Transfer window analysis: Summer 2024

Game State analyses football’s 2024 transfer window - from São Paulo to Saudi Arabia.

In all but a handful of nations, 2024’s summer transfer window closed a little over a week ago. As ever, it was a summer laden with rumour, intrigue and, above all else, money.

Football’s transfer windows are high on the interest register, to the point it’s hard not to wonder if some fans and observers prefer the hyperbole that surrounds the buying and selling of players to, well, the actual playing of the sport itself.

It is therefore with a fair dollop of hypocrisy that Game State brings to you its inaugural transfer window analysis. What follows is an in-depth look at the events of the summer, bursting at the seams with numbers and narrative and, we sincerely hope, something to interest you.

We’ll take a look at the window as a whole before delving into the dealings of those clubs in the world’s 10-highest spending divisions this summer; along the way, we’ll look at emerging trends and highlight various clubs whose dealings merit further inspection.

So, without further ado, come on in.

A note on Methodology

At the risk of boring the reader onto another tab immediately, we start with a quick note on the source and usage of data in our analysis. If you don’t care about this (and we really wouldn’t blame you), feel free to navigate straight to the good stuff via the contents bar on the left side of your screen.

For the most part, the figures you’ll find here can be found on the website Transfermarkt, it being the resource that most comprehensively covers player trading. Where possible, and particularly where English clubs are concerned, we have used figures from club financial statements for past seasons. However, where comparisons are made only to past summer transfer windows, we’ve necessarily used Transfermarkt figures in order to ensure we exclude any winter dealings.

It is worth noting, too, that the figures reported in the media and on websites like Transfermarkt rarely show the full picture. Transfer announcements and journalists’ reports routinely leave out chunky amounts that make up the total cost of a deal, with agent fees the most prominent example.

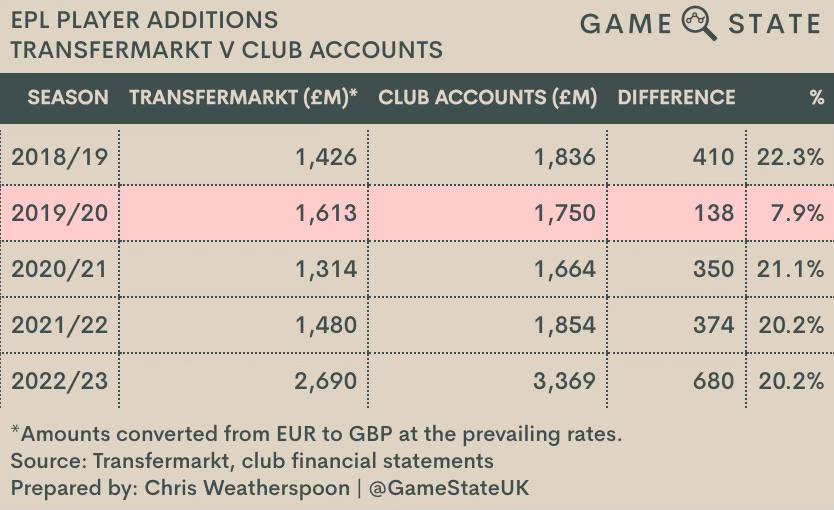

To that end, and to enable a projection of those additional ‘unreported’ costs of transfers, Game State has undertaken a comparison of Transfermarkt data and that per club accounts for EPL clubs over the last half-decade, spanning the 2018/19 season to 2022/23 (the last for which we have publicly available club financials).

As expected, in each season sampled we find the acquisition costs per club accounts exceed those reported in the media. More promisingly, the quantum of the excess appears to be relatively consistent, ranging from 20-22 per cent in each year other than the 2019/20 season.

That year sees a sharp fall to around eight per cent, the reasons for which are likely numerous. The most obvious one is the Covid-19 pandemic: the 2019/20 EPL season was delayed, which for the most part meant the entirety of the 2020 summer window was pushed into the next accounting period. A look at the differences between Transfermarkt and club accounts on an individual basis showed no consistency of variance, so that season has been excluded from consideration here.

Left with the four other seasons, we find that player additions per club accounts were, on average, 20.9 per cent higher than those reported publicly. It is therefore this figure that we have applied to Transfermarkt throughout our analysis, though there are two important caveats to that point:

Where individual player transfers are listed, unless stated otherwise, we have not included the 20.9 per cent of additional costs. There have only been applied where transfers are considered on a collective club or divisional basis;

We have only applied the 20.9 per cent uplift to those clubs on the buying side of transactions. One of the main additional costs of a transfer concerns agents (or, to use their official term, intermediaries). Were we to apply an equal percentage to both purchases and sales, we’d in effect be grossing up the amounts passing between clubs, leaving no cut for the agents involved. Per FIFA’s most recent report on agents in international transfers, agent fees account for roughly 10 per cent of the total value of cross-border deals. To that end our analysis has only applied an uplifted amount of 10.9 per cent to clubs’ sales.

This is an inexact science, and applying a blanket rate across all leagues, not least one derived from a league that spends way more on transfers than any other, probably wouldn’t pass the muster of any half-decent statistician. Still, for our purposes here, we’ve deemed it the best of the options available to us.

In terms of currency, we have predominantly used Euros, with any exceptions noted clearly. The main such instances arrive when considering English clubs and divisions. Where it has been deemed not confusing to do so, we have converted to Sterling.

Summer 2024

For the first time in four years, the most expensive summer signing wasn’t made by an English club. Atlético Madrid and their €75 million purchase of Julian Alvarez topped the charts this summer, the first time a club outside of England has done so since Juventus’ capture from FC Barcelona of Arthur Melo in June 2020.

That being said, Melo’s transfer was hardly straightforward; Melo’s lofty price tag was mostly matched by the fee Juve received from Barca for Miralem Pjanic, in a deal that foreshadowed several of the player ‘swaps’ undertaken by EPL clubs in June of this year, ostensibly to improve their figures for PSR purposes.

While Alvarez’s switch from Manchester to Madrid contained the largest fee, the EPL’s pre-eminence in transfer matters was still clear. Three of the top four and five of the top 11 deals involved an English club as the buying party.

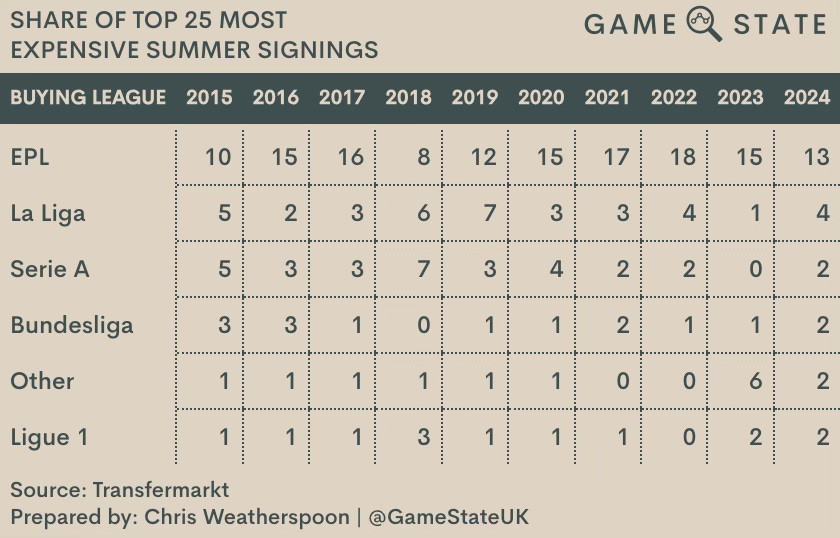

In total, 13 of the top 25 deals inked this summer were ones in which players moved to an EPL club. For each of the last 10 years, English clubs have commanded the lion’s share of the most expensive deals; only in 2018 have EPL clubs not accounted for 10 or more of the 25 highest fees, a summer when Juventus splurged on Cristiano Ronaldo, Douglas Costa and Joao Cancelo, while Real Madrid recycled the Ronaldo money into Thibault Courtois and Vinicius Junior as Paris Saint-Germain snatched future Madridista Kylian Mbappe from AS Monaco.

That being said, 13 of the top 25 is a sizeable fall from two seasons ago, when 18 of the most expensive deals were instigated by English clubs. That is in part down to the entrance of Saudi Arabia to world football, with the Middle East nation’s Pro League (SPL) accounting for six of the biggest deals last year and a further two this summer.

La Liga clubs paid four of the largest fees in 2024, though it’s notable these were spread across the three clubs that outstrip the rest of the division in spending. Atlético sent another €42 million to England in exchange for the services of Conor Gallagher, while FC Barcelona and Real Madrid got in on the act too, signing Dani Olmo (€55 million) and the hot Brazilian prospect Endrick (€47.5 million) from RB Leipzig and Palmeiras respectively.

Correspondingly, on a club-by-club basis, EPL sides dominated the top 25 highest spenders on new players. No fewer than 14 English clubs appear in that top 25, with the EPL occupying the top three spots.

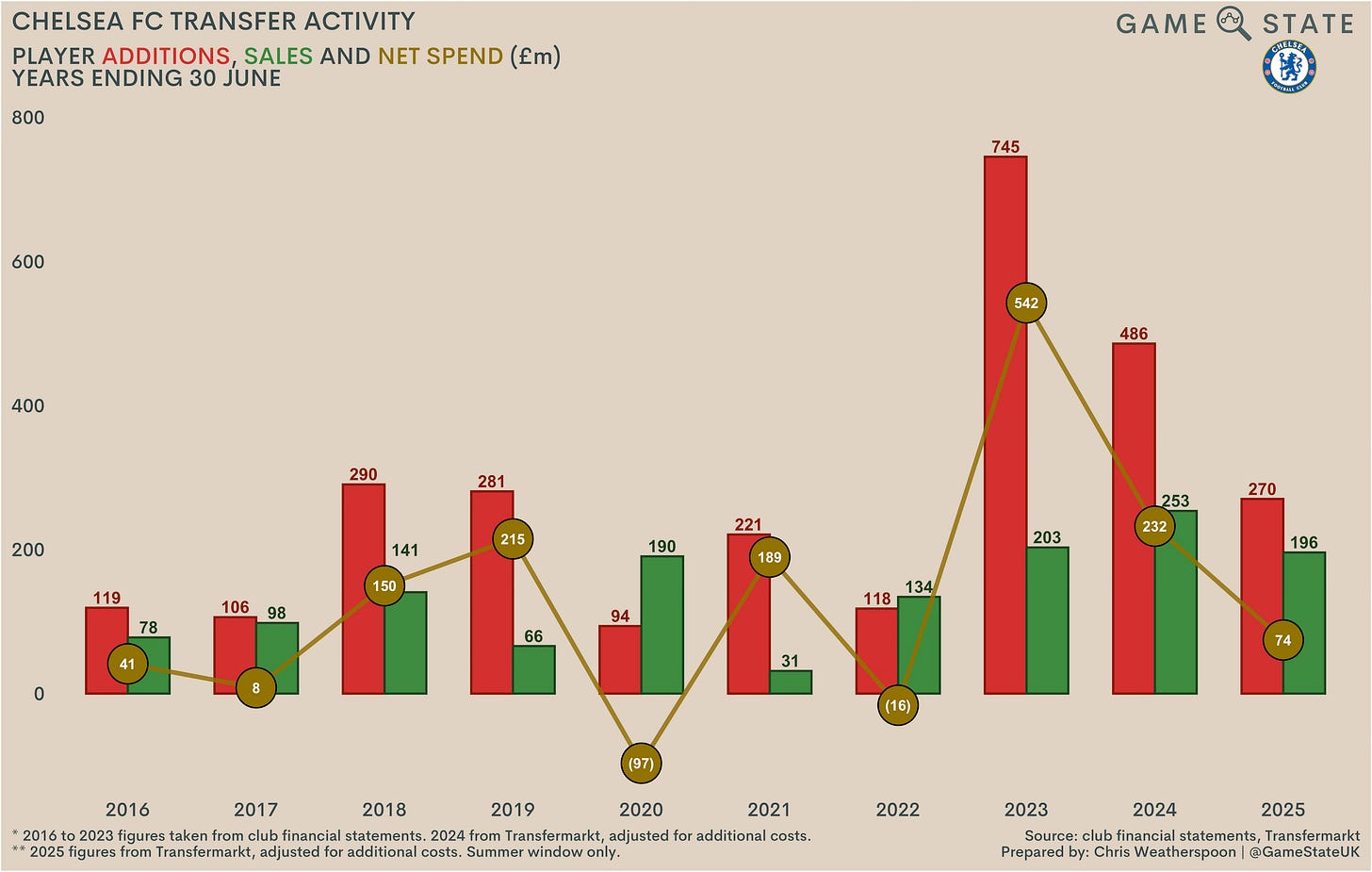

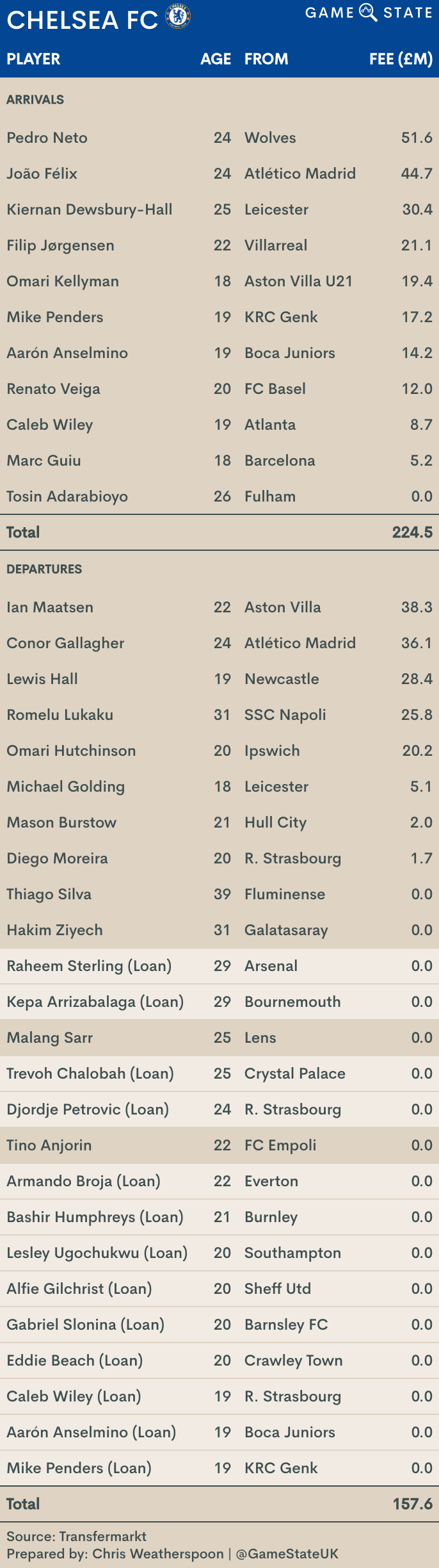

The highest spending club on a gross basis this summer was precisely the same club that topped the same list in each of the past two summer windows: Chelsea. Far from the departure of Russian oligarch Roman Abramovich ushering in an era of frugality, the Stamford Bridge outfit’s spending has been turbocharged since their takeover by majority owners Clearlake Capital in May 2022.

