Club financial analysis: Celtic FC 2023/24

Game State's analysis of Celtic FC's 2023/24 financial results.

Celtic successfully defended their Scottish Premiership (SPL) title in 2023/24, winning their 12th league championship in the last 13 years and their 54th overall, one shy of arch rivals Rangers’ world record. The Bhoys finished eight points ahead of their fellow Glaswegians, then rubbed salt firmly into the wounds a week after the league season ended, as a last minute goal from Adam Idah proved enough to seal a league and cup double.

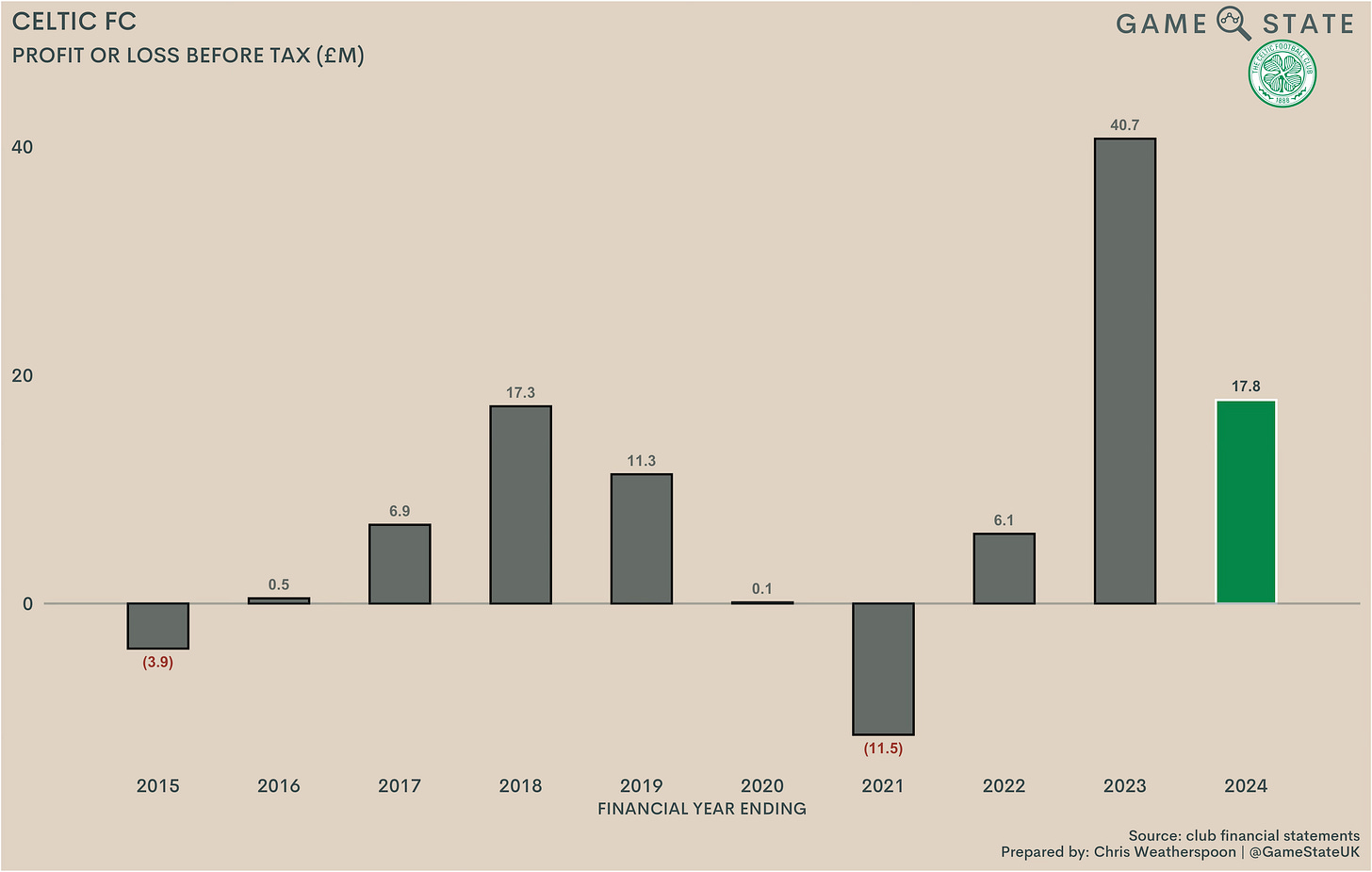

Off the pitch, Celtic booked £18 million in pre-tax profit, their third straight annual surplus. Having said that, it did comprise more than a halving of the 2023’s £41 million profit, as the loss of £14 million in one-off income in the previous season (being £10 million received from a Covid-19 business interruption insurance recovery and £3.5m from Tottenham Hotspur for the services of manager Ange Postecoglou) combined with reduced player sales and increased costs to tighten club margins.

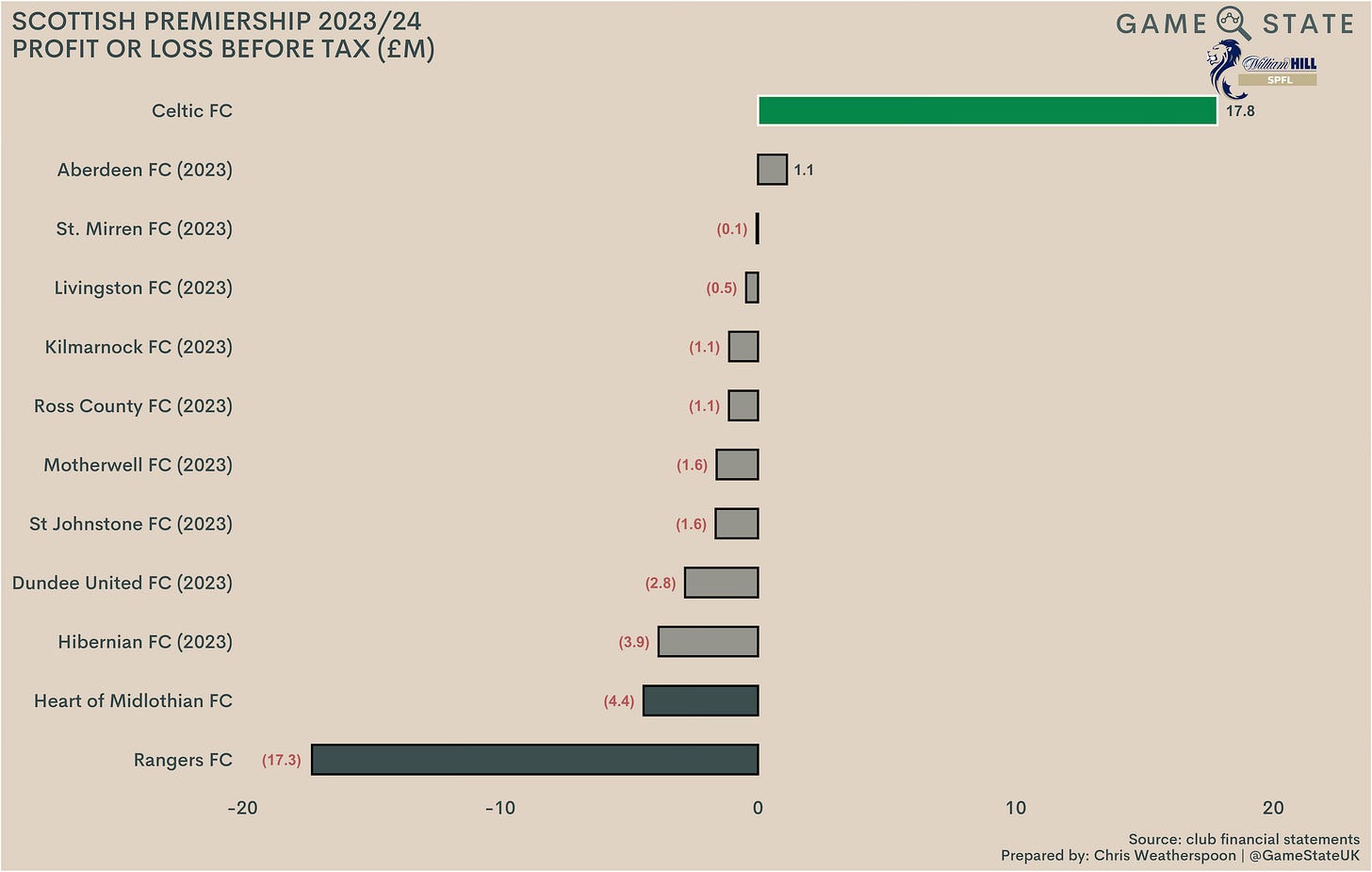

That £18 million profit is still an impressive result, made all the sweeter by yet more silverware arriving at Celtic Park last season. Indeed, it’s not only the best result in Scotland so far released, but also one of the better ones in Europe to date. Granted, most teams still haven’t published 2023/24 financials, but of those that have and were profitable, Celtic’s surplus sits ahead of most currently, including the likes of AZ Alkmaar, Beşiktaş JK, Real Madrid, SC Braga, Sporting CP and AC Milan.

Profit and loss account

Celtic have booked around £65 million in profit across the last three years, and have been in the black in eight of the last 10 seasons. Indeed were it not for the advent of the Covid-19 pandemic, it’s likely the Glasgow club would be looking back on nine consecutive profitable seasons.

That pits them as an outlier not only in Scotland but in football in general, as most clubs make a loss. Correspondingly, their £18 million in profit last season is comfortable the highest recent financial result north of the border and, of the three SPL clubs to have announced 2023/24 results, they are the only to have booked a profit.

Celtic’s positive financials stand pretty opposite those of their Glaswegian rivals. Rangers have lost money in every year of the past decade, with losses in that time totalling £110 million. Celtic, meanwhile, earned £85 million in the same 10-year span, a near-£200 million swing.

Celtic’s profitability is a long-run thing. After seven consecutive years of making chunky losses at the beginning of the new millennium, The Hoops have turned a profit in 14 of the last 18 seasons. In that time the club’s cumulative surplus sits at £118 million, reflecting (as we’ll see) the club’s ability to mostly fund itself with minimal owner funding, in sharp contrast to many clubs nowadays.

Though Celtic’s pre-tax results have been pretty rosy for a while, the picture at the operating level has only recently brightened. 2024 saw them book £8 million in day-to-day profits, down from £26 million in 2023 but still their second-best operating result of the past decade. The fall was arguably less pronounced than that; 2023’s figure includes that £14 million of one-off income, which could instead be booked below the operating line. Had it been, their prior season day-to-day profit would have been £13 million, much closer to 2024’s figure.

