporting’s ratio sat at just 54 per cent - 36 per cent below last season’s limit.

Fast-forward to the current season and, despite Sporting’s presence in the Champions League this year, their SCR headroom will be squeezed. That owes to two things in particular. For one, the allowable limit has dropped, down to 80 per cent before it drops to - and stays at - 70 per cent from 2025/26 onwards.

The second factor is the significant likely drop in player profits this season, which Champions League revenues will only offset if Sporting go deep into the competition. Even then, based on the summer’s transfer activity, when only around €16 million in player profits were booked, reaching last season’s zenith looks highly unlikely.

As a result, based on the summer’s incomings and outgoings, an uplift in player wages and a modest projection of European TV revenue, we project that Sporting’s SCR will be 76 per cent this season - just four per cent below the allowed limit.

Sporting have already earned an estimated €20 million more from the Champions League than the Europa League banked them last season, so any relative success in the competition will increase their headroom further.

Our model includes some fairly conservative assumptions, and the likelihood is the club will have no issue this season, but it does show that the 70 per cent limit could prove troublesome to hit if Sporting were to fall out of the Champions League for any sustained period of time. It also seems unlikely the club will be moving too far from the player sales model any time soon, with this year a potential one-off in that regard.

The future

Based on reported fees, Sporting spent three times more on new players than they recouped in sales this summer.

That points to two things. For one, buoyed by a return to Champions League football and the riches that entails, Sporting have sought to consolidate their spot at Portugal’s peak. As well, before UEFA’s financial regulations tighten further, the club appears to have sought to utilise much more of its PSR headroom, perhaps in the hope it will leave the club on stronger financial footing going forward.

Financial projections for 2024/25 are difficult to make with any great degree of accuracy, but Sporting will expect to post club record revenues this season. Champions League participation has already earned them a guaranteed €21.4 million (€18.6 million for group stage qualification, €2.8 million for achieving a win and a draw in their opening two games), with a further €11 million on top estimated as due via the new ‘value’ pillar UEFA has introduced. Whether that will translate to more profitability remains to be seen though; the significant dip in player profits could see the club tip into the red this season.

On the field, there appear to be few problems. At the time of writing, Sporting sit top of the Primeira Liga once more, eight wins from eight, 27 goals scored (the most in the league) and only two conceded (the least).

But how long that will last might be beyond Sporting’s control. Already, sporting director Hugo Viana has been snaffled away from the club: he’ll join Manchester City next summer as a replacement for the outgoing Txiki Begiristain. Viana has been described as “indispensable” by current manager Ruben Amorim, and it’s clear his presence in Lisbon will be missed.

So too would Amorim’s. The manager hasn’t announced his departure yet, but his time in the Sporting dugout looks limited; in the past week alone, he has been linked with both Manchester clubs, and his four years at Sporting have highlighted him as one of the hottest managerial prospects in football.

Sporting fans will doubtless be pushing that thought to the back of their minds. For now, the club is a roaring success on the field and not too shabby off it either. Bumper player sales have ensured the club has been largely profitable in recent years, while Amorim’s managerial skill contributed to the club out-performing its wage bill en route to domestic success last season.

Though player sales have dipped this season, were Sporting to need a big departure they need look no further than Gyökeres. The striker’s move has been a huge success already, and most estimates of his market value pitch it at around three times what Sporting paid for him. Of course, the tricky part would come in replacing him, something that may prove harder to succeed at without the guidance of Viana.

While things are rosy now, the economics of football aren’t in Sporting’s favour. Portugal’s elite clubs suffer from diminished domestic revenues while needing to carry high wage bills in order to compete on the international stage. The likelihood of that changing seems remote, especially with a potential centralisation of Primeira Liga broadcast rights on the horizon. Sporting will need to keep finding edges in scouting and the dugout if they are to continue their impressive recent progress.