Chelsea now boast three of the top seven most frivolous transfer summers in football history, each of those coming in the last three years. Across those three windows the club has brought in 36 new players, 33 of them for fees, with 27 arriving for fees in excess of €10 million.

That is without even including their winter spending; per the club’s most recent 2022/23 accounts, they spent a world record £745 million (over €850 million) on acquisitions in a single season. The rate of spending has slowed, particularly on a net basis, but Chelsea still lead the way when it comes to splurging on transfers.

Necessarily, if not for the club’s bank balance that certainly any attempts to comply with financial regulations, Chelsea were also this summer’s biggest sellers, recouping over €200 million on players that departed West London. Within the top 25 deals worldwide, two ex-Blues featured in the forms of Ian Maatsen (21st-highest deal, sold to Aston Villa) and Conor Gallagher (23rd, Atlético Madrid), while Lewis Hall (to Newcastle United), Romelu Lukaku (SSC Napoli) and Omari Hutchinson (Ipswich Town) all left in exchange for fees above and beyond the €23 million mark.

EPL clubs again dominated, making up 11 of the top 25 sellers. Yet the more intriguing appearances on the list were those made my clubs outside of England’s top tier. In particular, Leeds United booked around €180 million in sales this summer, which was not only the fourth-highest quantum of sales worldwide but also ranks 23rd in the all-time list of single-summer sales.

Leeds, who narrowly missed out on an immediate promotion back to the EPL in the play-off final in May, saw a huge exodus of star players this summer, reflecting a growing trend whereby EPL clubs pick up the best of those sides recently relegated from the division. Of the five players who left for fees only one, Glen Kamara, moved to a non-EPL club, joining Stade Rennais of France in a €10 million move.

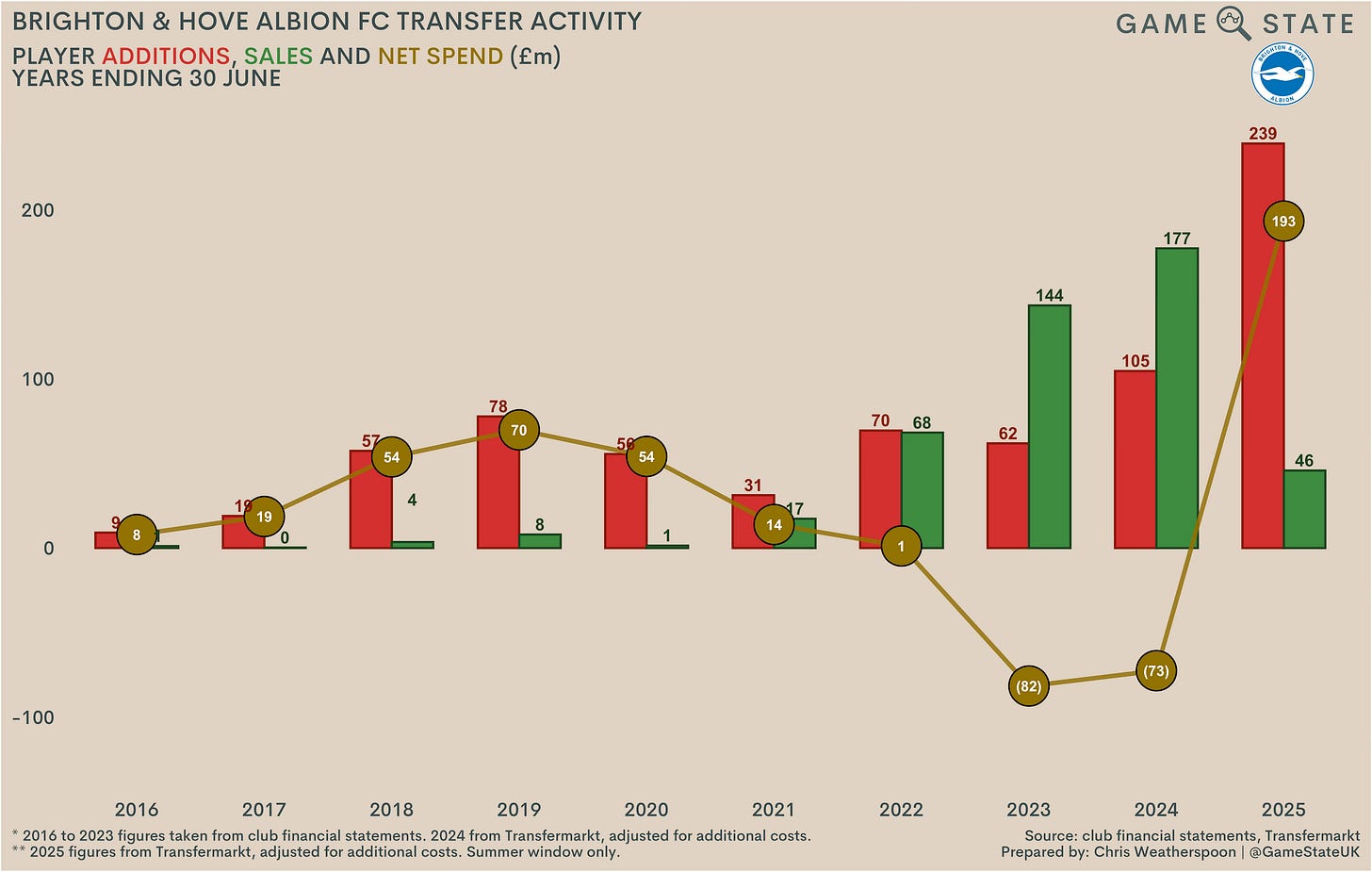

One of the beneficiaries of Leeds’ failed promotion bid were Brighton & Hove Albion, who parted with over €46 million for 22-year-old forward Georginio Rutter. In doing so they helped propel themselves to the top of this summer’s net spend table; Brighton’s net purchases of €226 million were a fair way ahead of second-placed Napoli (€168 million).

That hefty outlay represented a change from the past two seasons, when Brighton banked a net €180 million (£155 million) through their transfer dealings, much of that money coming via the hand of Chelsea. This time around, Brighton undertook the heaviest spending in their history, splurging €280 million (£239 million) on, among others, Rutter, Newcastle’s Yankuba Minteh (€35 million) and Feyenoord’s Mats Wieffer (€32 million).

On a net basis, that €280 million sits as the seventh-highest in summer window history, albeit a long way behind the €427 million Al-Hilal spent on bringing Neymar, Malcom, Rúben Neves and Aleksander Mitrović, to name just four, to the Saudi Pro League in 2023.

Permanent deals dominate headlines, but one noteworthy development concerns football’s loan market. While our analysis has only considered the 10 highest-spending leagues this summer, it does highlight a clear downturn in the total number of incoming loan deals agreed by clubs across those 10 divisions.

In the summer of 2015, there were 329 such deals; this year, that figure was just 196, a 40 per cent drop. The decline started in earnest in the summer of 2022, which coincided with the introduction by FIFA of new rules dictating the number of professionals aged over 21 that a club can allow out on loan at any given time. The maximum number of loans has tapered down, from eight to six, across the last two years. Correspondingly, the number of incoming loans agreed in our sampled divisions has fallen precipitously since the summer preceding the new laws coming in.

More surprising is the fact that the number of fee-bearing loans to clubs in our sampled divisions has scarcely budged. As a proportion of overall loan deals it has doubled in the last decade, from 8.5 per cent in the summer of 2015 to 17 per cent in the most recent window. Of the 10 highest fees for loans this summer, eight were paid by Serie A clubs, including all of the top six most expensive temporary deals. Juventus FC were the chief instigators in that regard, spending over 16 per cent of their €199 million summer outlay on loan fees.

Top 10 leagues analysis

The analysis contained from hereon will focus upon the following 10 highest-spending divisions (on a gross basis) this summer:

English Premier League (EPL)

Serie A (Italy)

Ligue 1 (France)

Bundesliga (Germany)

La Liga (Spain)

Saudi Pro League (Saudi Arabia)

EFL Championship (England)

Primeira Liga (Portugal)

Campeonato Brasileiro Série A (Brazil)

Liga MX (Mexico)*

*Note: the Mexican transfer window doesn’t close until Saturday 14 September. Figures used here are correct to the end of Monday 9 September.

1. EPL - €2.861 billion / £2.445 million

(Note: all figures in the EPL section below are shown in GBP)

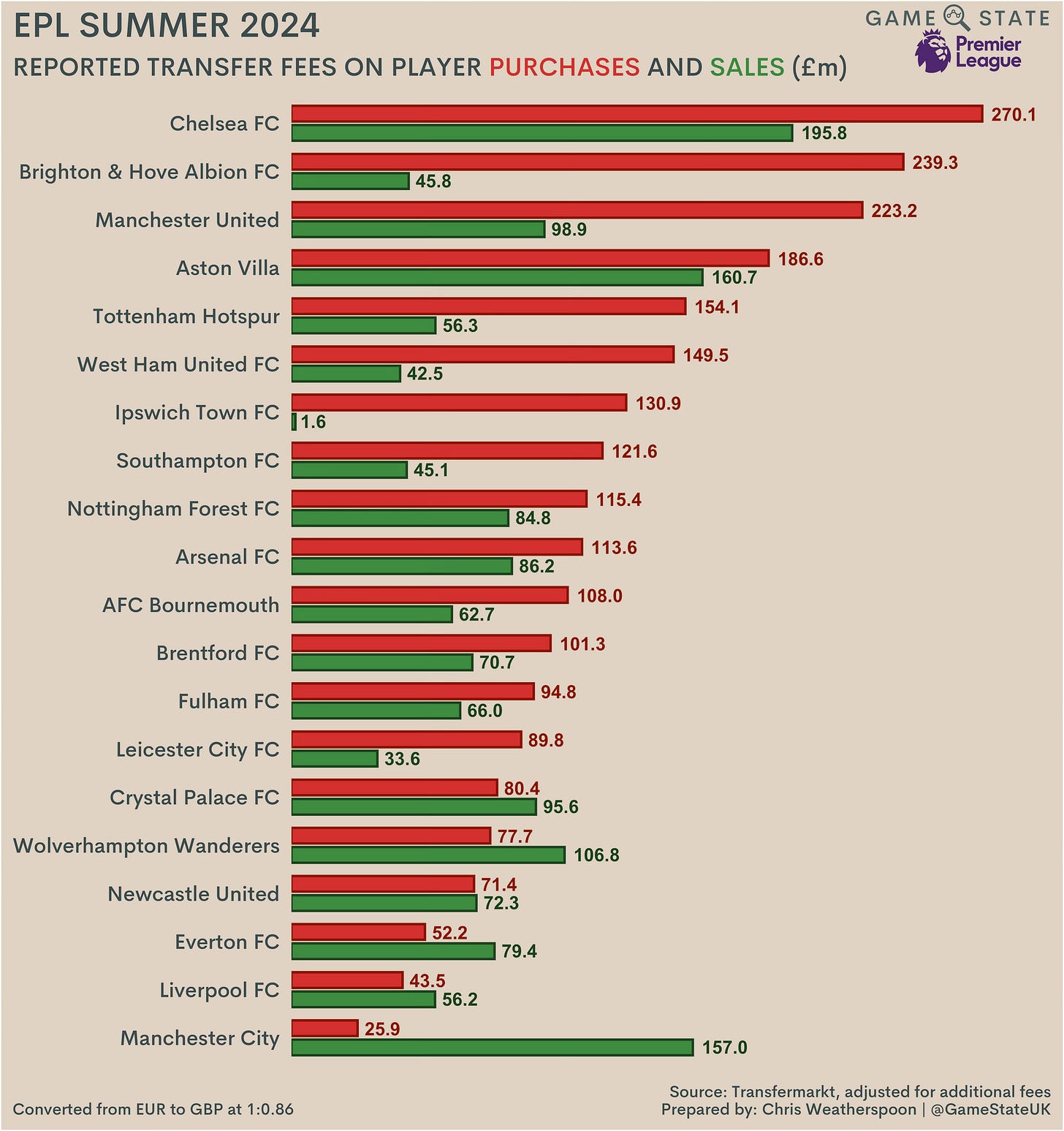

While the EPL remained comfortably the highest-spending division in world football, doubling the layout of second-placed Serie A in both gross and net terms, there was nevertheless a clear slowdown in spending. Where English clubs spent almost £3 billion in the summer of 2023, this time around that figure was down by almost £500 million. On a net basis, spend fell 42 per cent, down from £1.4 billion to £826 million.

There were several reasons for that, though one of the most obvious was the reality of financial rules starting to bite. After a season in which two clubs, Everton and Nottingham Forest, were deducted a combined 12 points for breaching Profit and Sustainability Rules (PSR), clubs were understandably wary of laying themselves open to PSR charges this summer.