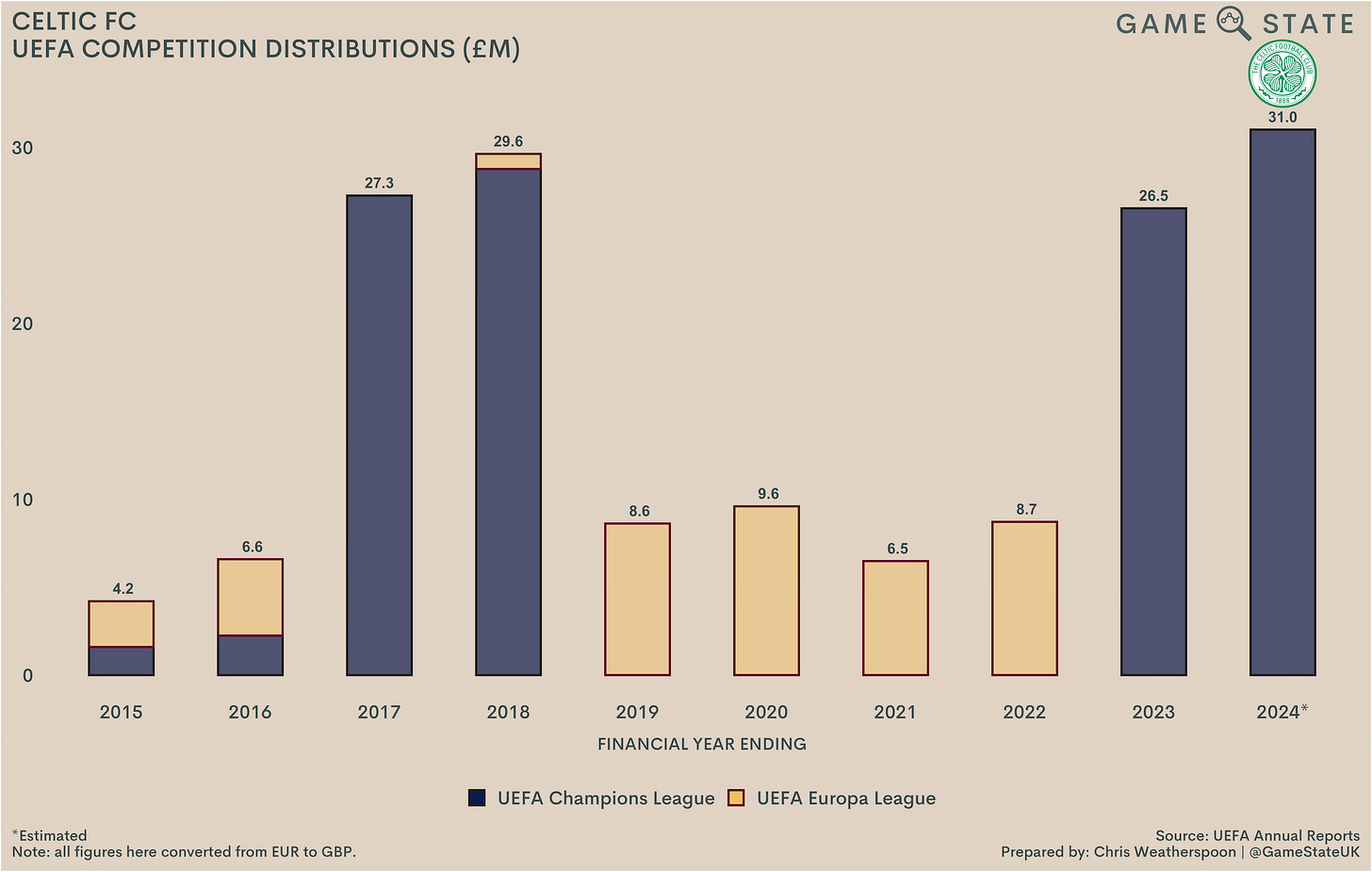

The driver behind the improved operating results in recent years is simple enough to identify: Champions League football. Of the four seasons in the last 10 where Celtic have booked a day-to-day profit, all four have been in years where they qualified for the group stages of Europe’s premier club competition.

That’s not to play down the achievement. A significant majority of football clubs fail to book operating profits, including plenty of Champions League sides, with many clubs increasingly reliant on player trading to improve the bottom line (and many more simply not posting a profit at all).

Celtic’s day-to-day profitability is impressive, then, even if it does appear reliant on them retaining their Champions League status from year to year. Comparing to the rest of the Scottish Premiership highlights how much of an outlier Celtic are; based on most recent figures, they were the only top tier club to book an operating profit.

Turnover

At the top line, Celtic’s turnover of £125 million was a new club record, up £5 million and four per cent on 2023. Despite being profitable over the years, the club’s income growth had often been unimpressive, but 2024 marked the second consecutive year, and only the third time ever, that Celtic booked revenue in excess of £100 million.

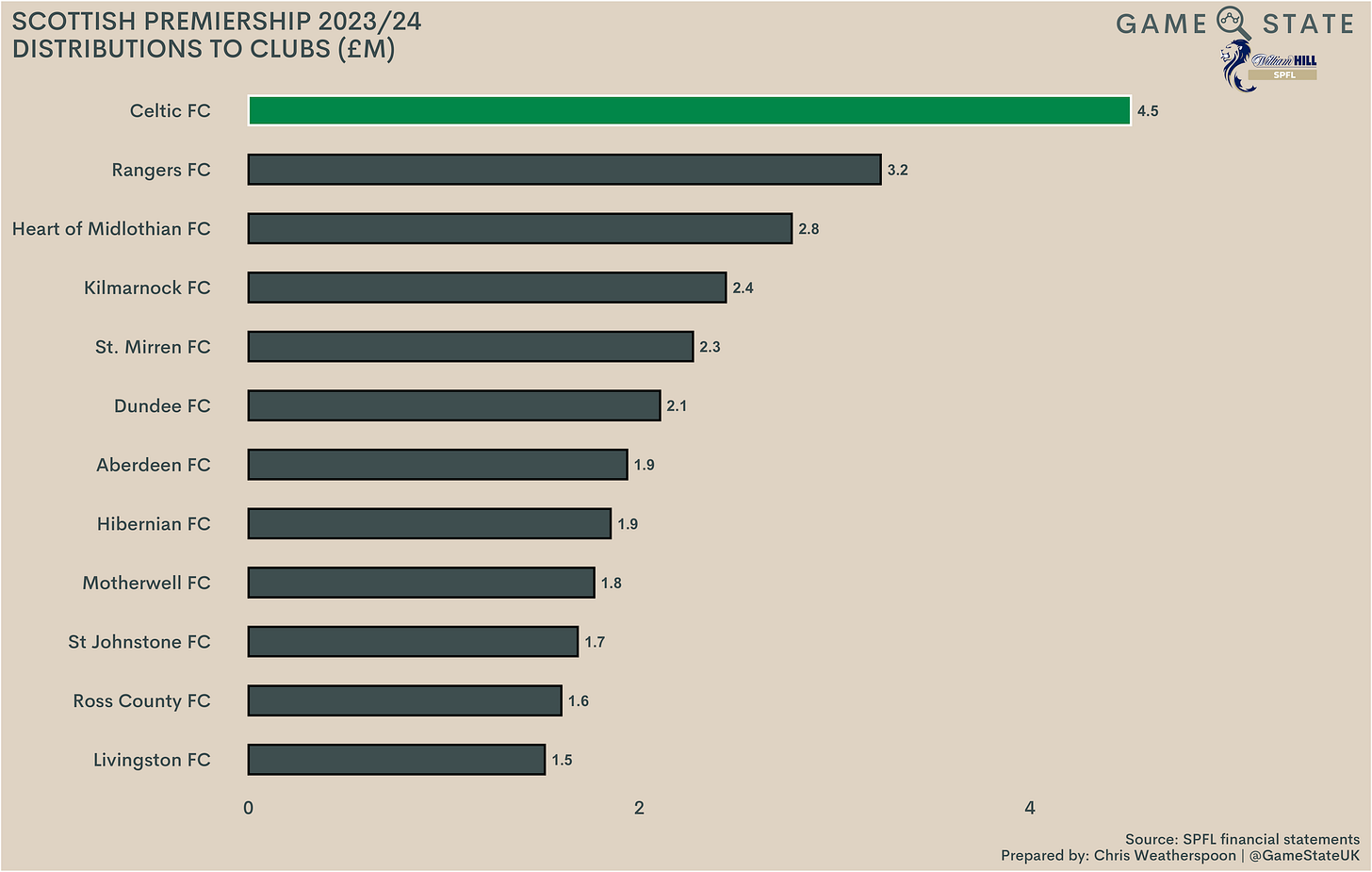

Not surprisingly, that also translated to a Scottish record, and comfortably the most in the top tier last season. In fact, other than Rangers, Celtic’s income was over £100 million ahead of everyone else in Scotland’s top tier. For the 11 clubs to have published turnover figures (Livingston FC don’t), the most recent combined revenue for SPL clubs was £297 million. Of that, the two Old Firm clubs accounted for £213 million (72 per cent), which is a clear indicator of why they remain the league’s dominant entities.

Both Celtic and Rangers enjoyed club record revenues in 2024, with both coming as result of roughly £5m increases on the previous season. Yet Celtic will take heart from the fact that, after years of their arch rivals narrowing the gap, the green half of Glasgow once more enjoys a fairly significant revenue advantage. How wide that gap is in 2025 will largely depend on how each club fares in Europe this season.

Matchday income

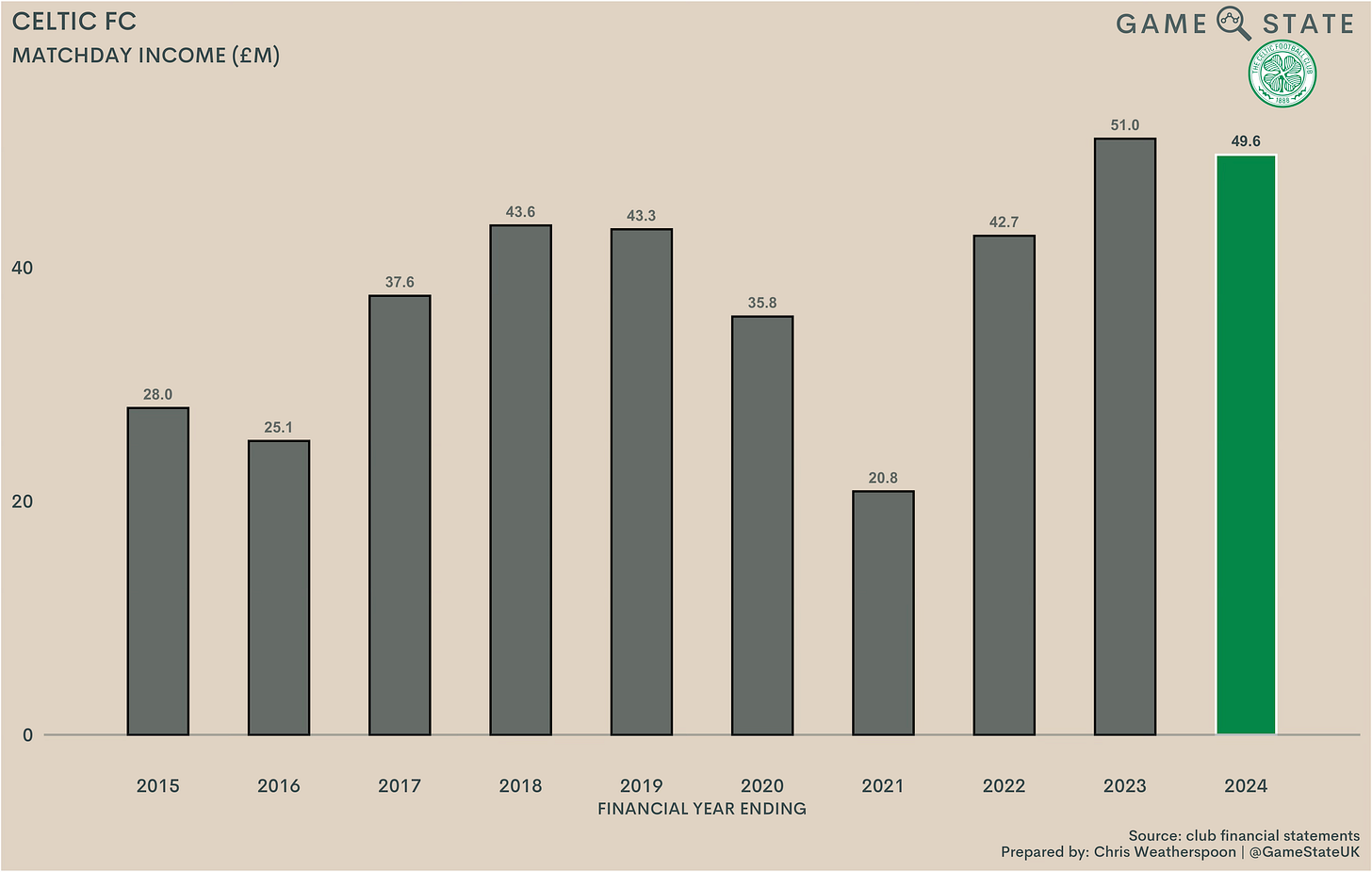

Though they mightn’t wish to admit it, Celtic may owe Rangers a small debt of gratitude simply for them returning to the top tier in 2017. In the two seasons prior, while Rangers were trying for promotion from the Scottish Championship, Celtic Park was on average less than three-quarters full and, though there were other factors in play, it’s hard not to think that the lack of serious competition (not to mention the Old Firm derbies themselves) had an impact.