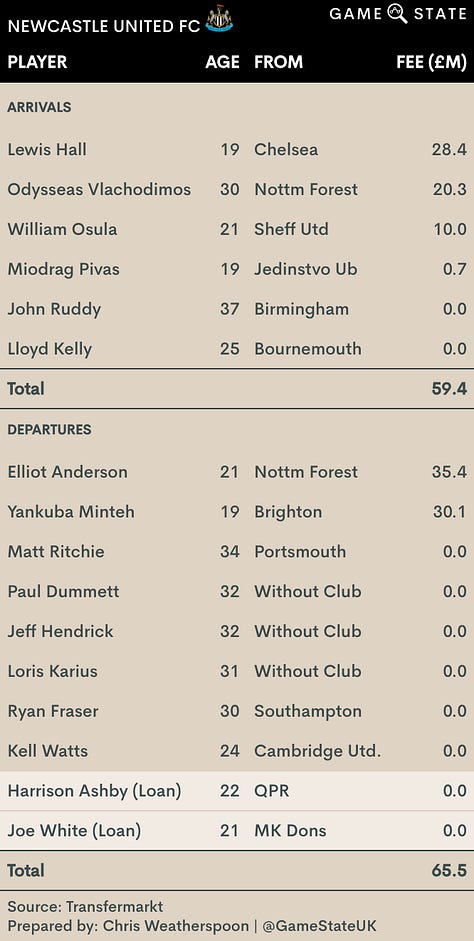

In fact, were it not for PSR, the EPL’s gross spend would have fallen even further. The end of June saw a spate of ostensibly separate deals made between the same parties, whereby clubs in need of a boost to their bottom line ensured they recouped chunky fees for sold players rather than simply engaging in player swaps. At least six different clubs - Chelsea, Aston Villa, Nottingham Forest, Newcastle United and Everton - engaged in such deals before June was out.

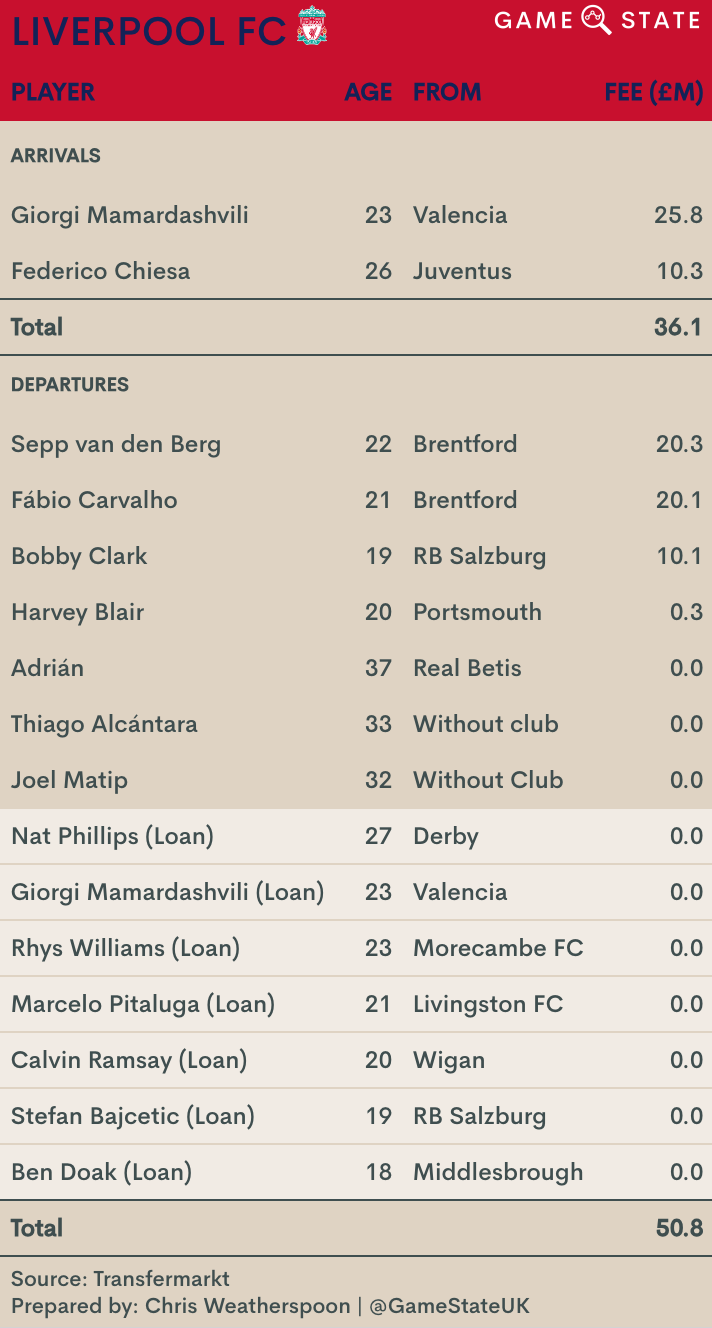

We’ve already covered the largesse of Chelsea and Brighton, while Manchester United’s new-look backroom setup blew through the £200 million barrier too. Yet perhaps the most intriguing aspect of the window was at the other end of the scale where Manchester City, Liverpool and Newcastle all spent minimally, albeit for a variety of reasons. Sandwiched amongst them were Everton, whose ongoing financial travails ensured the Merseyside club booked negative net spend for the third time in four summers.

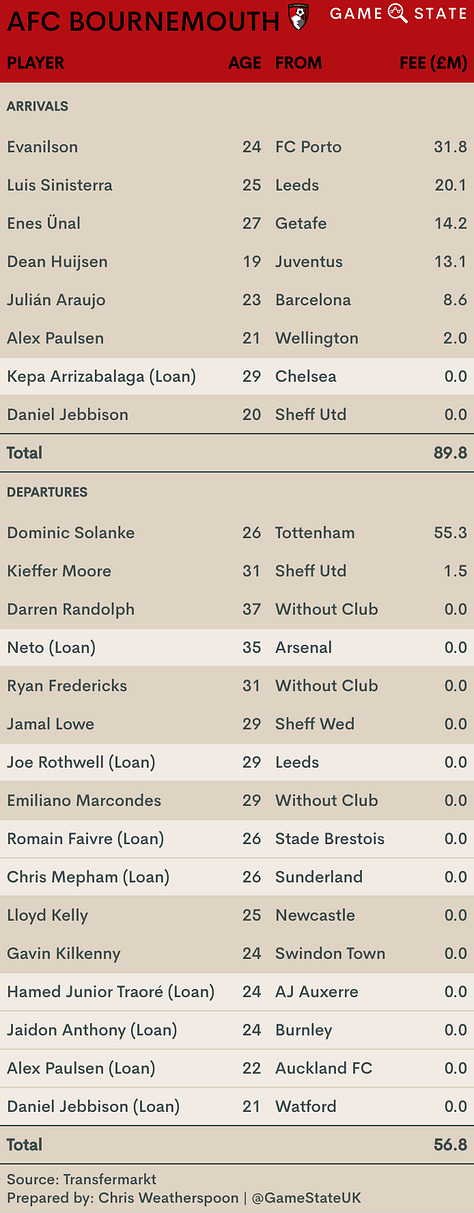

In terms of the biggest deals made where EPL clubs were buyers, Tottenham’s yearlong wait to replace Harry Kane ended with the £55 million capture of Dominic Solanke from Bournemouth. Five of the seven most expensive deals were intra-EPL ones, albeit unlike in many other leagues there was a decent spread of teams doing the buying.

Defence-minded players were in high demand, perhaps in light of last season being the most goal-laden in the EPL’s three decades. Manchester United spent over £53 million on 18-year-old centre-back Leny Yoro, and another £43 million on Manuel Ugarte to sit in front of him once Yoro returns from a foot injury.

A further £39 million went on bringing another centre-back to Old Trafford in the form of Matthijs de Ligt, meanwhile West Ham’s £40 million purchase of Max Kilman from Wolves saw Kilman’s old side, Maidenhead United of the National League, pick up a reported £4 million in sell-on fees. Rounding out a bumper window for defenders was another centre-back, or occasional left-back, in Riccardo Calafiori, who joined Arsenal from Bologna for just shy of £40 million.

State-owned fortunes

In a significant break from the past, Manchester City had the lowest spend, on both a gross and net basis, of any EPL club this summer. More notably - despite it going by and large unnoticed - the current season looks set to be the first since the club were taken over in 2008 where they will receive more on player sales than they will spend on incoming transfers.

City’s net income this summer was £131 million, as the club only spent a fee on signing winger Savinho from fellow City Football Group club, ES Troyes. Julian Alvarez’s departure to Atlético Madrid was the summer’s biggest deal worldwide, but City also recouped chunky fees on the sales of João Cancelo (sold to Al-Hilal), Taylor Harwood-Bellis (Southampton), Liam Delap (Ipswich Town) and Sergio Gómez (Real Sociedad).

The club’s minimal spending this summer and impressive sales reflect a more than decade-long project to take command of the best young talent in world football and, if they aren’t deemed good enough to make it at City, sell them for strong profit. Harwood-Bellis, Delap and Gómez played a total of 2,086 minutes for City’s first-team between them. After the equivalent of just 23 full games across their City careers, the trio left for a combined £43 million.

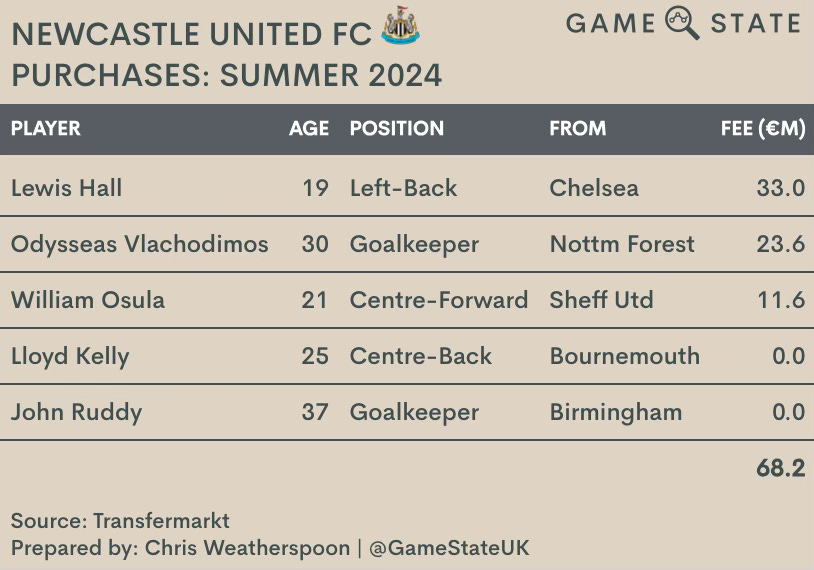

City weren’t the only state-owned club to spend less than they brought in this summer, as Saudi-backed Newcastle United booked net income too. After we add in our projected additional costs the club’s summer transfer balance sits at almost break-even, but that still represents a fairly stark shift given they’d previously spent roughly £435 million on players since October 2021 with little coming the other way.

Newcastle’s summer was bookended by concern, first with the need to plug a reported PSR gap of over £50 million, then, as the window wound down, via their ultimately unsuccessful attempt to agree a fee with Crystal Palace and coax Marc Guehi to the North East.

In the end, Newcastle signed just three players for fees, and one of those was the £20 million signing of Odysseas Vlachodimos from Nottingham Forest, in a swap-that-wasn’t-a-swap for academy graduate Elliot Anderson that helped the Magpies out of their PSR hole.

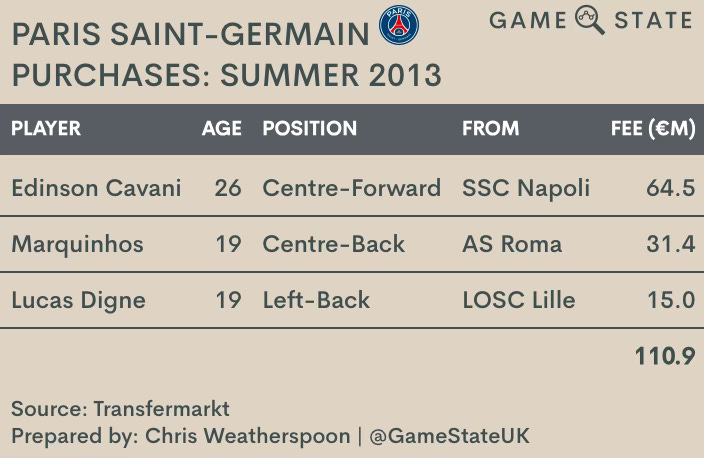

Newcastle, like Manchester City, are a rare breed, being one of only three clubs in Europe’s main leagues - the other being Ligue 1’s Paris Saint-Germain - to be owned by a (Middle Eastern) state. This was Newcastle’s third summer window since being taken over by the Public Investment Fund of Saudi Arabia (PIF), and a look at their activity in this window against City and PSG’s at the same time following their takeovers is instructive.

Despite the passing of over a decade and the rapid inflation in transfer fees the last 10 years has brought, Newcastle spent significantly less than their two peers in the third summer window following their takeover. Newcastle’s €68 million total outlay was only just more than the €65 million PSG spent on Uruguayan striker Edinson Cavani in 2013, and less than half the €147 million City spent in 2010 (note: we have included 2008 as City’s first ‘post’-takeover window, despite them not being bought until near the end of that period).

Neither City nor PSG had much in the way of financial rules to contend with in their early days, and PSG, outside of European competition, still largely don’t. Yet Newcastle’s slowing spend was reflective of a wider trend, as we’ll see, whereby the money flowing from Saudi Arabia into football appears to be proceeding at a much slower rate than a year ago.

Comparing the three clubs and their first three summer transfer windows on a cumulative basis shows Newcastle as having spent more than PSG at the same stage of the French club’s development. But, again, we are comparing to over a decade ago, and to a club that has far less domestic competition than the Magpies do. What is more, where both City and PSG’s gross spend continues up at a rate of knots each season, this summer showed a clear tightening of the pursestrings on Tyneside - intentional or otherwise.

Promoted clubs

What of the recently promoted clubs? Nottingham Forest’s big spending in the summer of 2022 drew headlines - and played no small part in that eventual points deduction for breaching PSR rules - but it did help ensure survival.

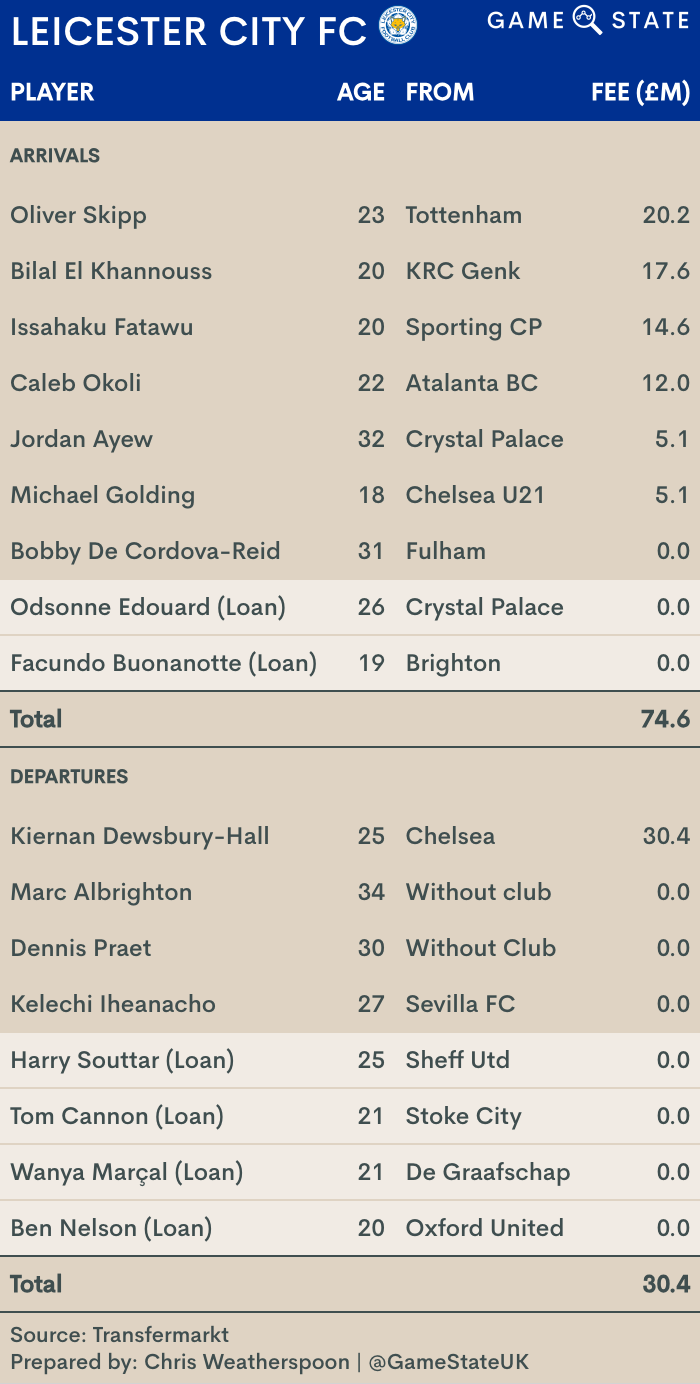

The highest promoted spenders this time around, on both a gross and net basis, were Ipswich Town. That’s fairly unsurprising; both Leicester City and Southampton were returning to the top table after just a season away, whereas Ipswich were in League One two years ago.

Yet even set against promoted clubs in the last 10 years, Ipswich stand out. Their estimated £131 million spend on new players is the second-highest of any promoted club, and pits them among just seven other EPL newbies to spend over £100 million immediately after coming up (Southampton, who were promoted via the play-offs in May, also form part of this group).

Spending money is by no means a guarantee of success, but it might soothe Town fans to know that only Fulham in 2018/19 and Burnley last season have spent nine figures on new players and not survived their first year in the top tier. That being said, most of those clubs were arguably starting from a higher base than Ipswich, with none of them having been in the third tier as recently as the Tractor Boys, and it remains to be seen whether Ipswich’s transfer activity will be enough to see them avoid the drop.

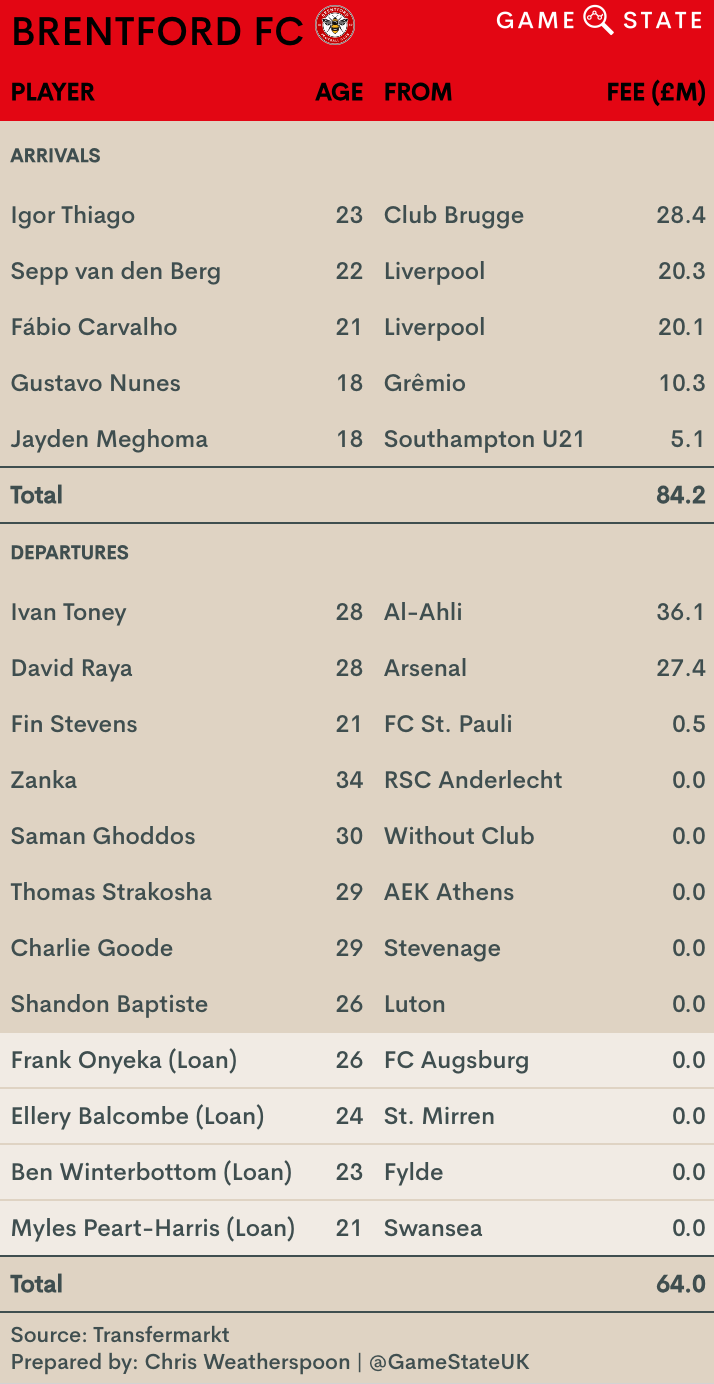

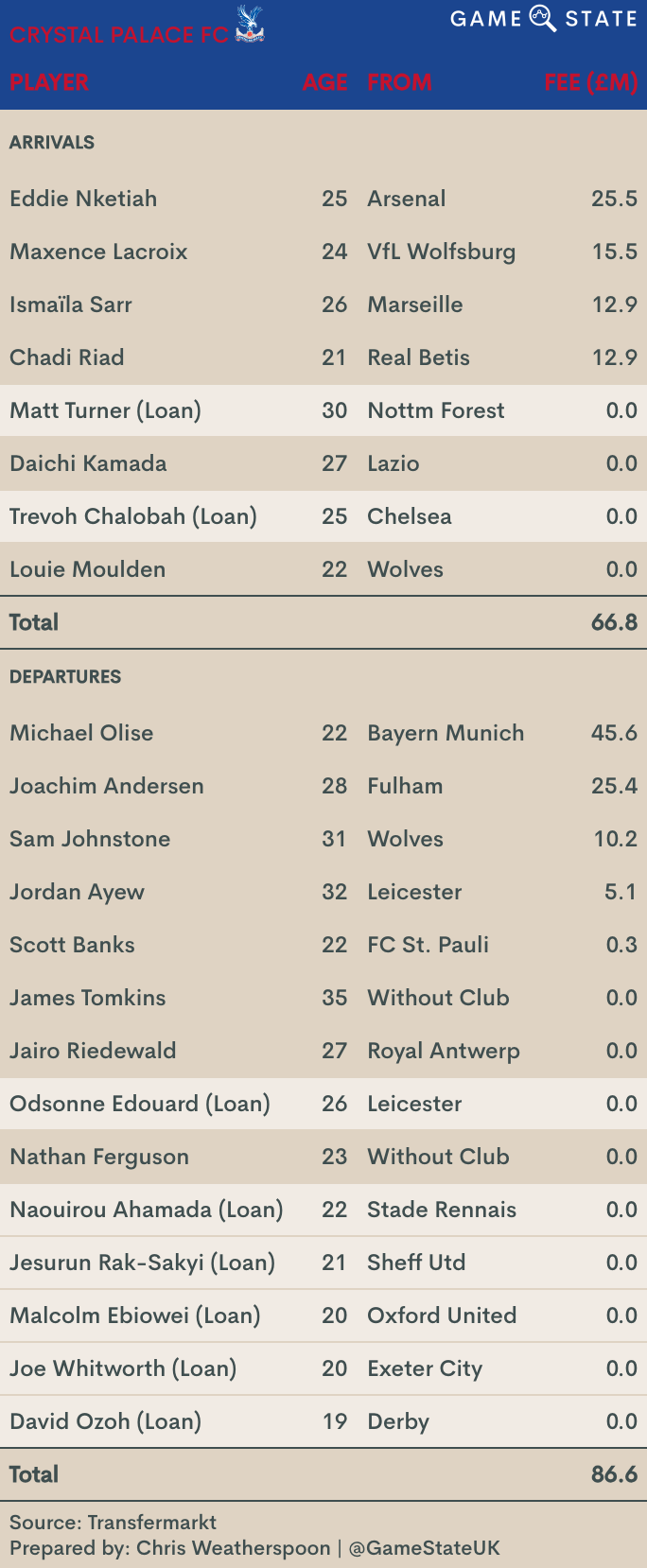

Individual clubs’ transfer activity

Game State has, below, produced three galleries showcasing the full summer 2024 transfer dealings of each of the 20 EPL clubs:

2. Serie A - €1.212 billion

Serie A booked a rare instance of net income on player trading in 2023, but bounced back considerably this summer, clearing €1 billion in gross spending for the first time in four years. Despite a domestic TV deal that has actually fallen slightly, several Italian clubs showed little sign of worrying about any impending credit crunch.

Juventus led the way both collectively and individually, their signings of Teun Koopmeiners and Douglas Luiz setting them back over €100 million of their €200 million outlay.

Yet the biggest spenders on a net basis were Serie A’s 2022/23 champions Napoli. Fresh from what some have described as the worst title defence in Italian football history, the Naples outfit went big this summer, spending €181 million gross and bringing in Scott McTominay and Romelu Lukaku from the EPL, alongside big money deals for Torino centre-back Alessandro Buongiorno and Benfica wideman David Neres.

The age profile of many Serie A signings was higher than seen elsewhere, which, if we’re to use an old trope, might reflect the slower pace of the Italian game. Regardless, Italian clubs didn’t shirk from opening their chequebooks this window, with several of them spending big on a net basis.

Unlike the EPL, where even the lowest spenders (gross) parted with an eight-figure sum, the bottom end of Serie A saw a contrast to the top. At FC Empoli not a penny was spent on new players, even after the club survived relegation last season by just a single point. Having said that, perhaps consistency will prove key: only three games have been played, but at the moment Empoli sit seventh and unbeaten.