Since Rangers’ return to the top table, attendances at Celtic have consistently been over 90 per cent of their home stadium’s capacity, with the understandable exception of those seasons impacted by the Covid-19 pandemic. The last two seasons have seen Celtic record average attendances of a shade under 58,000 in the league which, based on recent figures, puts them around 16th in all of world football.

Accordingly, Celtic’s matchday income is pretty weighty, hitting the £50 million mark for a second season running. That was a small dip on 2023’s club record figure, but was still more than the total revenue of every other SPL club (bar Rangers).

Celtic’s matchday income stands up impressively south of the border too. Based on most recent figures, The Bhoys £50 million in gate receipts last season were more than any club outside of England’s ‘big six’. That might change when Newcastle United released 2023/24 figures, but it’s still clear that Celtic’s big fanbase and the monies they earn from attendances are a huge asset to the club, comprising around two-fifths of total income last season.

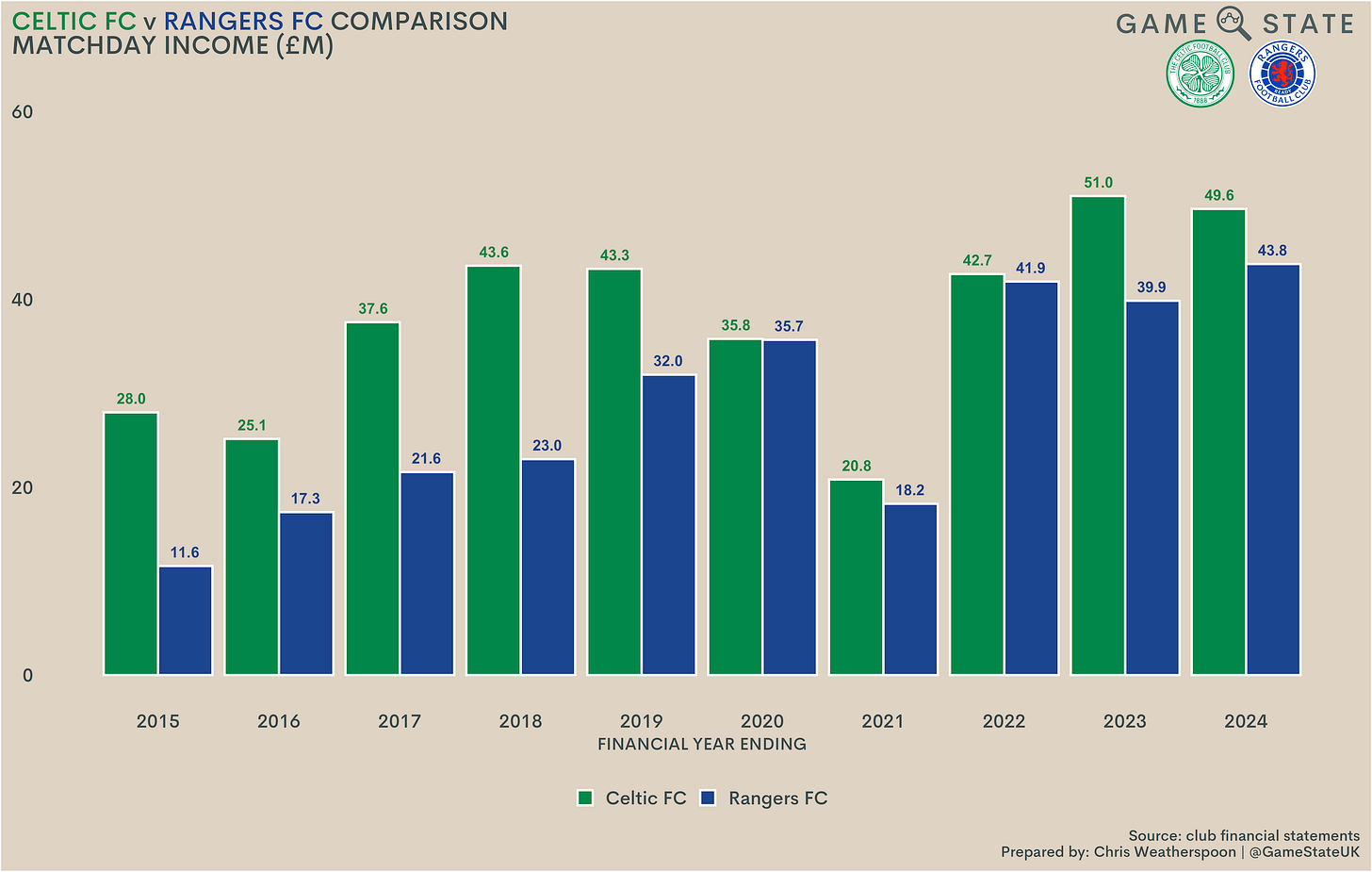

Not surprisingly, Celtic’s £50 million matchday income was more than anyone else in the SPL, £6 million ahead of Rangers. Whether that gap should be even bigger is a question those within the club might well be considering though, with Celtic Park holding some 9,000 more spectators than Ibrox and Celtic also hosting lucrative Champions League matches last season while Rangers had to make do with the Europa League.

Indeed, a comparative look at the two clubs’ gate receipts show a significant rate of growth from Rangers, albeit they were (re-)starting from a low ebb. Celtic have opened up an advantage again in this revenue stream, though it won’t have gone unnoticed that the Gers were able to boost gate receipts last season while Celtic’s fell, even as the latter once again enjoyed greater on-field success.

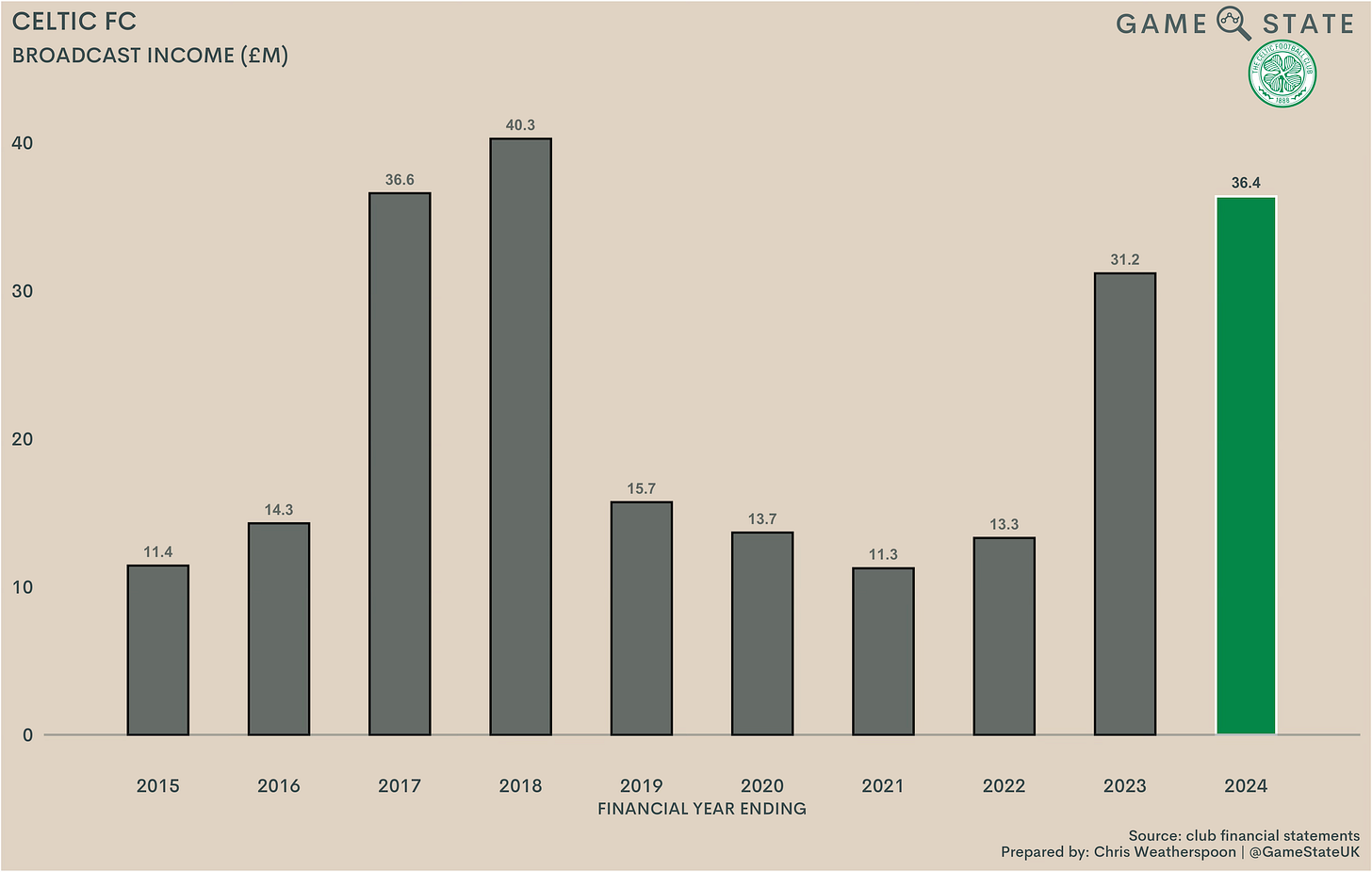

Broadcast income

Celtic’s impressive matchday income acts as a buffer against fluctuating broadcast income, but it’s still true that the club’s successes or failures on the pitch have an outsized effect on finances. As mentioned, the club’s last four years of operating profits all came in seasons where they qualified for Champions League football and enjoyed the prize money that flows from it.

Broadcast income rose to £36 million last season, with all of the £5 million uplift coming from improved European revenues. Half of this increase arose from Celtic earning a greater share of the ‘Market Pool’ element of UEFA prize money - a fact only made possible because of Rangers failure to qualify for the 2023/24 group stage, meaning Celtic picked up almost all of the Market Pool pot available to Scottish clubs. Alongside that, picking up four points instead of just two like they did in 2022/23 earned Celtic an extra £2.1 million this time around.

Based on Game State’s prize money distribution model, we estimate Celtic have already earned €37 million (around £31 million) from this season’s competition. In Euro terms that’s already a club record from UEFA prize money, and it seems pretty likely from here that’ll end up being the case in Sterling too.

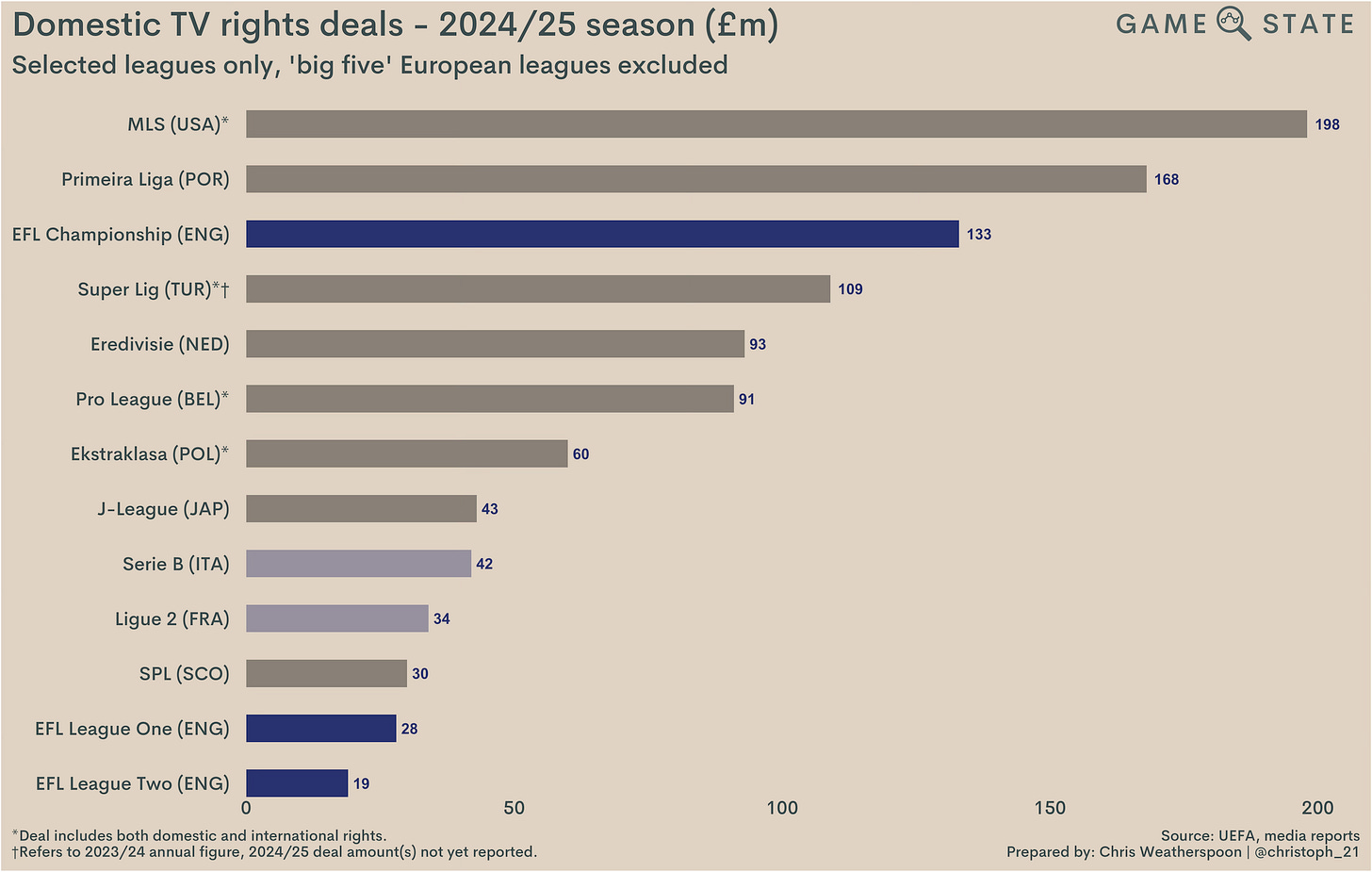

At home, the SPL TV deal is miserly, providing the league’s clubs with around £30 million a season across the period 2024 to 2029. For context, that’s a fair sight lower than many other top tier divisions in Europe and, on a proportional basis, just £2 million per season better than the third tier in England (EFL rights are bundled together, so this is a proportional estimate only).

In many ways that makes sense. Outside of the bigger clubs, SPL club wage bills would fit right in with EFL League One, but it can still be galling to those who feel Scottish football has consistently undersold itself. A counterpoint is that the gulf between the Old Firm and the rest is such that the league isn’t sufficiently attractive to generate a bigger deal; a similar example can be seen in France, where the one-team dominance of Paris Saint-Germain has helped push Ligue 1 TV rights off a cliff.

For winning the SPL last season Celtic earned £4.5 million, more than anyone else but also less than a third of what they banked from this season’s Champions League just for qualifying for the group stages. On top of that, they’ve already earned around £4.1 million for their two wins and a draw in Europe this autumn; if they pick up one more point in this season’s competition, they’ll surpass the total amount they received for winning their domestic league last year.

Celtic’s broadcast income last season was therefore the most in Scotland, over £12 million ahead of Rangers and more than £30 million ahead of everyone else.

Where matchday income saw Celtic’s advantage over Rangers narrow, on-pitch successes have seen them eradicate a gap that The Gers opened up in 2021 and 2022. That came on the back of Rangers’ unbeaten league season in 2020/21, followed by their run to the Europa League final a year later. Now, with Celtic ascendant, Gers fans will doubtless be fearful the gap will grow - especially after Celtic’s positive start in this season’s Champions League.