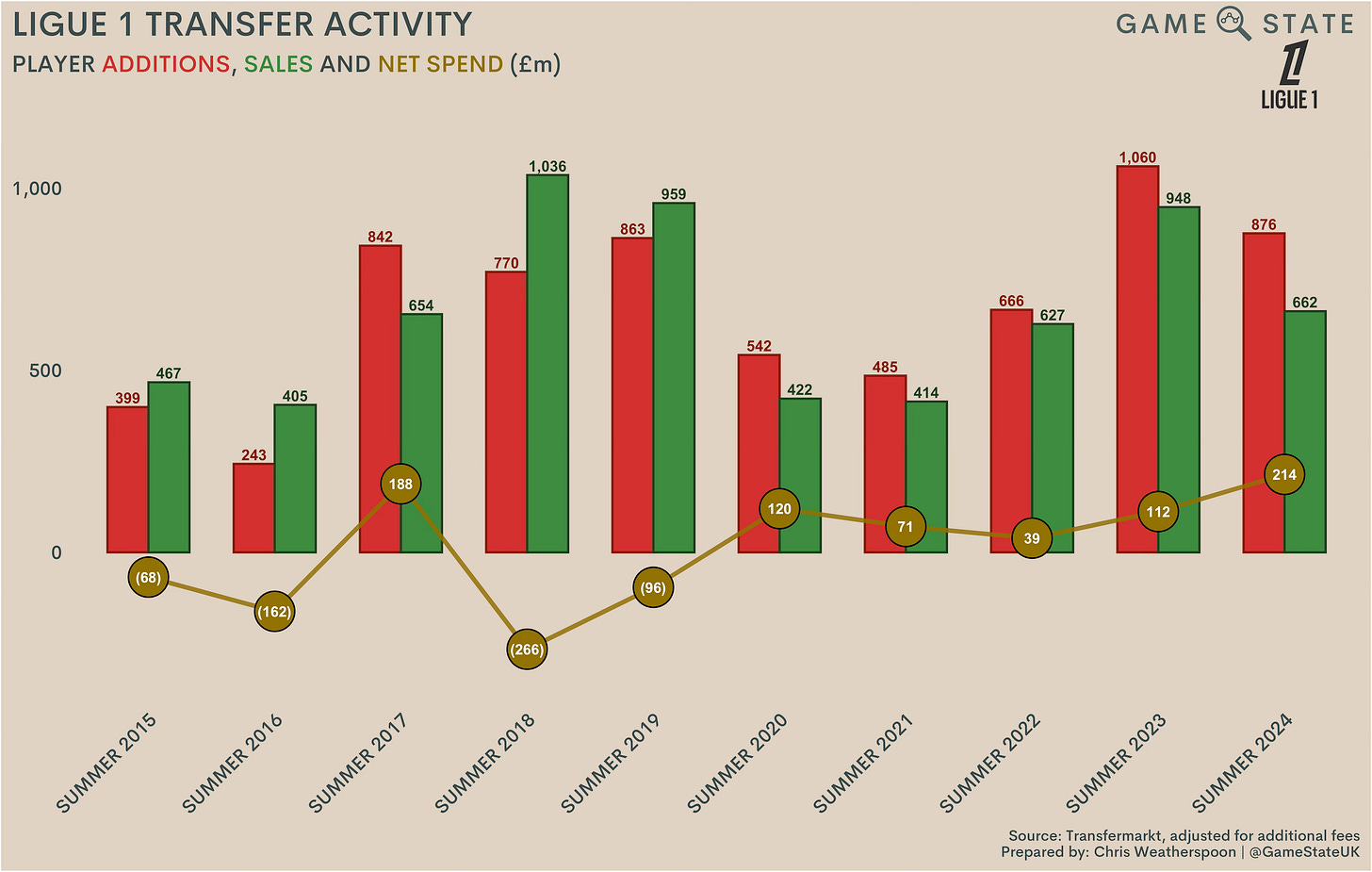

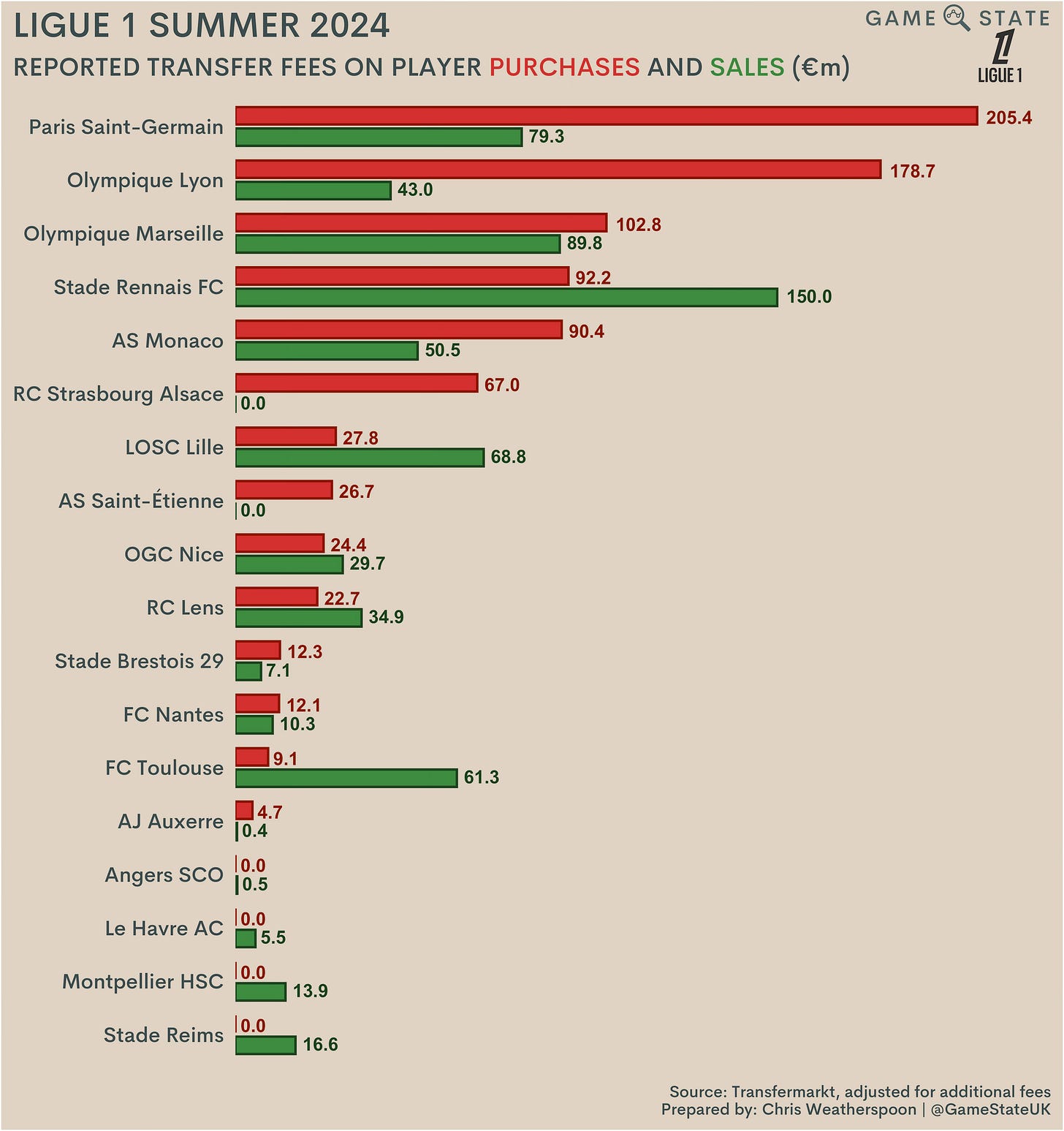

3. Ligue Un - €876 million

Despite the well-documented financial troubles currently plaguing French football, Ligue 1 clubs actually saw net spend on transfers double this summer, rising to over €200 million. In truth, league-wide views of the French top tier have been skewed ever since PSG’s takeover in 2011; their largesse is wildly out of step with the rest of the division, and

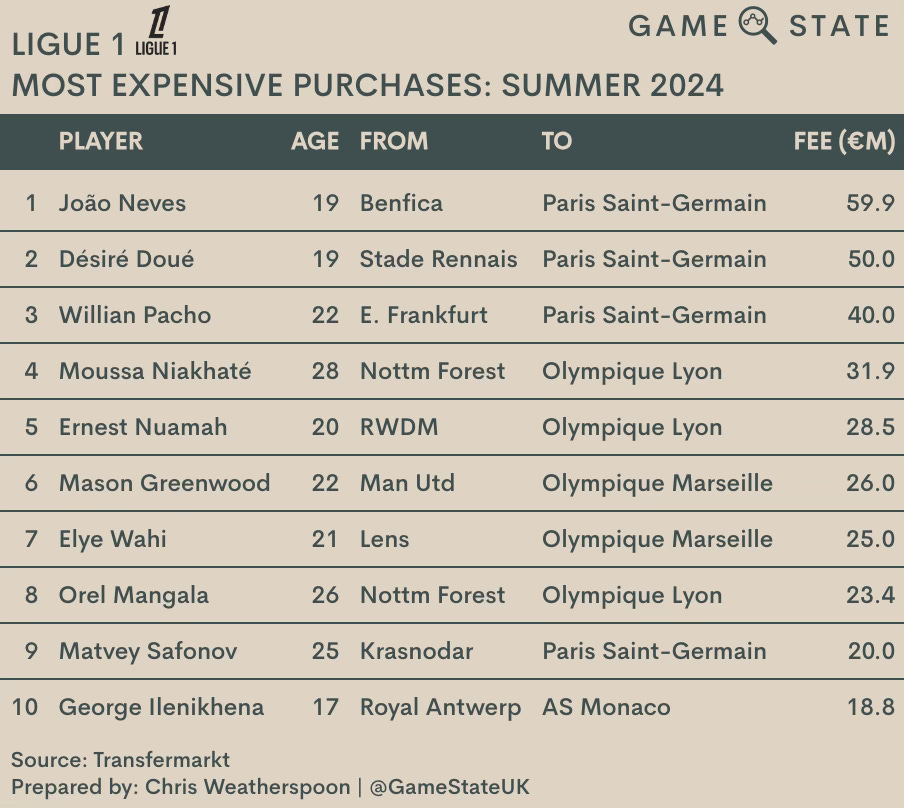

This time around, though, it wasn’t just the team from the capital that pushed the boat out. In fact for much of the window PSG weren’t even the biggest spenders, though they ultimately retained their spot atop the pile through the signings of João Neves, Désiré Doué and Willian Pacho, with all three deals costing more than any other French club spent on a single player.

Vying with PSG were Olympique Lyon, who parted with the thick end of €180 million this summer, sending around €60 million of that to Nottingham Forest for the services of Moussa Niakhaté and Orel Mangala. Lyon enjoyed (or endured) a strange summer, spending heavily before, reportedly, putting the majority of the first-team squad up for sale in order to raise funds. That they were outsold by six other Ligue 1 clubs would suggest the tactic didn’t particularly work.

Four clubs in Ligue 1 didn’t spend a penny on new players. Stade de Reims were the lowest net spenders, which former manager Will Still might see as vindication following his decision to leave the club earlier this year, ostensibly due to dismay at their transfer policy.

French football finds itself in a perilous state right now, and it’s telling that some of the biggest outlays came from clubs owned by types with plenty of apparent wealth behind them whether or not the domestic TV deal improves any time soon.

PSG’s source of wealth is well-known, but below them the likes of AS Monaco, owned by Russian oligarch Dimitry Rybolovlev and RC Strasbourg, part of Chelsea’s Multi-Club Ownership group, spent fairly heavily by current Ligue 1 standards. In a division where the extent of financial regulation is club owners ensuring solvency, it seems the have-nots may be about to be left even further behind.

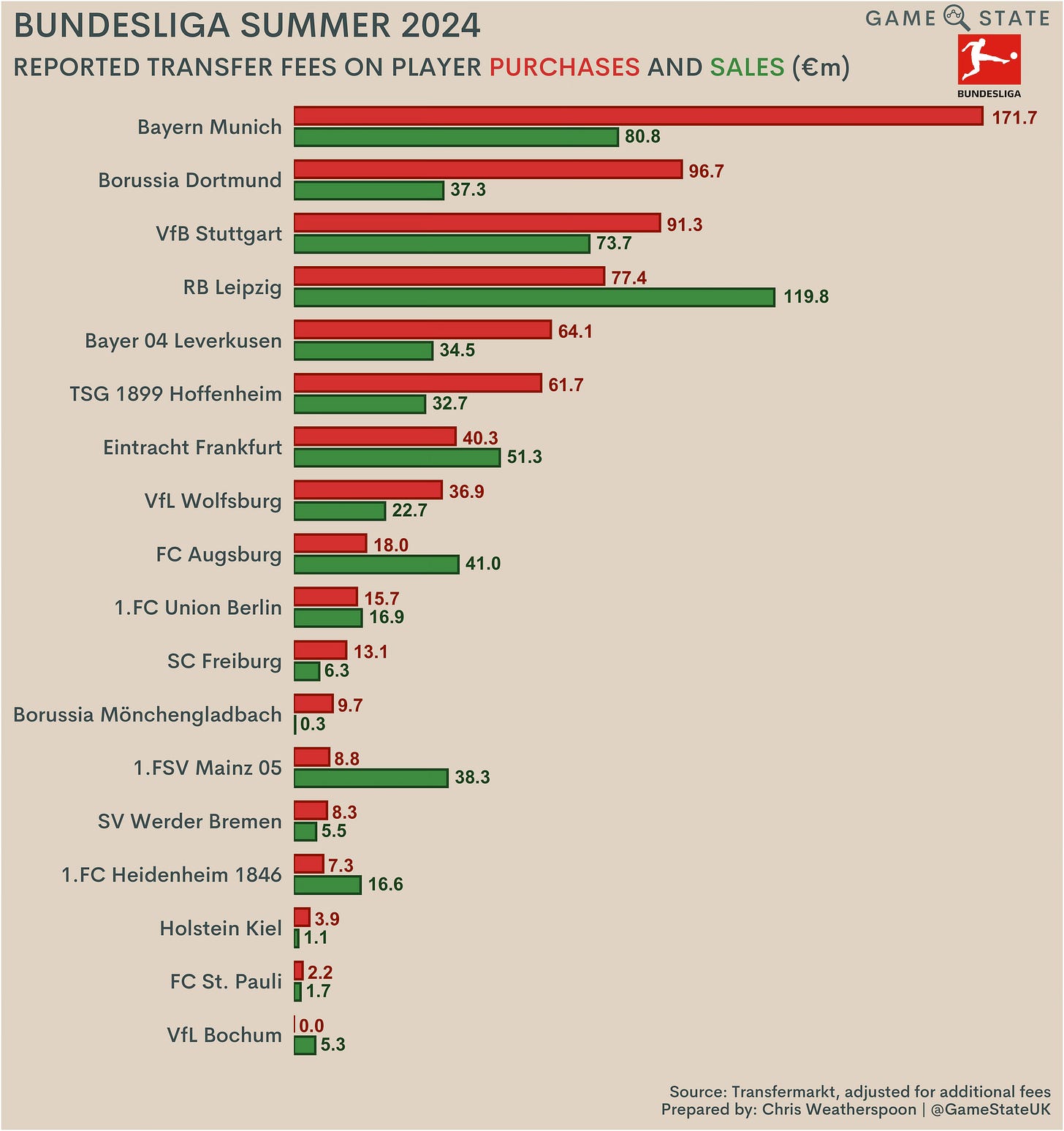

4. Bundesliga - €727 million

In Germany, transfer spending rebounded from the quarter-billion Euros of net income clubs enjoyed a year ago, a summer in which Jude Bellingham, Randal Kolo Muani and Josko Gvardiol all commanded fees in excess of €90 million from foreign buyers, and three more - Dominik Szoboszlai, Christopher Nkunku and Moussa Diaby - each moved abroad in deals worth over €50 million.