Commercial income

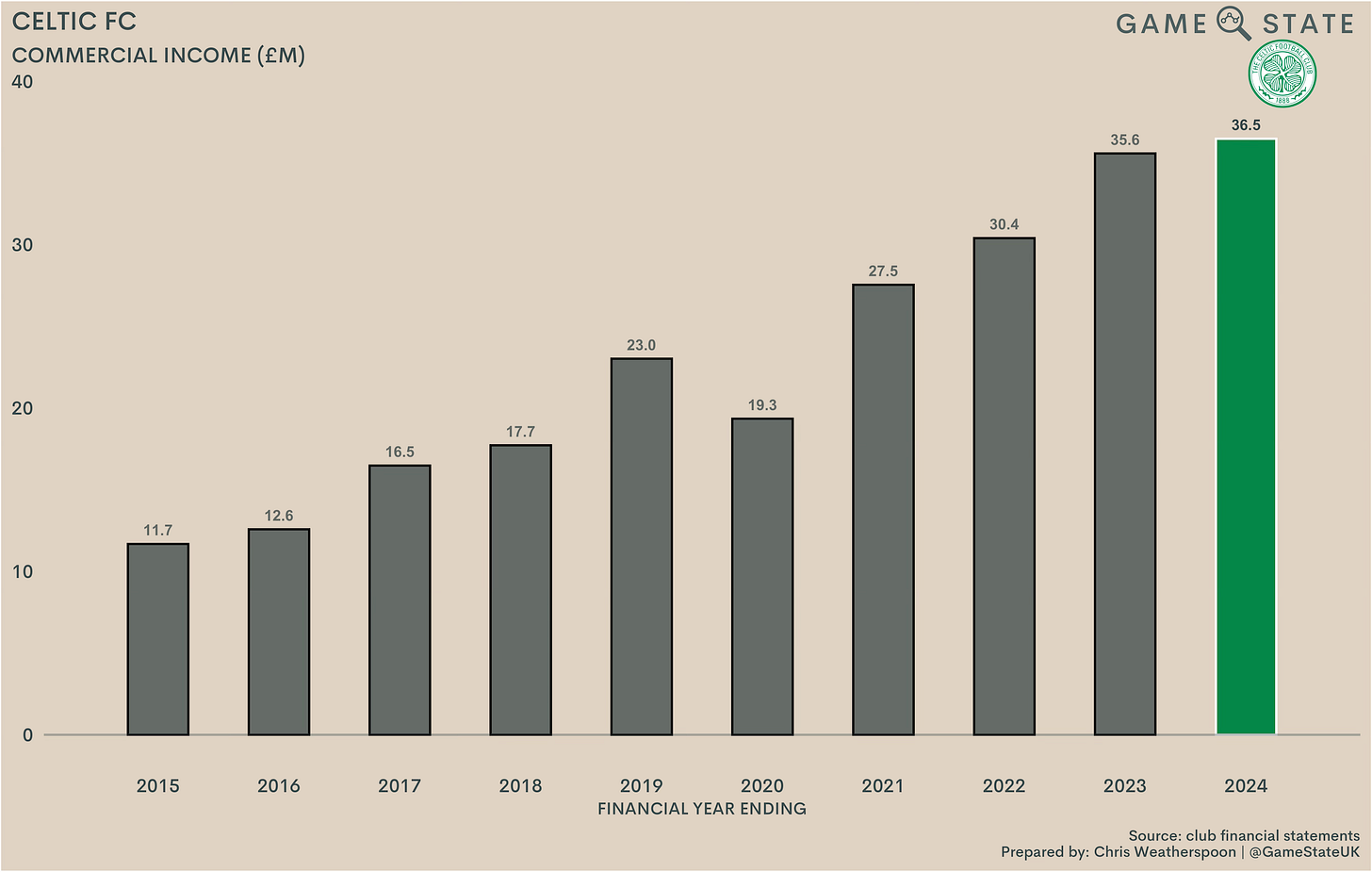

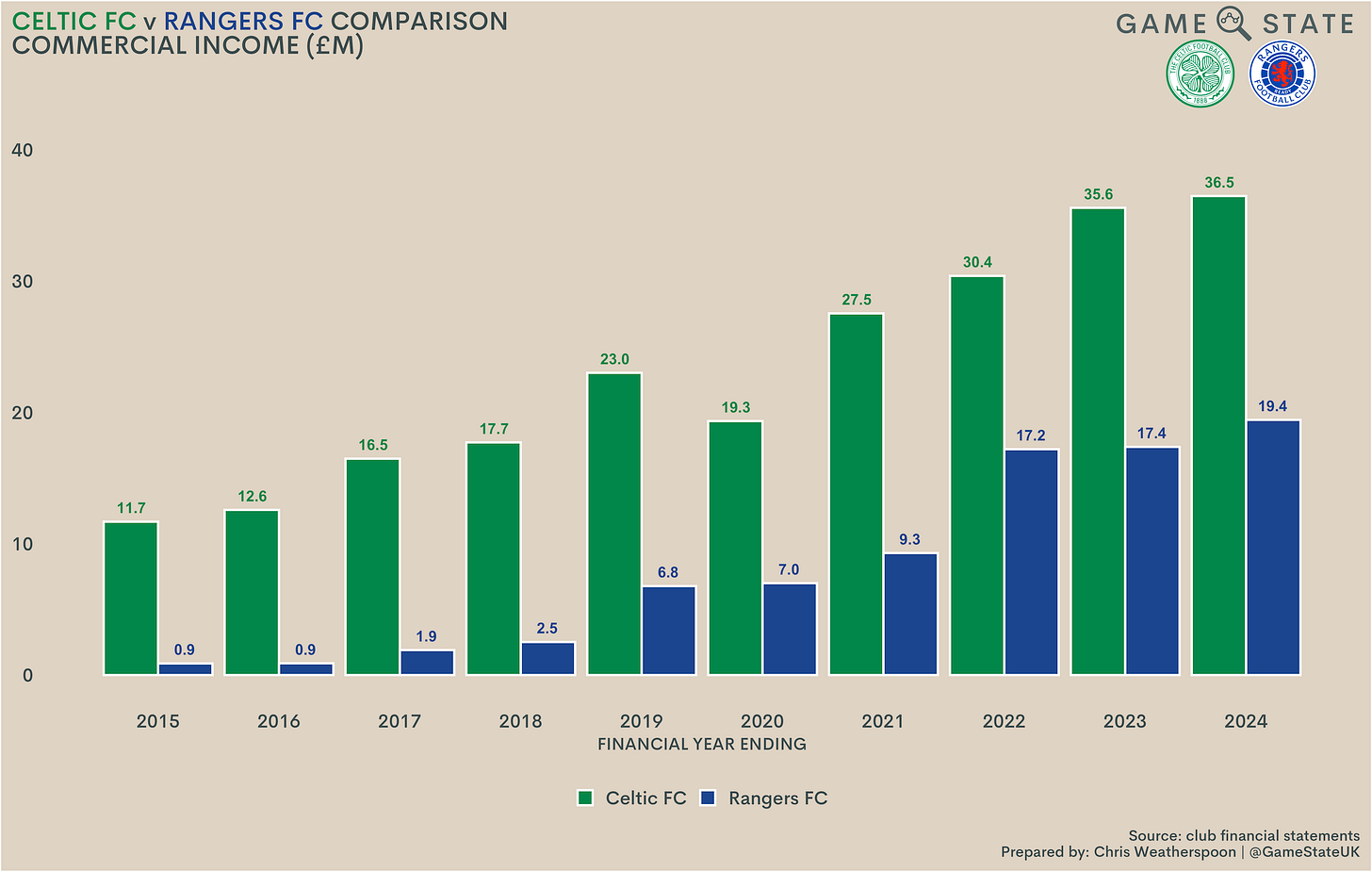

Commercially, Celtic’s £37 million income last season was a new club record, and there’s been pretty impressive growth in this revenue stream over the last decade. After a dip that most clubs experienced during the pandemic, Celtic have rebounded and then some. Retail and merchandising sales now sit at £23 million, a 78 per cent increase in just six years.

Celtic again top the SPL in this regard, but more notably their commercial income sits at nearly double that of Rangers. That’s believed to be a product of different accounting treatments, whereby Rangers’ link-up with Castore means the club only discloses its commercial income from that deal on a net basis. That would explain the much lower income figure than their rivals, but we’d then expect to see a corresponding fall in cost of sales something which, based on our later section on the clubs’ other expenses, doesn’t appear to be the case.

In any case, Celtic’s commercial income has long been well ahead of Rangers, and there’s a clear gap between the two. That’s a little surprising, and surely something those at Ibrox will be looking to rectify as soon as possible.

Wages

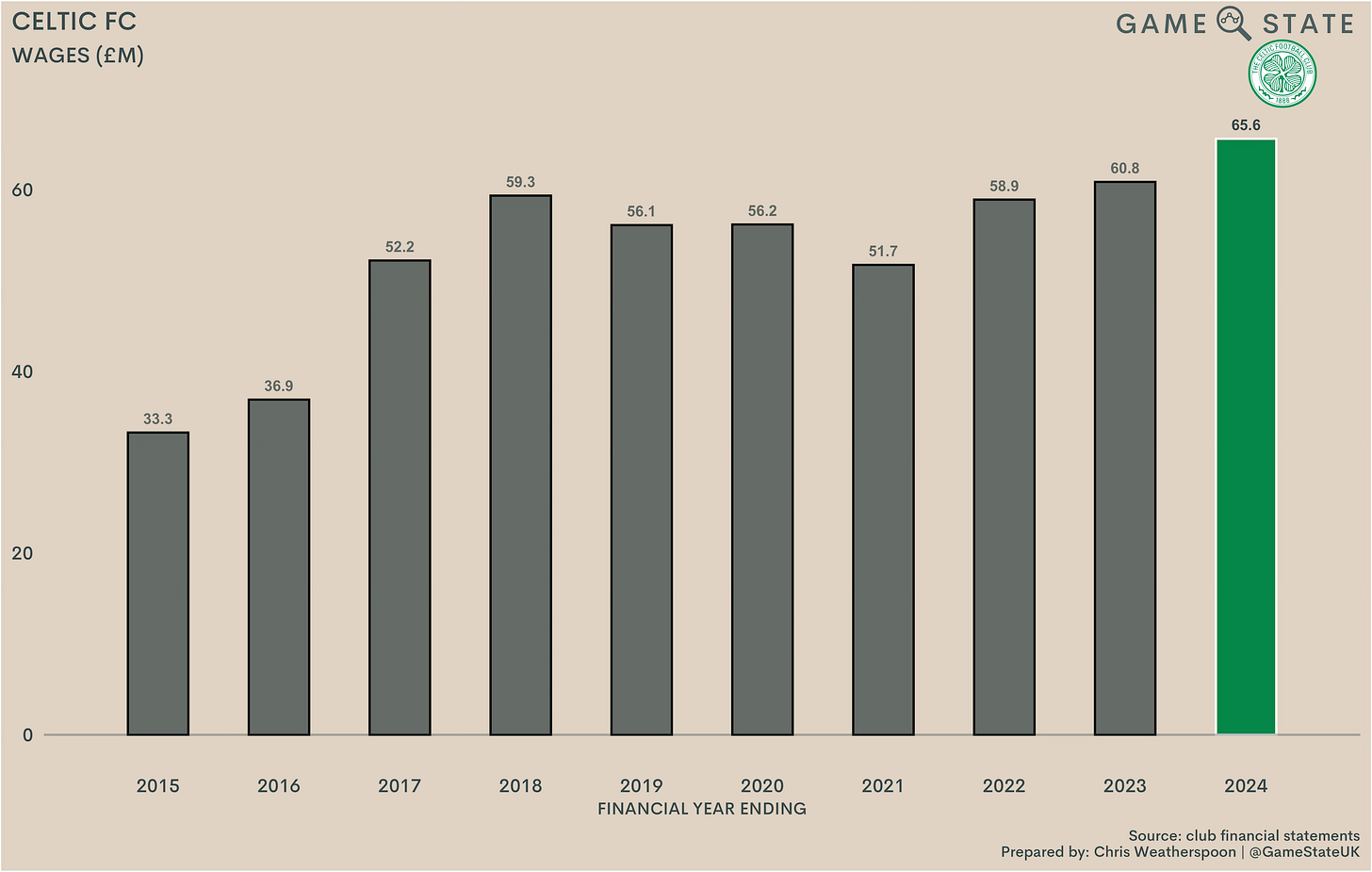

Mirroring club record turnover, Celtic’s wage bill last season hit a new high of £66 million. Staff costs at Celtic Park have now doubled over the last decade, though that’s below the 143 per cent revenue increase over the same time period. Effectively, while income has grown, Celtic have managed to keep a lid on costs.

That still had them at the top of the league for wage costs, but that’s to be expected given they had Champions League football to (try and) compete in. Both they and Rangers topped £60 million in wages last season, once again way beyond any of their domestic competitors.

The difference in Old Firm wage bills has narrowed considerably since Rangers’ return to the SPL, as they’ve naturally sought to get back on terms with their old rivals. That obviously worked in the early part of the 2020s, though there’s an argument the Gers haven’t got much value for money in the last two seasons.

Plotting SPL wage bills against points earned makes for a bit of a laughable graph, but we’ve done it anyway. Way out to the top right are Celtic and Rangers, with everyone else occupying a much lower wage bill range and, correspondingly, obtaining far fewer points.

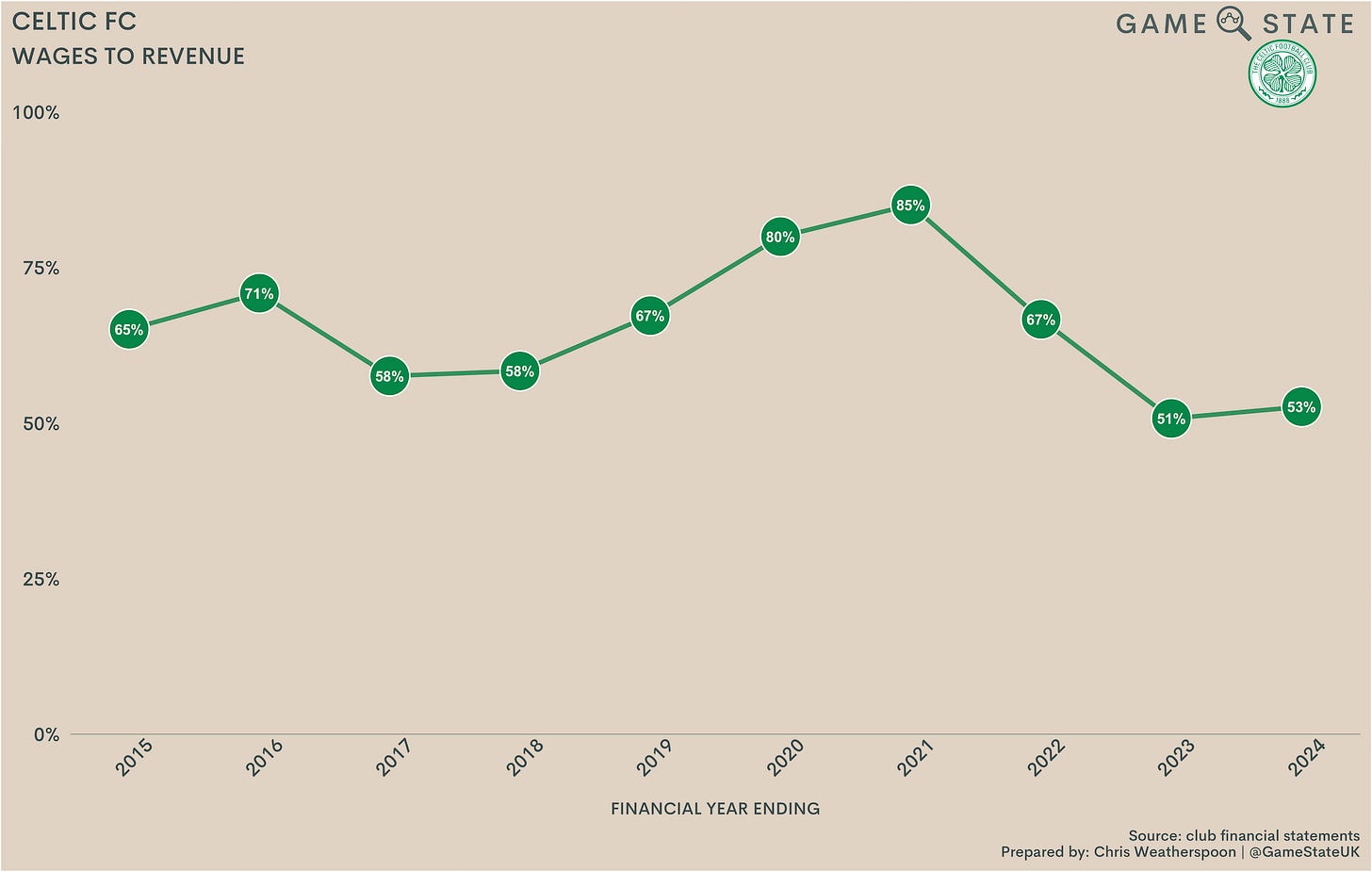

High wages aren’t a problem if they’re covered by sufficient revenues, and that’s certainly the case at Celtic Park. Celtic's wages to revenue did jump up a smidge to 53 per cent last season, but that’s still healthy and well below UEFA’s recommended 70 per cent mark. Other than the Covid years of depleted revenue, Celtic’s wages to revenue has been at or below 71 per cent in eight of the last 10 seasons.

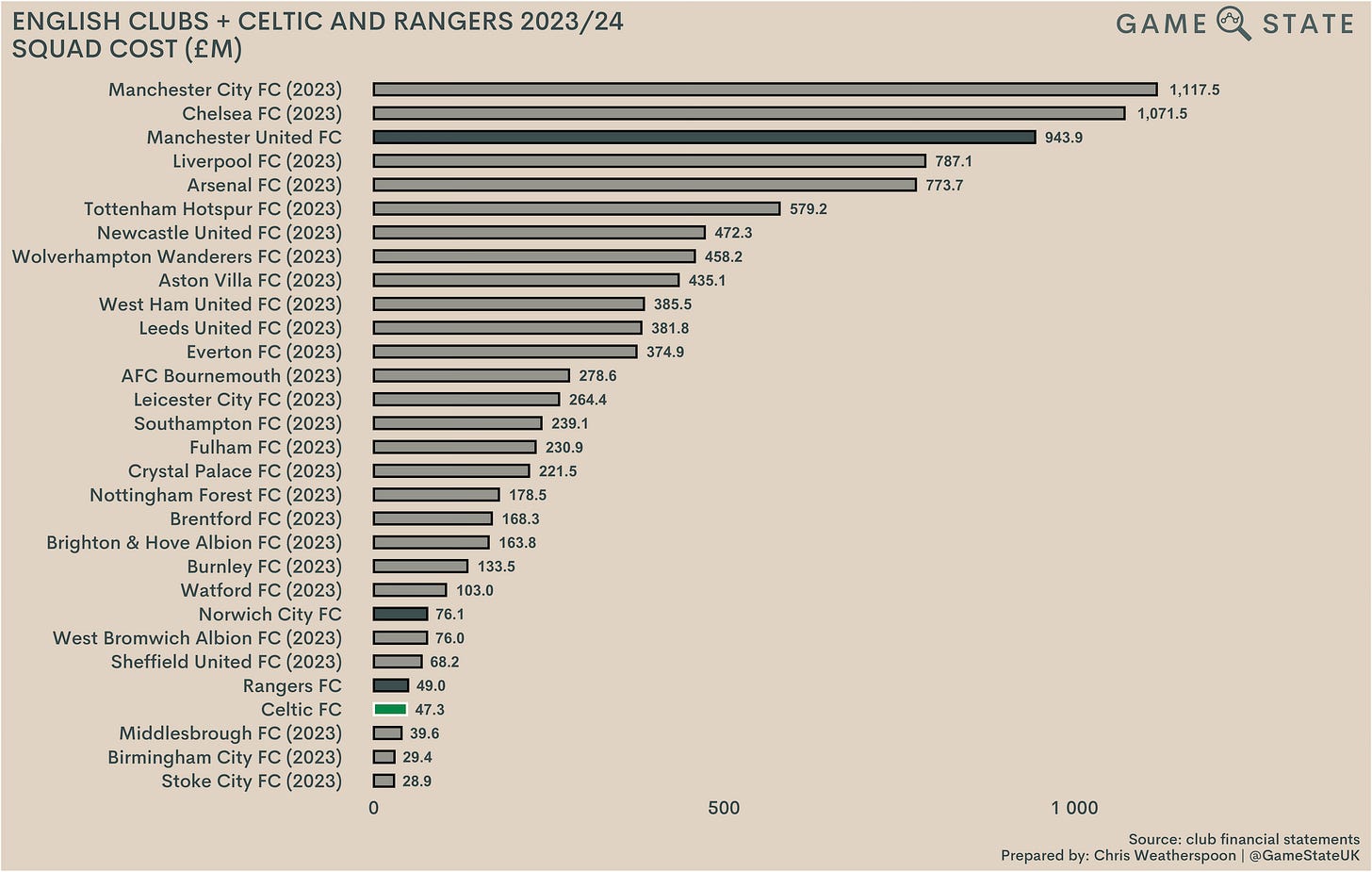

One question often asked about the Old Firm is one that will likely never be answered: how would they fare in England? A true analysis of this isn’t really possible, given both Celtic and Rangers would see their incomes rise significantly if they were EPL clubs, but we can at least compare where the clubs would sit in England based on most recent figures.

Based on most recent figures, Celtic’s wage bill would be England’s 21st-highest. In other words, more than every EFL Championship club but less than every English Premier League club. Rangers, for what it’s worth, fall into the same category.

Celtic and Rangers both clearly outstrip the rest of Scotland when it comes to paying players, but what of their continental rivals?

Wages are the best financial barometer of how a club might fare on the pitch, albeit on a game-to-game basis the correlation doesn’t hold us as well as it might over a season or longer. But a decent exercise here is to look at Celtic’s recent results in Europe and assess whether or not, based on wage bills, those results (if not necessarily the scorelines) were in line with what we’d expect based on

The Bhoys’ recent 1-7 drubbing away to Borussia Dortmund doesn’t go down as a good or expected result in anyone’s book, but it makes a little more sense when we consider Dortmund’s most recent wage bill of €269 million was almost four times that of Celtic’s in 2023/24 (€71 million, based on recent exchange rates). Similarly, Celtic’s 5-1 home win over Slovan Bratislava was a job well done, but an achievement perhaps tempered in the knowledge the visitors own most recent wage bill was just €13 million.

The below table considers Celtic’s European opponents over the past five seasons, plus the current one added in for good measure, in terms of those clubs given wage bills in the season Celtic faced them. Colour coding has been added to identify whether a result for Celtic was very good (bright green) or very bad (deep red) when we consider the expected result based solely on the two clubs’ wage bills.

Perhaps not surprisingly given their patchy recent European record, there are more blotches of red than green. 2021/22 was a particularly down year - Celtic spent €70 million on wages yet were defeated by clubs that spent just €23 million, €16 million and €11 million respectively that season.

This is by no means a foolproof way of assessing results, but it does at least provide a jumping off point. The good news for Celtic is that this season has already seem what look, on paper, to be two pretty impressive results. While we don’t have current season wage bills to go off, The Bhoys’ draw away to Atalanta and 3-1 victory over RB Leipzig appear likely to be instances where they overcame a hefty disadvantage when it comes to player salaries.

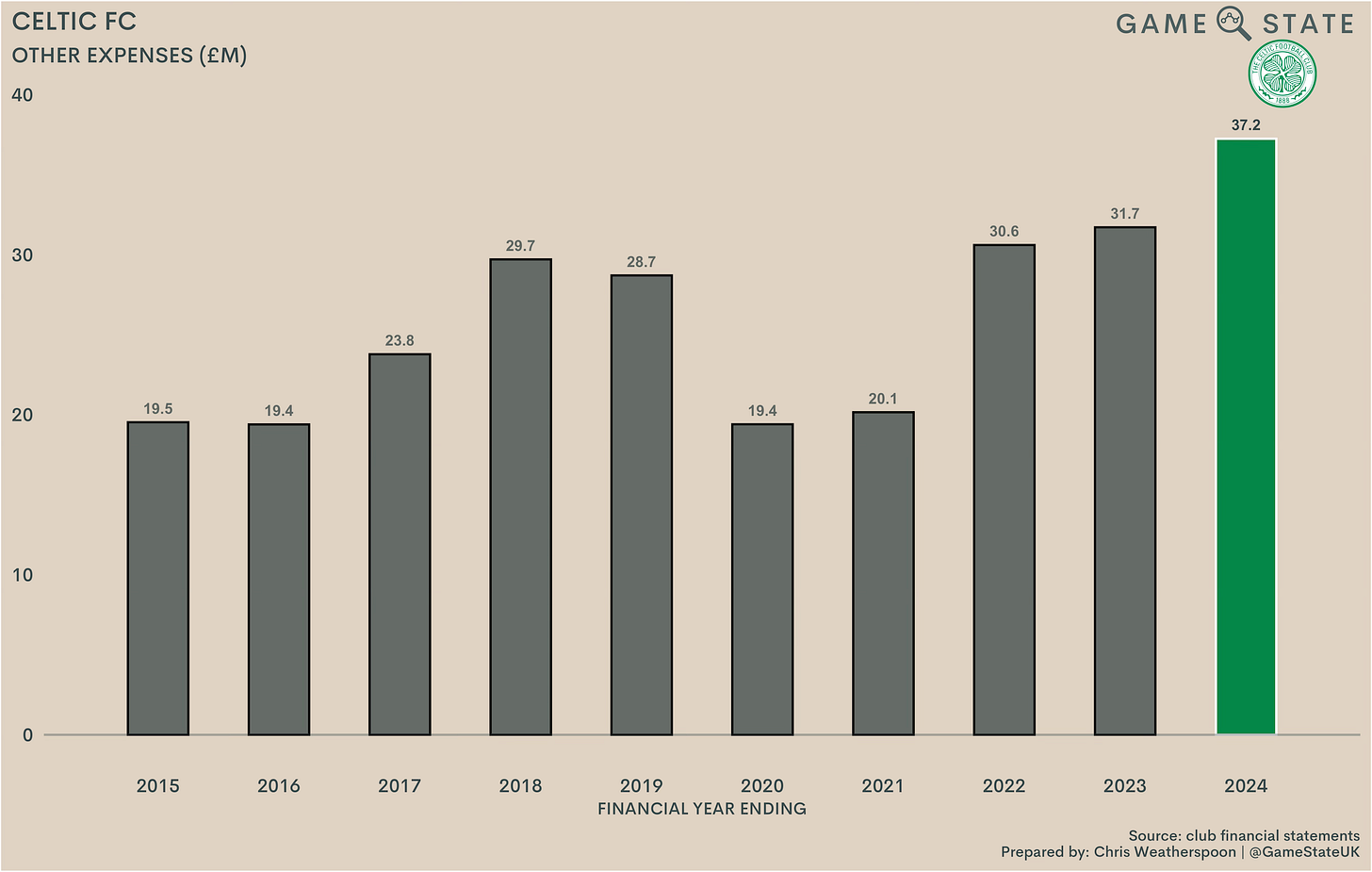

Other expenses

Celtic’s other expenses (essentially, non-staff costs) hit a club record £37 million in 2024, a product of the generally high inflation prevalent in the UK recently.

That was also the highest in Scotland last season, which shouldn’t be too surprising given Celtic Park is the biggest stadium in the SPFL (and so costs more to keep running). Correspondingly, Rangers were the next highest, just £2 million behind with £35 million in other expenses, before a hefty drop - again - to Hearts (£11 million).

Being top of the tree for any form of expenditure is hardly desirable, but a better reflection of whether Celtic’s non-staff costs unduly hamper the club can be determined from analysing those costs as a proportion of revenue. That proportion increased to 30 per cent last season (up from 26 per cent in 2023), but that still represents a sizeable drop from the 38 per cent of a decade earlier. Much like with their wage bill, Celtic have managed to keep costs under control.

Indeed, based on most recent figures, Celtic’s other expenses to revenue proportion was only bettered by St Mirren, and sat some way behind the rest of the Scottish Premiership. Dundee United and Ross County each spent around two-thirds of turnover on non-staff costs alone in 2023, reflecting the minimal income on offer for many clubs in Scotland.

Returning to our Old Firm comparison, given what we covered in our commercial income section - Rangers booking commercial income net of costs - we’d expect The Gers other expenses to see a corresponding drop. Yet, at least in comparison to Celtic, that’s not the case at all. In fact, Rangers other expenses grew more last season than The Bhoys’.