This time around, Bundesliga clubs paid out a net €141 million in fees, primarily via the hands of Bayern Munich and Borussia Dortmund. Bayern were, as is commonplace nowadays, the biggest spenders on both a gross and net basis; Crystal Palace’s Michael Olise and Fulham’s João Palhinha left London and the EPL in deals that each top €60 million once additional fees are taken into account.

While the summer’s two largest deals saw star players in English sides move to Bavaria, four of the 10 biggest were transactions that stayed within the confines of the Bundesliga. Dortmund nabbed 21-year-old striker Maximilian Beier for a shade under €30 million from TSG Hoffenheim following a breakout season last year, while VfB Stuttgart found themselves raided by both of the league’s biggest names for their centre-back pairing of Hiroki Ito (Bayern) and Waldemar Anton (Dortmund).

Stuttgart were the division’s third-highest sellers (€74 million), topped only by Bayern (€81 million) and RB Leipzig (€120 million), who booked nine figures in sales for the third time in the last four summers.

In all, Leipzig have banked nearly €600 million in player sales in just the last four summers. This year, the sales of Dani Olmo (FC Barcelona) and Mohamed Simakan (Al-Nassr) were German football’s highest and third-highest departing fees, only separated by Bayern’s sale of Matthijs de Ligt to Manchester United.

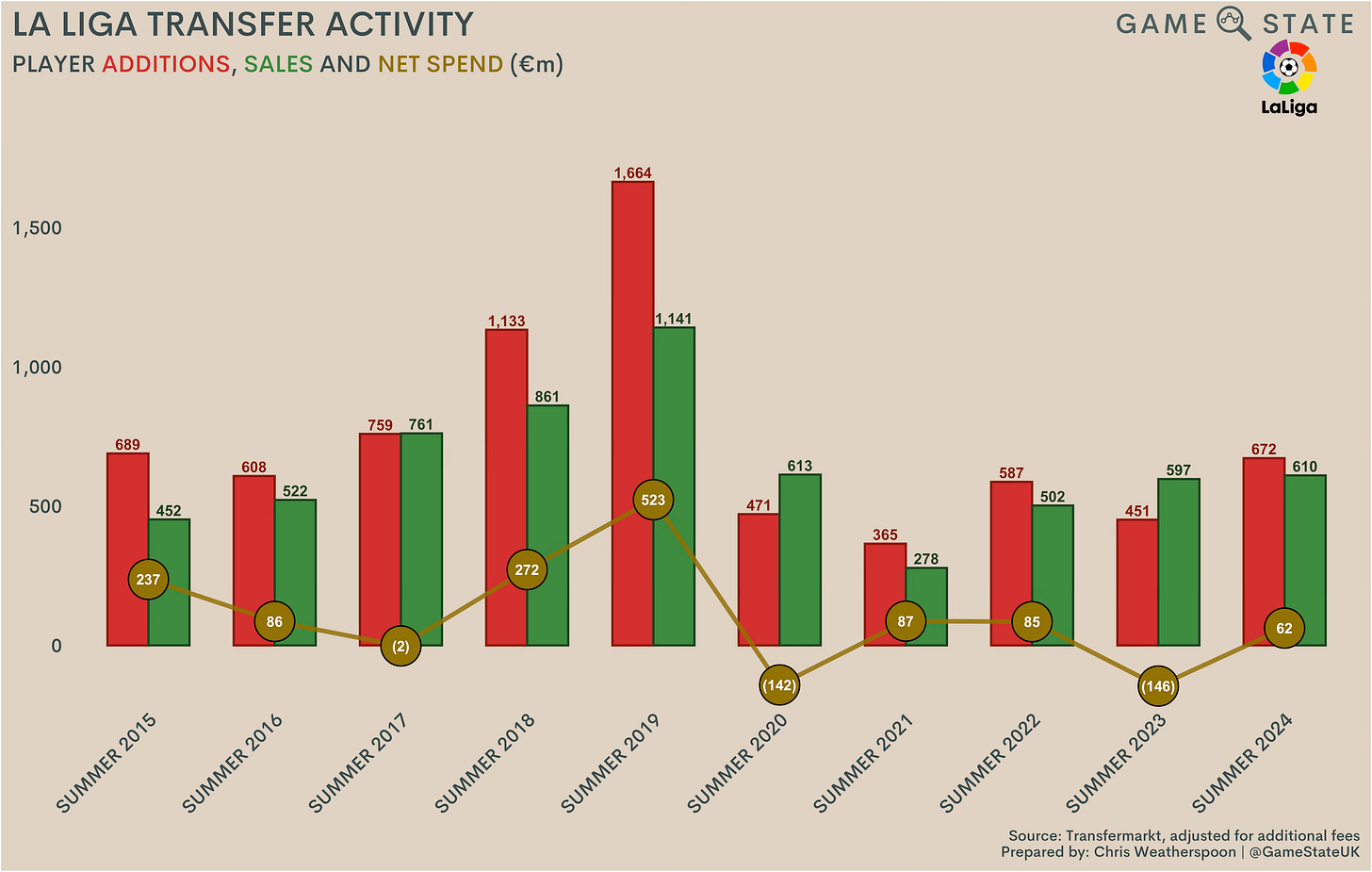

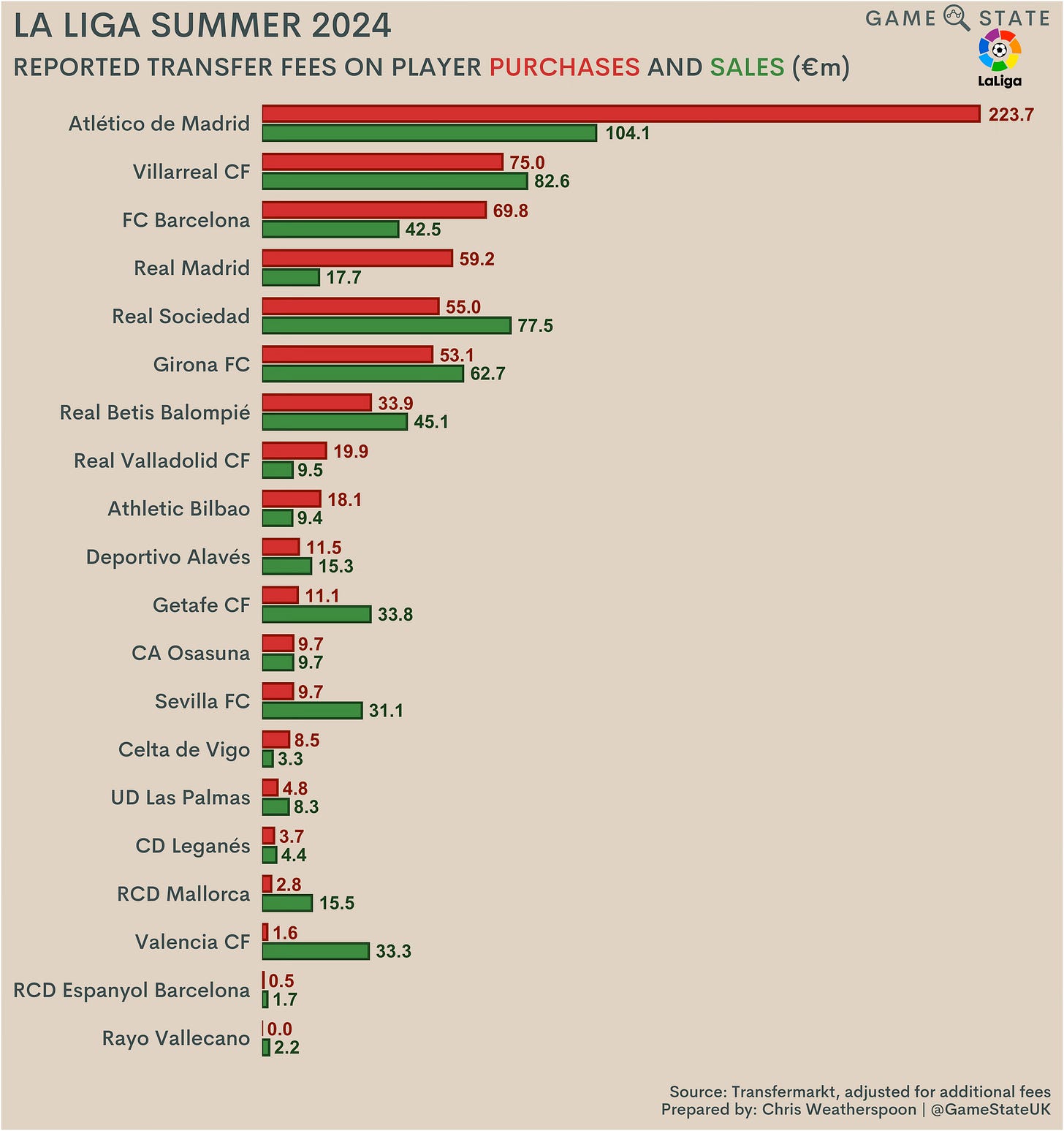

5. La Liga - €672 million

Despite boasting the biggest incoming transfer in the world this summer, La Liga clubs collectively came bottom of the gross spend charts when ranked alongside their fellow ‘big five’ European leagues. In many ways, Atlético Madrid’s chunky spending was the outlier this summer; their €224 million spend on new players was a third of La Liga’s total.

In fact, Atléti weren’t even joined at the top of the spending table by their usual allies. FC Barcelona and Real Madrid were bumped down the order a spot, as Villarreal spent €75 million on bringing six new players to the Estadio de la Cerámica. Logan Costa, Thierno Barry, Luiz Júnior and Willy Kambwala all arrived for fees in excess of €10 million.

It was, therefore, a fairly sedate summer at the Camp Nou and the Bernabeu. Both Barca and Real had to made do with just one ‘big’ signing each this summer, with Dani Olmo leaving Leipzig for Catalonia and youngster Endrick making the journey to Madrid from São Paulo.

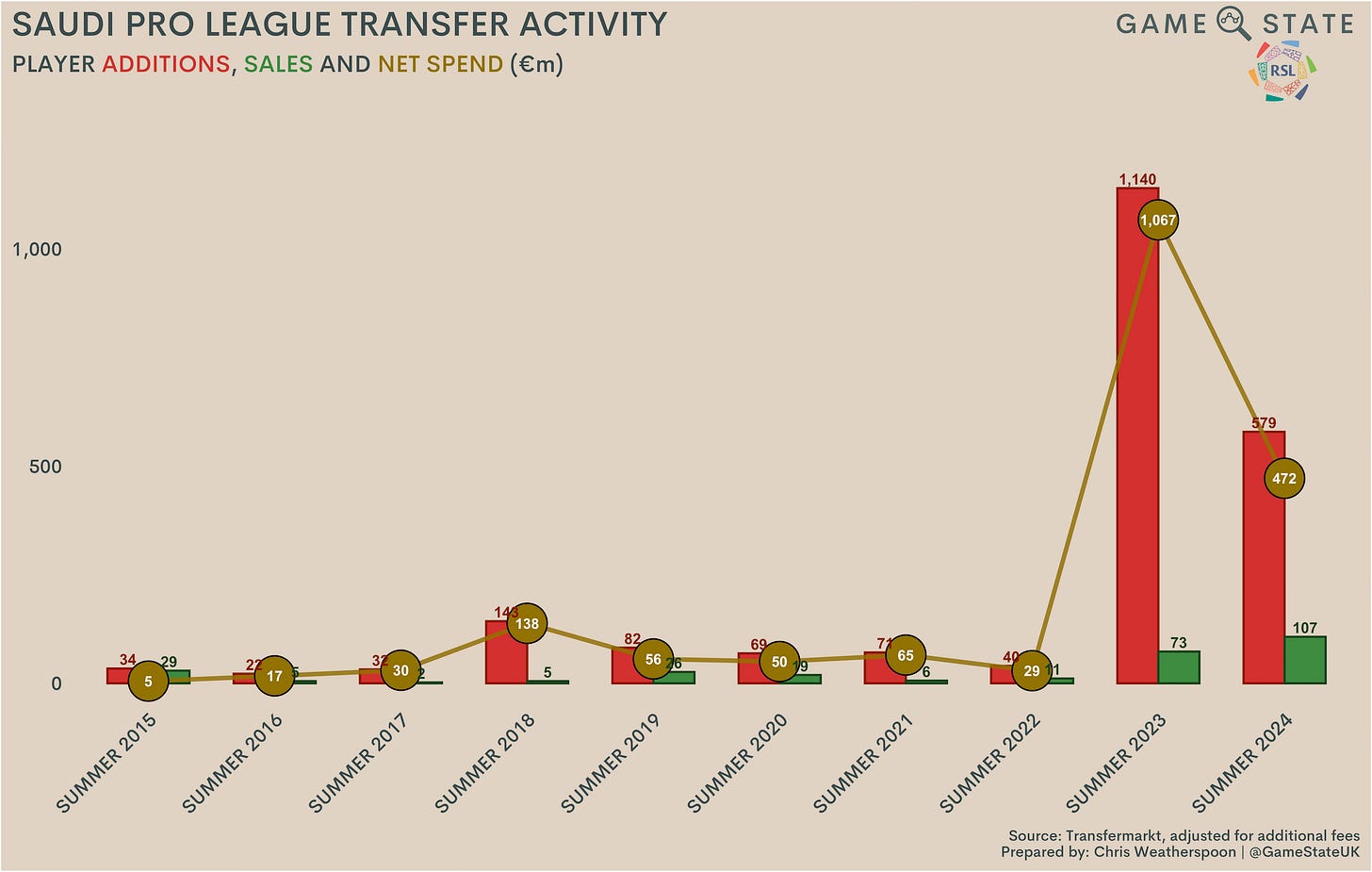

6. Saudi Pro League - €579 million

For the second year running, Saudi Arabian clubs were some of the largest spenders in world football. Yet both the numbers and the narrative of this summer have been far removed from 2023; where then Saudi clubs were seen as disrupters and, for plenty struggling with PSR rules, saviours, a year on and many are wondering if the Saudi football bubble has already burst.

Were it not for a flurry of activity in the later stages of the window - the last seven days accounted for over half of Saudi clubs’ total spending this summer - concerns about the appetite of the PIF to continue investing in football would be even more heightened.

Indeed, it is the activity of the four PIF-owned clubs - Al-Ahli, Al-Hilal, Al-Nassr, and Al-Ittihad - which mostly dictates the spending of the entire league. In the summer of 2022, those four spent just €6 million (net) on new players. A year later, that figure leapt astronomically, to €818 million, and while a €348 million spend this summer still dwarfs most other leagues on the planet, it’s difficult not to see 2024 as a significant slowdown on Saudi Arabia’s behalf (and that’s without even going back over the relative lack of activity at PIF-owned Newcastle United).

That being said, there was one interloper among Saudi Arabia’s big four this summer. Al-Qadsiah’s leapt ahead of Al-Ali with a €79 million spend, most prominently on Boca Juniors midfielder Ezequiel Fernández, though it’s probably worth highlighting that the club’s distance from PIF is fairly short.

Al-Qadsiah are owned by the oil giant Saudi Aramco, who in turn are owned 4 per cent by PIF and 90 per cent by the Saudi government. PIF is, of course, the Saudi government’s sovereign wealth fund. In other words, even if PIF isn’t the legal owner of more than four clubs in Saudi Arabia’s top tier, the hands of those in charge are never too far from whichever club has opened the purse strings.

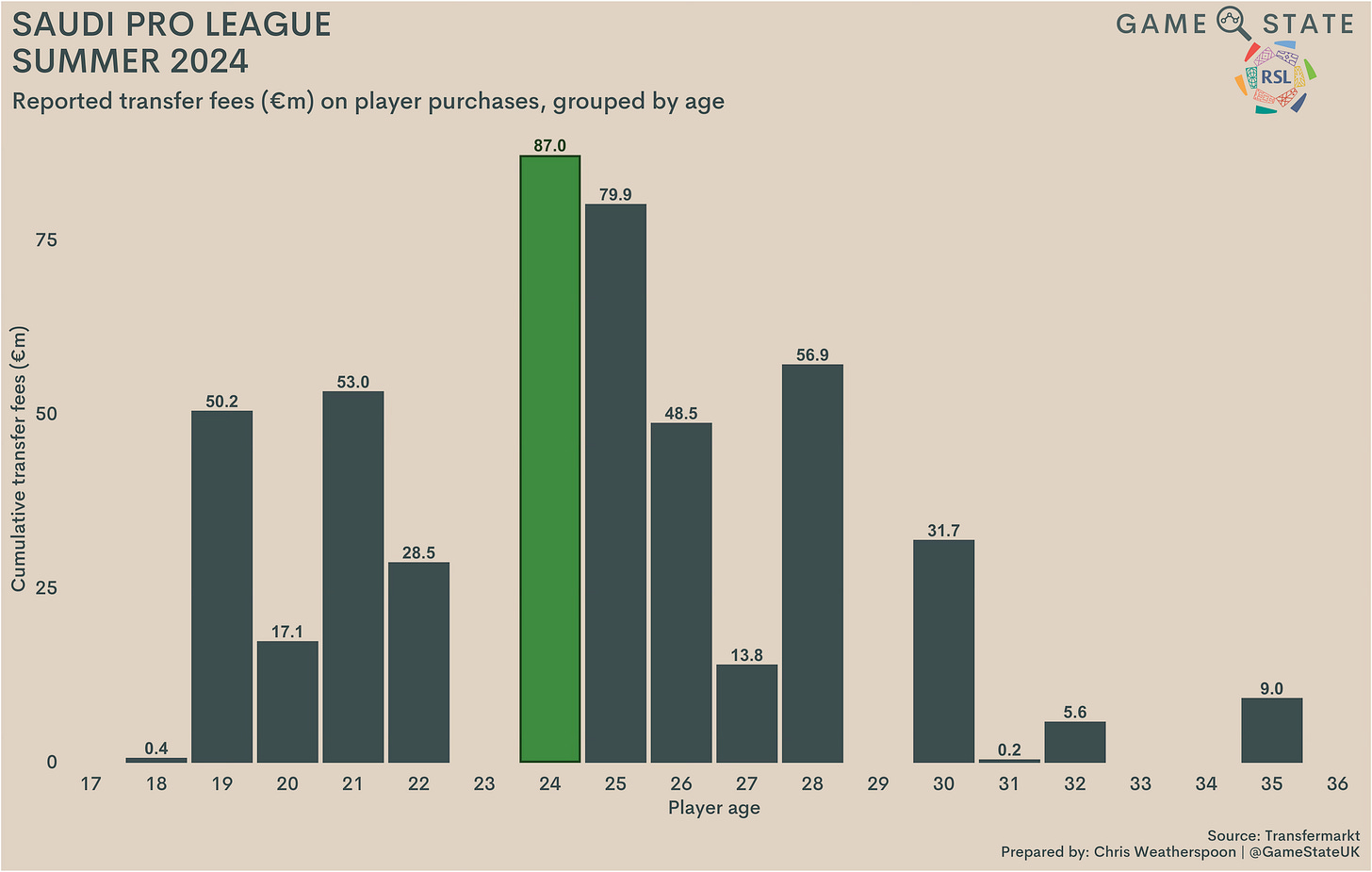

While there was an evident slowdown in overall spending by Saudi clubs this summer, one notable underlying shift - and one which perhaps counters the idea of waning interest from the powers-that-be - was the age of the players on which money was spent.

In 2023, around €540 million was spent on players aged 28 or over. This year, just €103 million was spent on the same cohort, and around two-fifths of that went towards Ivan Toney’s move from Brentford to Al-Ahli.

In a surprising shift, the vast majority of Saudi money this summer went on players aged 25 or under. The most expensive and most surprising was 25-year-old Moussa Diaby who, despite a solid opening season at Aston Villa and the imminent lure of Champions League football, chose to swap the Midlands for Jeddah in signing for Al-Ittihad in a reported €60 million move. Diaby’s transfer was the joint-fourth most expensive in the world this summer.

Whether Saudi (or PIF) spending continues to slow remains to be seen, but the fact so much has been expended on young players this year runs counter to the idea of Saudi Arabian football as a home for the aged.

It’s possible that the younger cohort signed this summer have put money ahead of the prestige they might gain playing in more recognised leagues, Toney, for example, is reportedly earning an obscene £1 million per week once bonuses are included, but it’s equally feasible that Saudi clubs have shifted toward aiming at bringing younger talent to their shores.

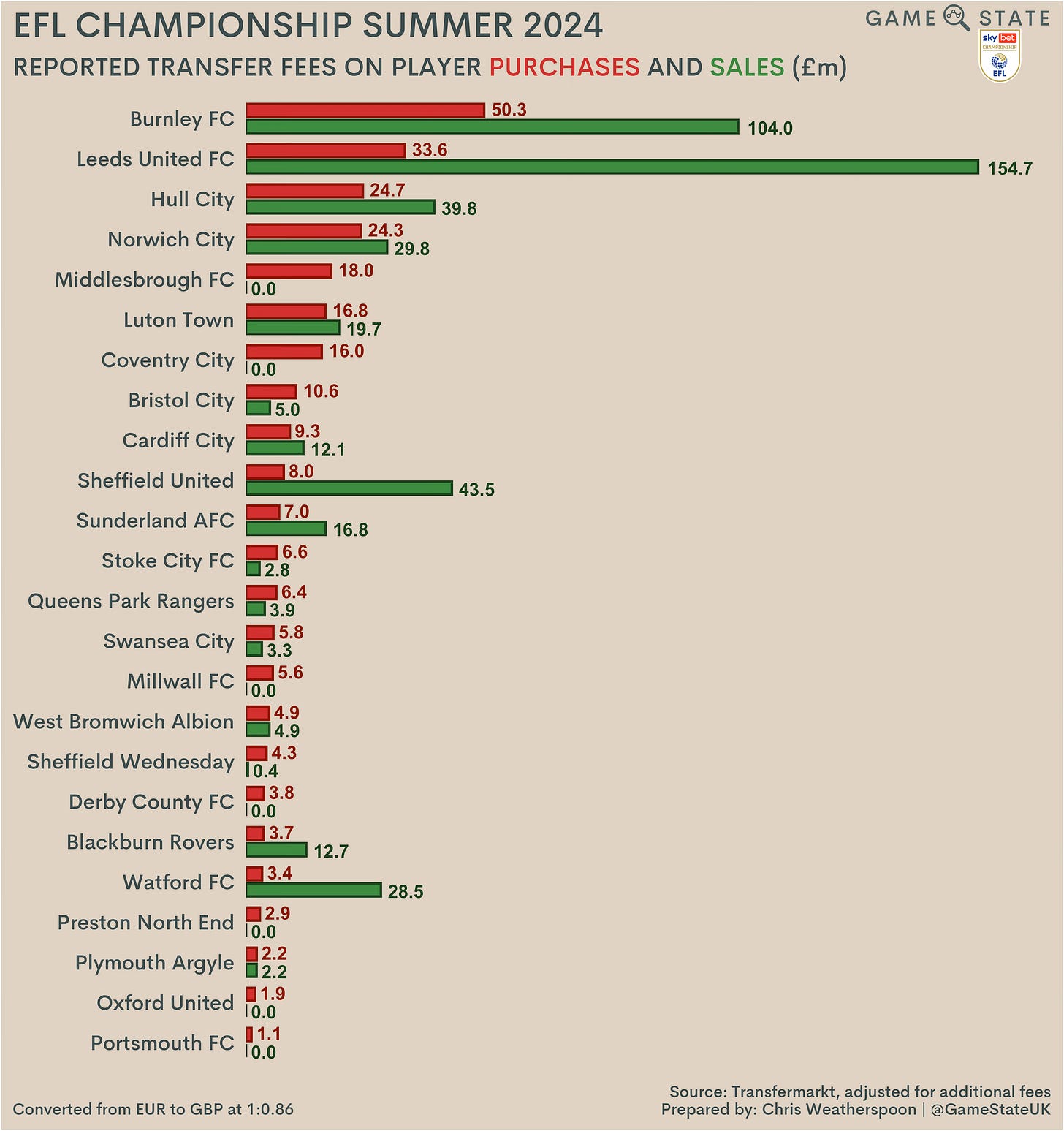

7. EFL Championship - €317 million / £271 million

(Note: all figures in the EFL Championship section below are shown in GBP)

The only second tier division to appear in our top 10 is England’s EFL Championship, reflecting both the madcap finances of clubs in that league as well as the trickle-down effect of sitting one rung below football’s wealthiest domestic competition.

Cementing its reputation as one of the best-selling leagues in world football, Chammpionship clubs banked over €500 million in player sales for the second summer running (and nearly more than £500 million each time too).

The origin of that near-half-billion pounds was overwhelmingly from the division above. The seven biggest sales by Championship clubs this summer saw players move to the EPL, reflecting an increasing trend in recent years of top tier clubs snaffling the best players from the recently relegated. That trend was further underlined by the split of sales between former EPL clubs and the rest: £322 million of the division’s combined sales of £484 million (67 per cent) wound up in the pockets of clubs that have been relegated from the EPL in one the last two seasons.

Elsewhere, there was ongoing vindication for Sunderland’s player recruitment model, as star winger Jack Clarke was sold to Ipswich Town for considerably more than the initial £750,000 the Black Cats paid for him. The fee actually received by Sunderland was lower than the £15-16 million reported, with former club Spurs owned 25 per cent of the profit on the deal, but this combined with last year’s sale of Ross Stewart means the Wearside outfit has now recouped in the region of £20 million for two players who, combined, cost them barely seven figures.

At the bottom end of the spending table, Championship new boys Oxford United and Portsmouth propped up the rest, putting down just £3 million between them on new players. The wealth of the EPL trickles down to England’s second tier - but only to a select few.