Player trading

Perhaps in response to Rangers winning the title in 2020/21, Celtic’s transfer spending has accelerated in recent years, totalling £68 million in the last three seasons. The summer just gone took that figure to just shy of nine figures too, as the Celtic spent £31 million in the most recent transfer window, including breaking their transfer record twice with the purchases of Adam Idah and Arne Engels.

On a net basis, Celtic shelled out £5 million last season - £17 million on new players less £12 million earned from sales. That £17 million was spread across six different players, with mixed results from those. Wideman Luis Palma was probably the pick of the bunch, weighing in with 12 goals and 13 assists across all competitions.

Rangers actually outspent Celtic last season, dropping £21 million on new players, principally the signings of striking trio Danilo, Cyriel Dessers and Sam Lammers. Much like everything else in Scotland, those two were way ahead of the rest; their joint £38 million spend on transfers last season was nearly five times as much as the rest of the division combined.

Where Celtic did top the transfer table was in sales, generating £12 million from outgoing players. The majority of that stemmed from the £7 million sale of Israeli forward Leil Abada to MLS side Charlotte FC, who left Celtic Park after a fairly successful three-year spell, but one which ended amid the backdrop of the ongoing hostilities in Gaza, about which plenty of Celtic fans have made their feelings clearly heard.

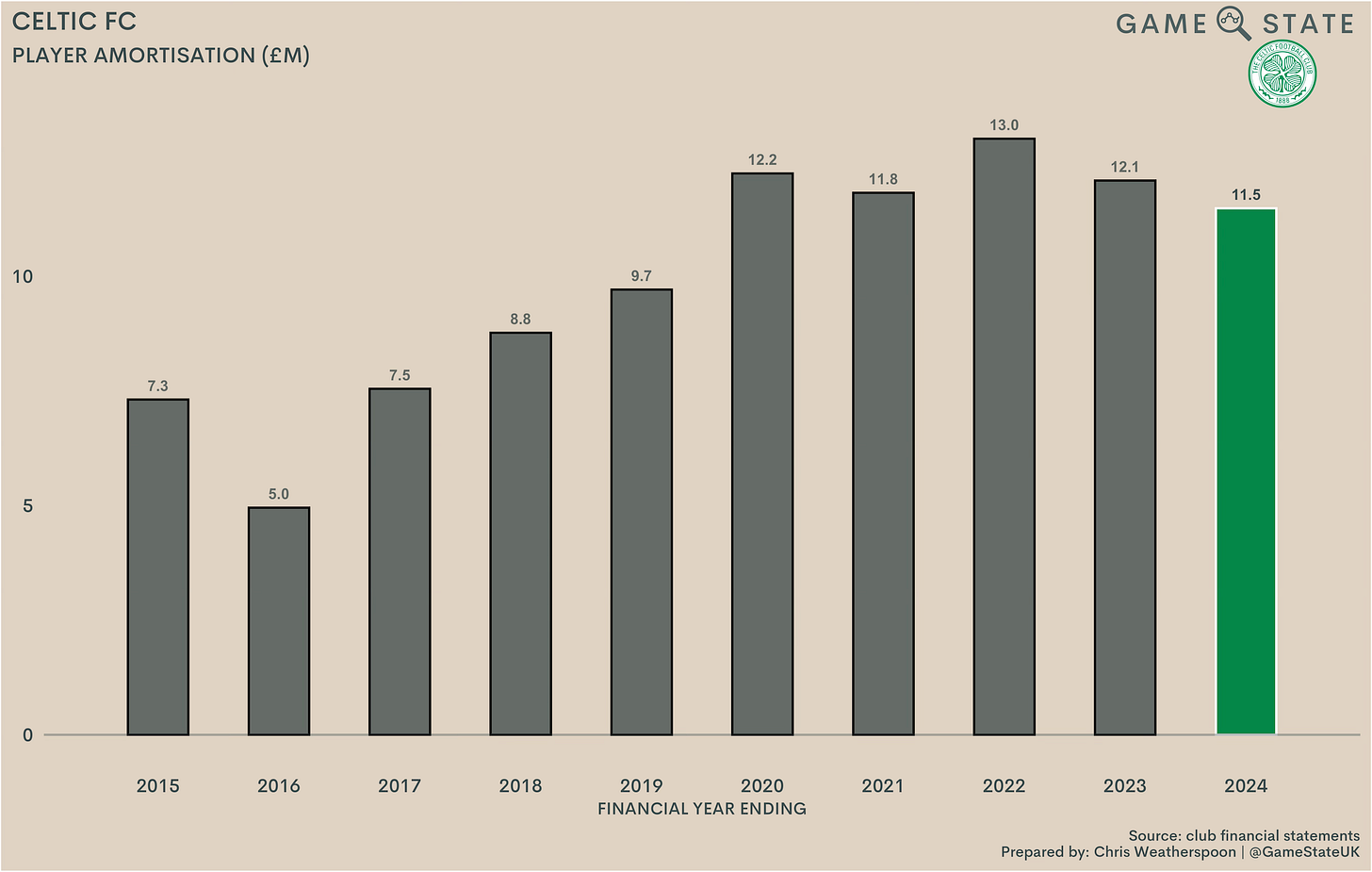

As a result of recent transfer activity, Celtic’s player amortisation costs have actually fallen for two years running. While 2024 was the fifth year running that the amortisation charge topped £10 million, that’s still a long way behind the costs incurred by many of the squads Celtic face on the European stage.