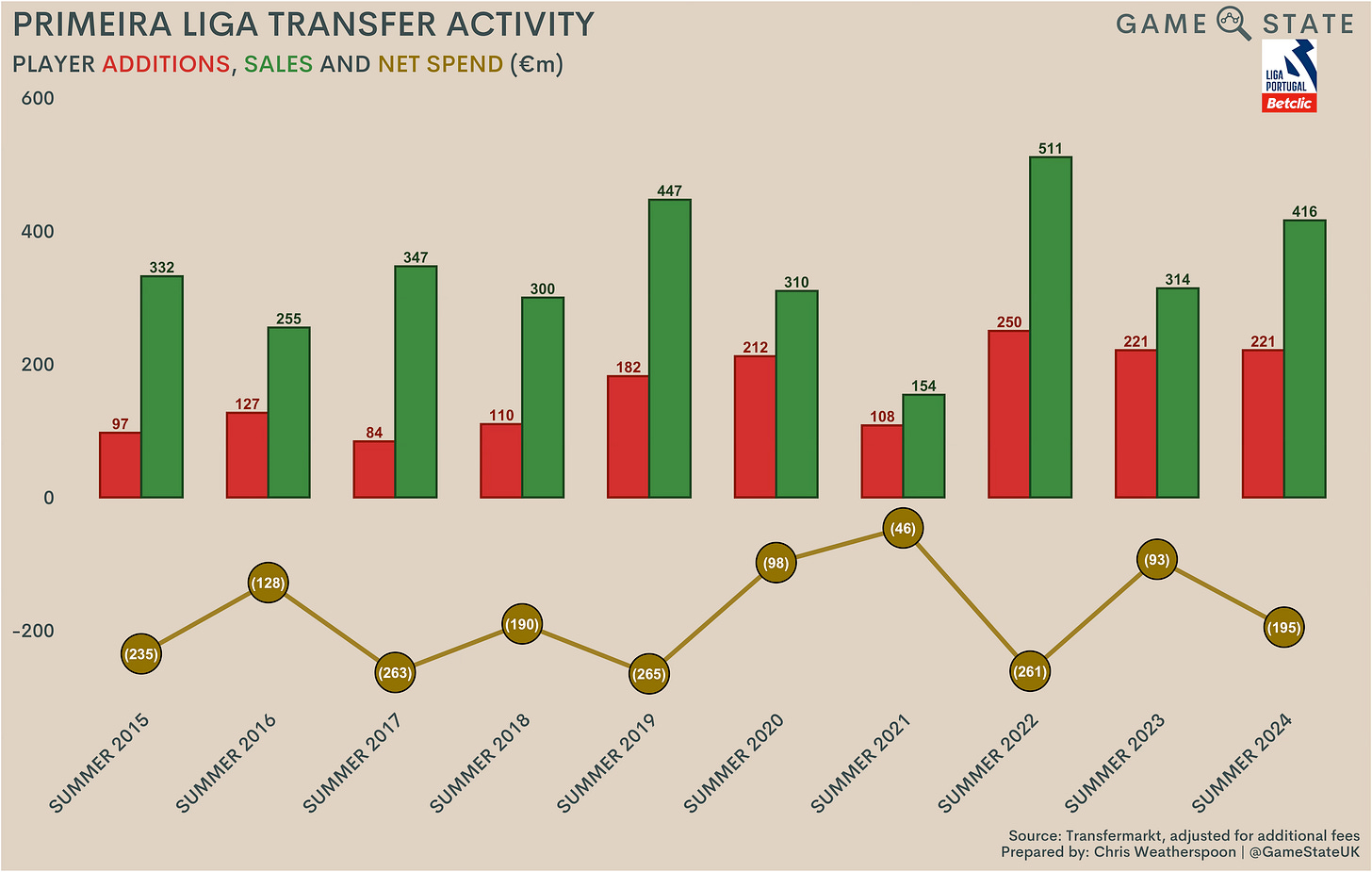

8. Primeira Liga - €221 million

In Portugal, the Primeira Liga retained its reputation as one of the best selling divisions in world football. Every summer for the last decade has seen Portuguese clubs generate net income from transfers, and only during the Covid-induced slowdown in 2021 did that net income dip below €100 million.

One reason Portuguese clubs have proven so adept at selling for chunky profits is the nation’s shared language with that bastion of South American football: Brazil. Portuguese sides routinely bring youngsters across the Atlantic to Europe - this particular transfer ‘flow’ is regularly the most numerous in the world when FIFA publishes its annual transfer report - before moving them on to wealthier clubs overseas.

This summer was no different in that regard, as three of the four largest sales by Portuguese clubs involved Brazilian nationals: Marcos Leonardo (€40 million) and David Neres (€28 million) left Benfica for Al-Hilal and Napoli respectively, while sandwiched between them was Evanilson (€37 million), who said goodbye to FC Porto to take up residence as Dominic Solanke’s replacement in Bournemouth.

The last club to win the Primeira Liga not named Benfica, Sporting or Porto were Boavista, 24 years ago. Given the transfer activity on display both this summer and previously, that record doesn’t look like ending any time soon. Between them, Portugal’s ‘big three’ accounted for 80 per cent of player purchases this summer.

Add in SC Braga and that figure rises to 91 per cent, showing the clear disparity that exists within Portugal’s top flight. In fact, of the 18 top tier clubs, 10 didn’t spend over €1 million in transfers this summer. Sizeable sales were thin on the ground too, though FC Famalicão did bank €12 million from Villarreal for goalkeeper Luiz Júnior, while FC Arouca pocketed a healthy €10 million for Spanish striker Rafa Mujica from Qatari side Al-Sadd.

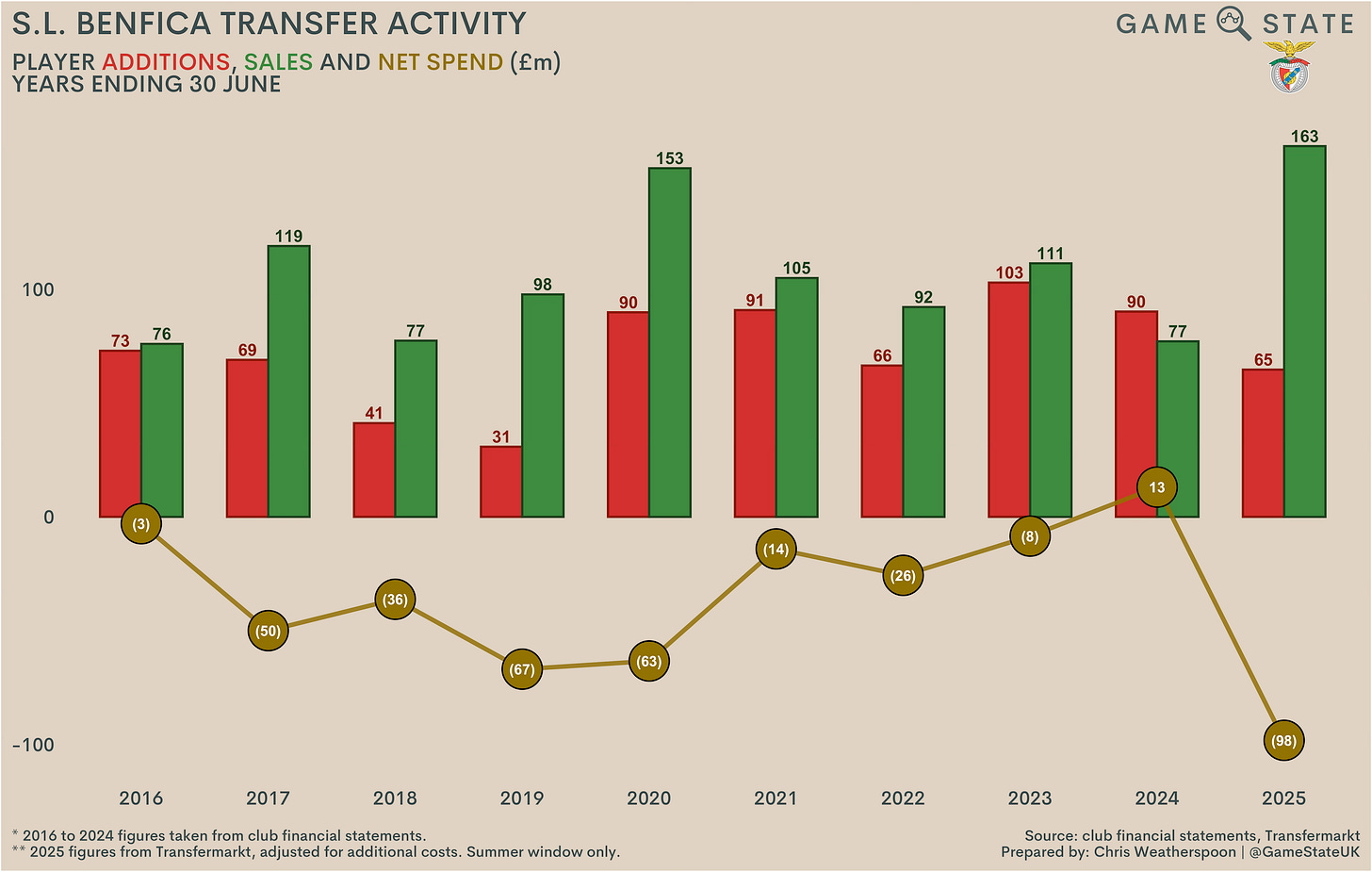

Lowly sales haven’t been a problem at Benfica for a long while, and this summer was little different. As Águias recouped over €160 million on outgoing players, commanding €60 million from PSG for João Neves and a further €40 million from Al-Hilal for young striker Marcos Leonardo.

The river of talent that flows through Campus Benfica shows little sign of drying up: the club has earned €1.1 billion in player sales in the last decade. Remarkably, far from player profits waning, this summer has been Benfica’s most successful in that regard for at least the last 10 years.

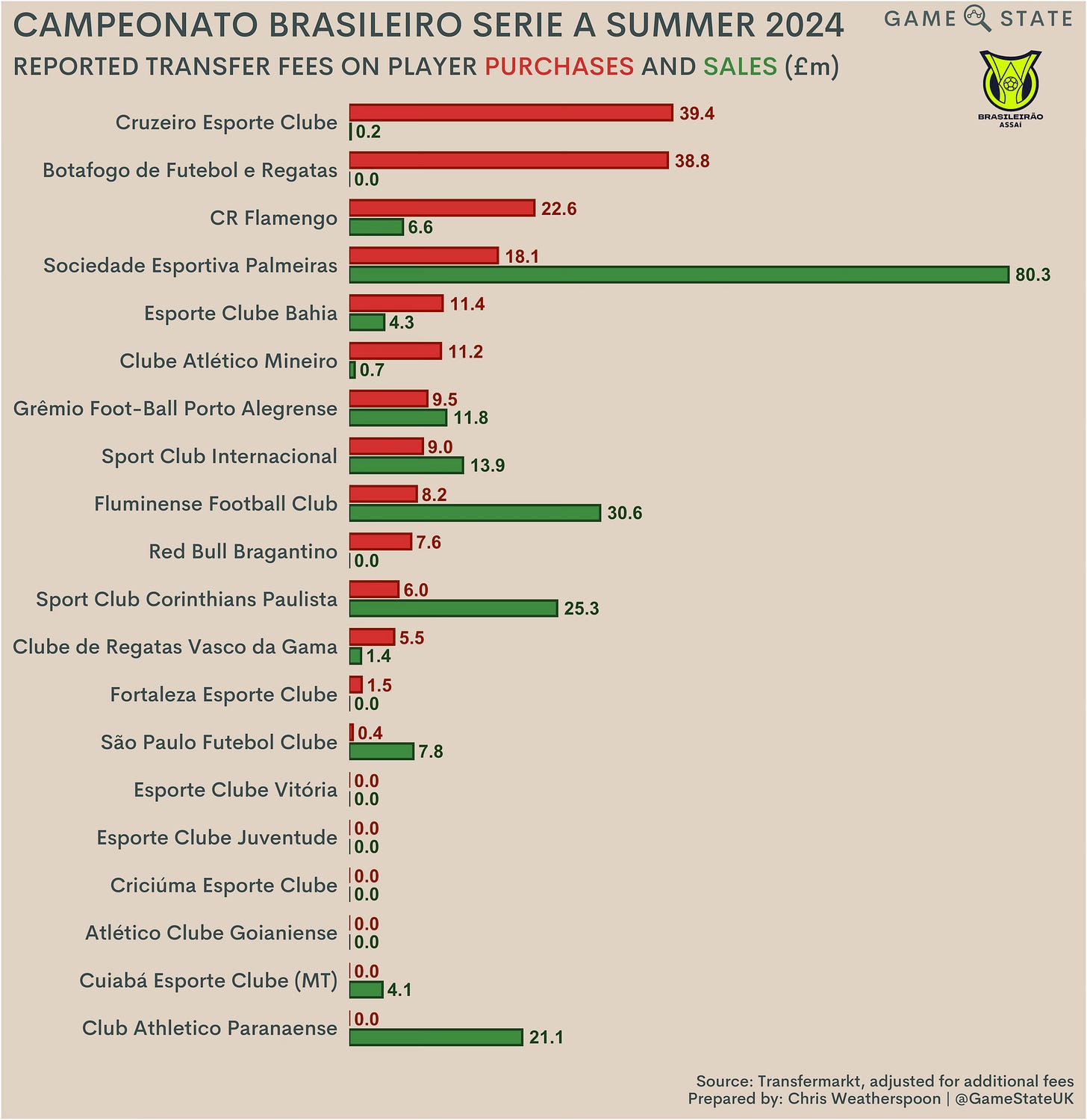

9. Campeonato Brasileiro Série A - €221 million

Outside of the Saudi Pro League, the only other non-European league in the top 10 spenders this summer was Brazil’s top tier. Following the relaxation, in 2021, of rules around private entities owning football clubs, swathes of money have entered Brazilian football. That, combined with the continued flow of young starlets to major European leagues, has ensured Brazilian clubs have pockets deep enough to collectively spend more than ever on transfers.

The contrast pre- and post- that ruling three years ago is stark. Gross spend has ballooned, topping €300 million over the last two summers, and while clubs remain strong sellers of young talent, spend on a net basis has jumped markedly up too.

Eight of 20 clubs remained net sellers this summer, but the uptick in spending is clear to see. What is more, there are signs of a prominent trend reversing. Where young Brazilians have, for a long while now, flocked to European shores, this summer presented evidence of Série A clubs wresting a number of young players from their transatlantic counterparts. Granted, the likes of Endrick still took their leave of Brazil, but a rung or two down on the quality ladder saw a number of players traverse the opposite route.

Of the 10 most expensive deals with a Brazilian club as the buyer, seven were engaged with European clubs as sellers (if you’ve counted eight above, take heed that the Liverpool FC that Bahia bought Luciano Rodríguez from is in Montevideo, not Merseyside). Five different deals cost €10 million or more, even before additional costs are considered; in 2015 the highest incoming deal cost just €4.5 million, and in total only 13 purchases topped €2 million.

10. Liga MX - €153 million

There was a sizeable drop-off in gross spend between the ninth and tenth-placed divisions on our listing this summer, with Mexico’s Liga MX and Turkey’s Süper Lig, both of whose transfer windows haven’t yet closed, competing (whether they’re aware of it or not) for a spot in the top 10.

At the time of writing the higher spenders, by a smidge, were the clubs of the Mexican first division, even despite the league’s net spend almost halving from summer 2023.

Indeed, the fees on show in Mexico were wildly removed from those seen elsewhere this summer. The highest fee (pre-any adjustment for additional costs) didn’t top €10 million, and that lowly net spend was the byproduct of money mostly going round in circles: all 10 of the most expensive deals in Liga MX so far this summer involved both the seller and the buyer as hailing from Mexico’s top tier.

If you enjoyed this piece, please share with your friends and networks. Additionally, if you don’t already, connect with Game State on LinkedIn, X, Facebook, Instagram, Reddit and Bluesky.