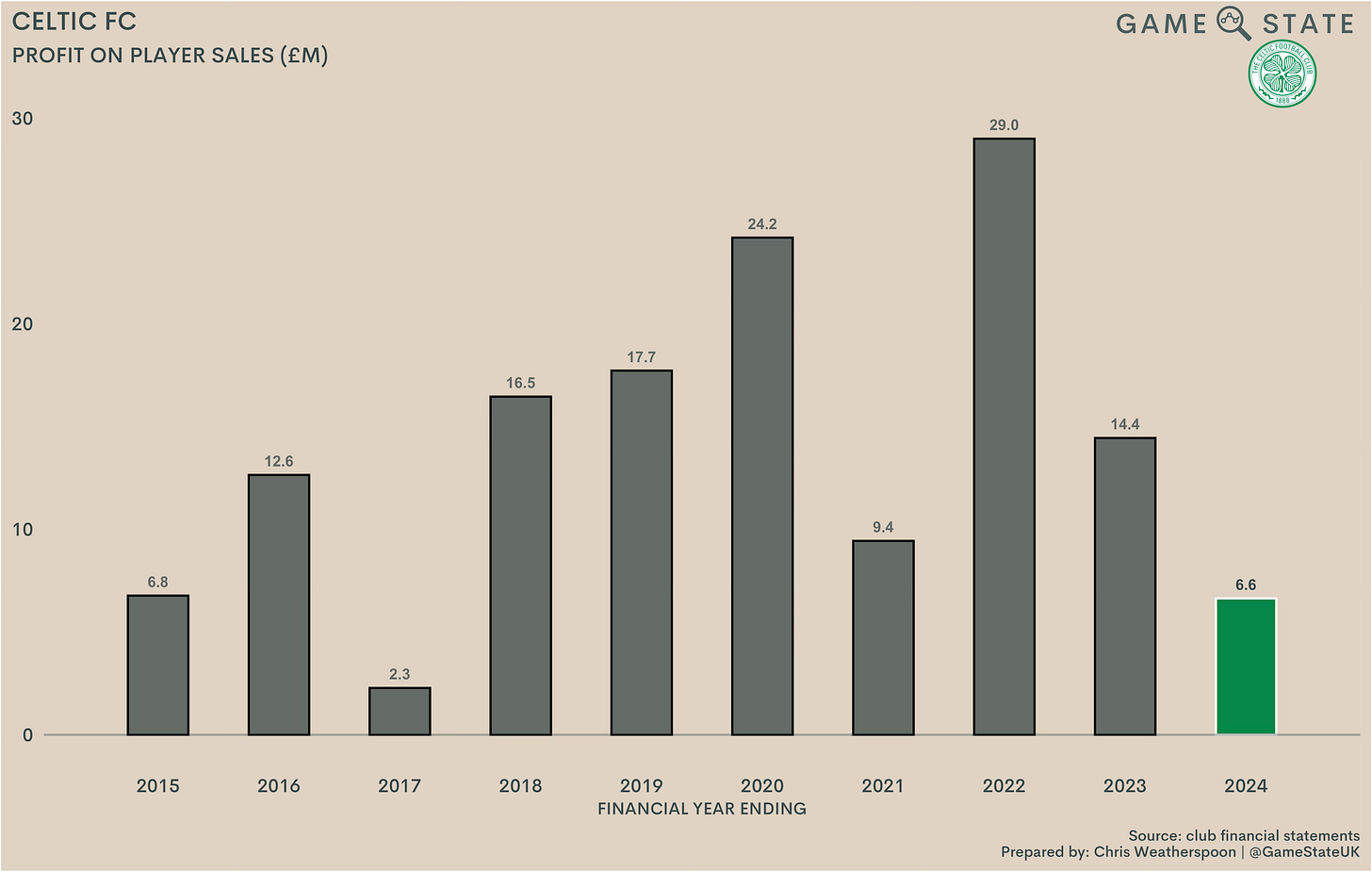

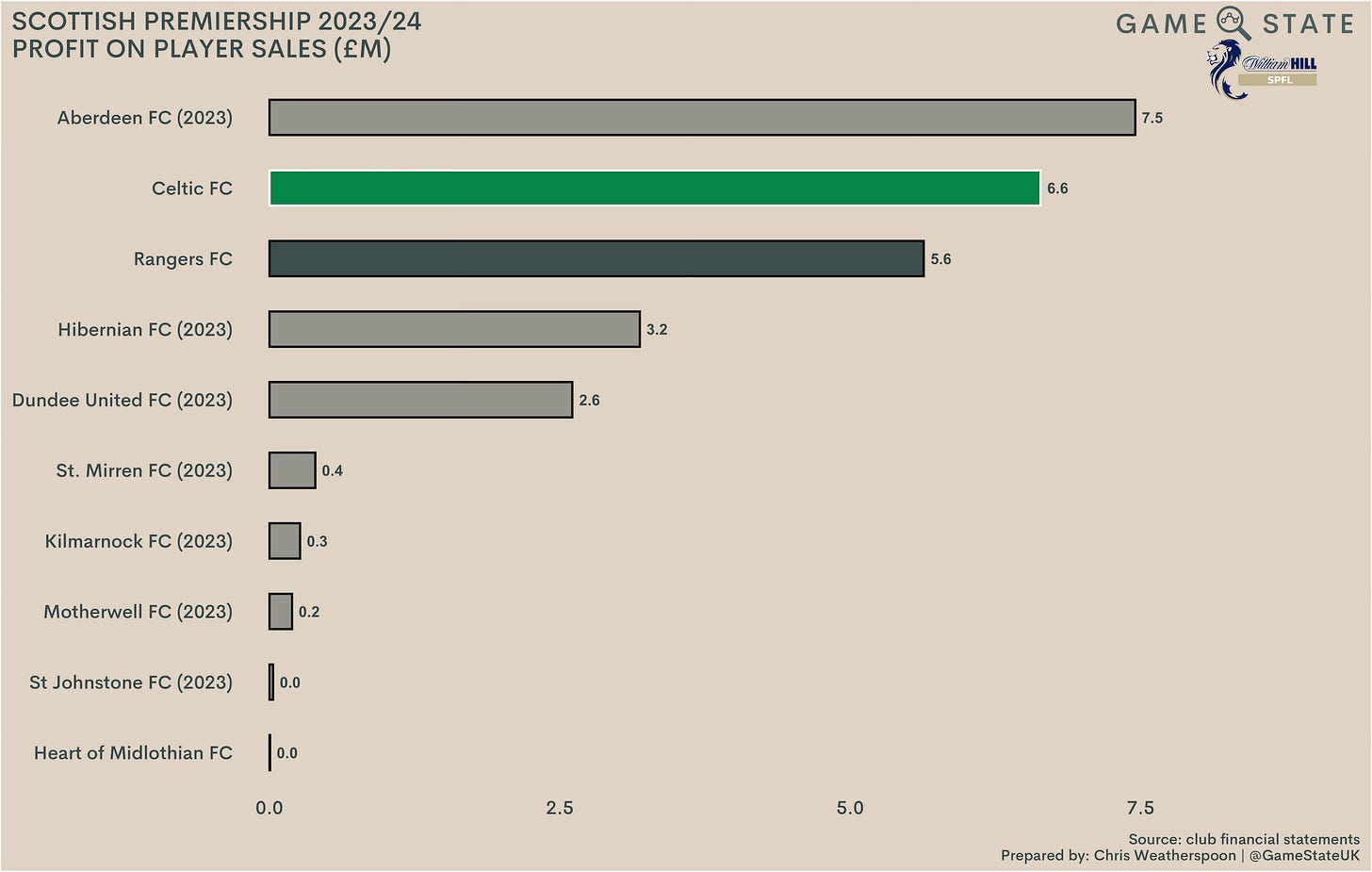

One of the main drivers of Celtic’s reduced profits was an £8 million fall in player sale profits. Still, this hasn’t been too bad a supplemental revenue stream for the club in recent years, with £140 million in profit generated from sales since 2015. In a league where clubs have generally struggled to sell their stars for big money, that represents pretty good going.

Aberdeen have yet to published 2024 financials, but based on most recent figures they actually had the highest player profits, with the sales of Calvin Ramsay and Lewis Ferguson helping them generate £8 million in 2022/23. Celtic’s £7 million puts them second, ahead of Rangers’ £6 million.

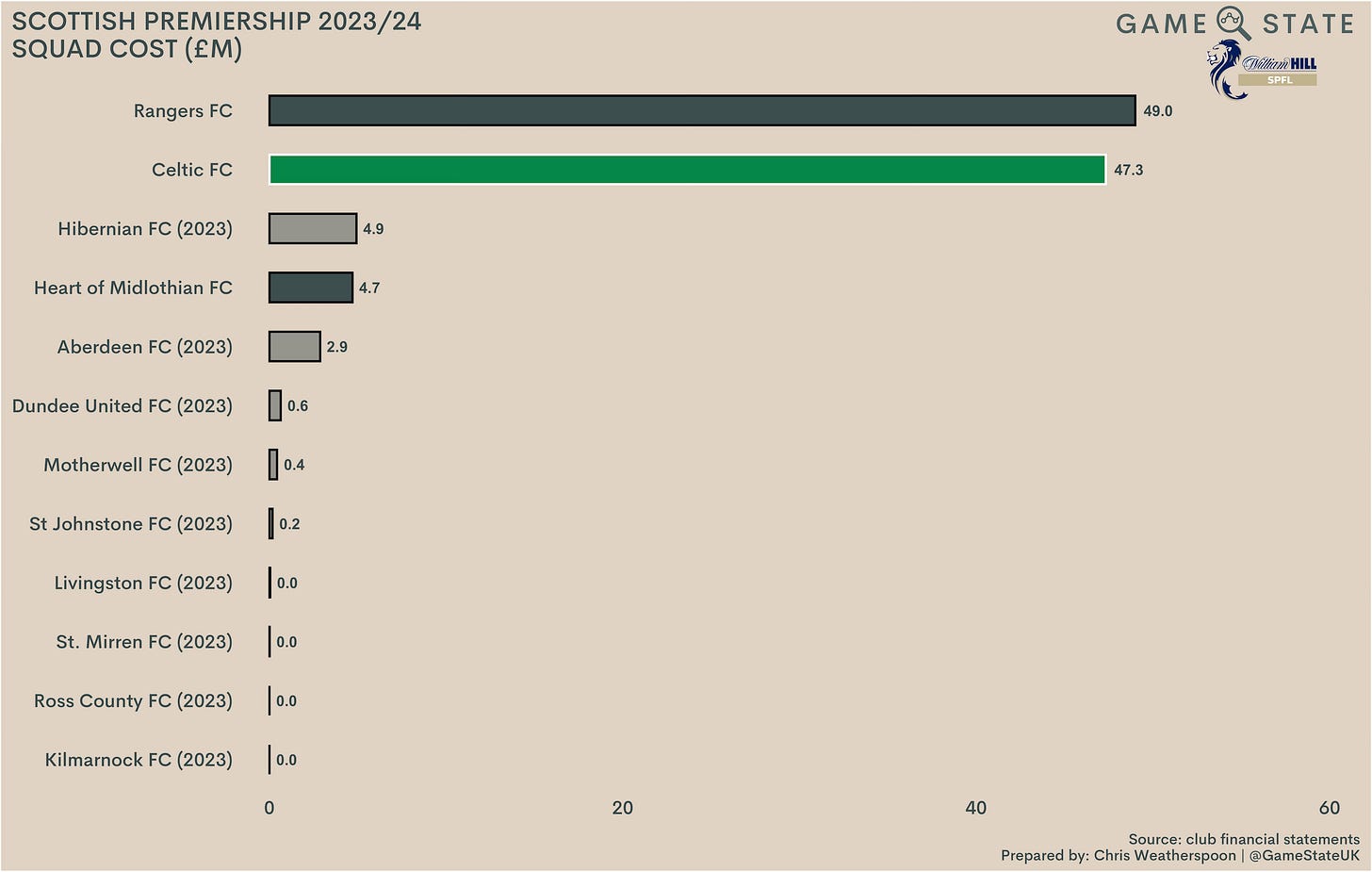

Squad cost

The upshot of Celtic’s recent transfer activity is the club’s squad cost has actually reduced, down £20 million in the last two years. The departure of Jota in summer 2023 saw his roughly £7 million fee fall off the books, with that move coming after the departure of former record signing Odsonne Edouard. Having said that, Celtic’s transfer activity in the summer just gone might well have pushed their current squad cost up to a new club record level.

At the end of June, Rangers’ squad actually cost them around £2 million more than Celtic’s. Again, the rest of the SPL sits a long way behind the Old Firm.

Returning to our English clubs plus the Old Firm thought exercise, the two Scottish giants would actually trail a fair few EFL Championship clubs based on recent squad cost figures. Using latest available numbers, Rangers and Celtic's squads are would be the 26th and 27th most expensively assembled if the two clubs were playing their domestic football in England.

Balance sheet

Football debt

Celtic, disappointingly, don’t disclose football debtors or creditors, so we don’t know how much they owe/are owed in terms of their transfer dealings. What we can see is their trade receivables and trade payables balances, with the former outstripping the latter by around £7 million. Based on that, it’s likely Celtic had a positive transfer balance at the end of June 2024, again underscoring the club’s strong financial standing.

Financial debt

Much more clear is the club’s financial debt position. This stood at £5 million at the end of last second, less than half of its size a decade ago and, really, not much at all for the club to worry about.

The bulk of that debt is comprised of convertible preference shares totalling just over £4 million, which generate an annual dividend payment to the holders of around £0.5 million. Otherwise, the club’s ‘borrowings’ are mostly liabilities due on leased assets.

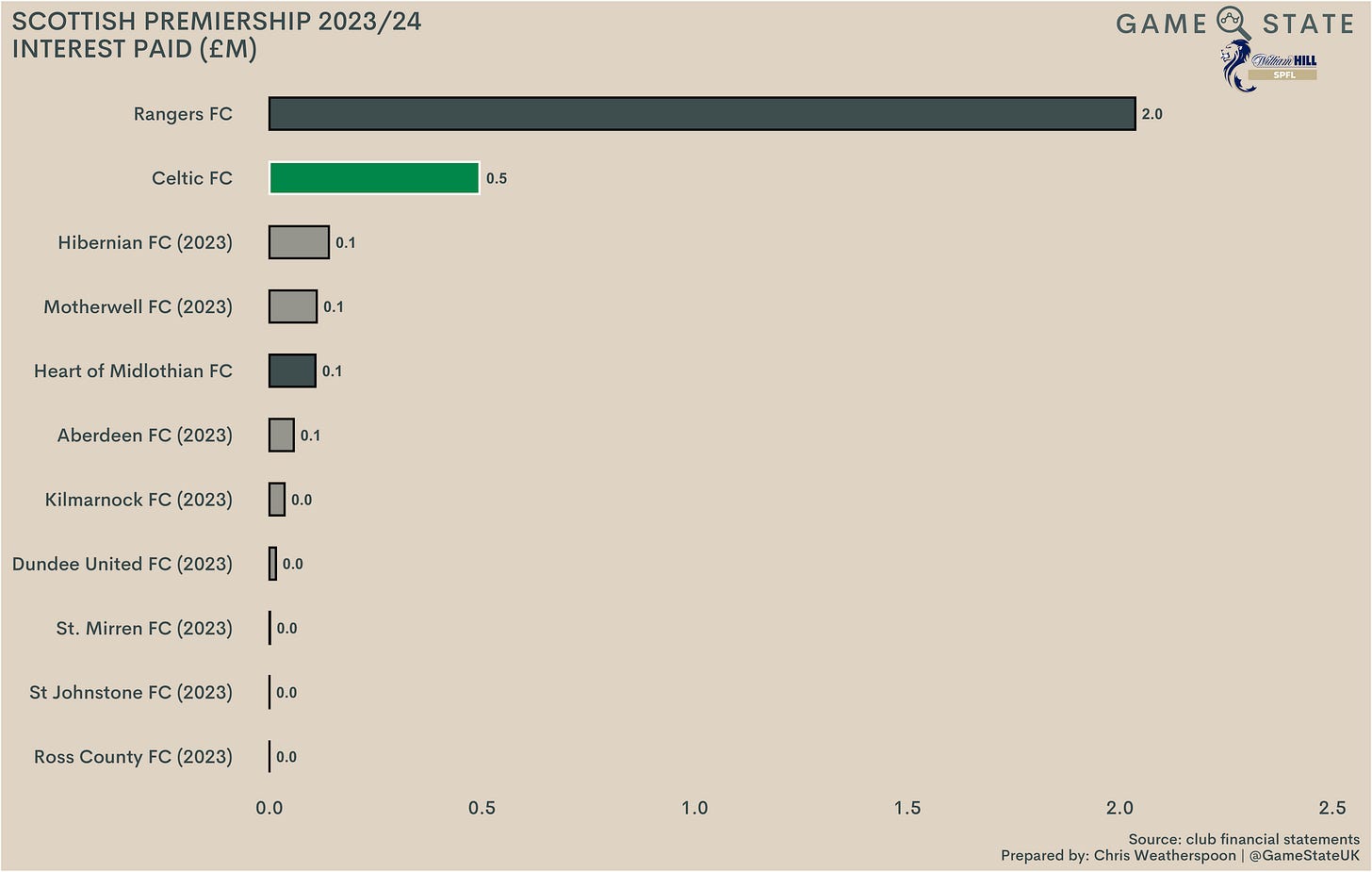

Debt in the SPL is generally pretty low, so Celtic’s own low figure is actually the fourth-highest in the division. Dundee United’s £12 million debt burden looks troublesome at first glance but incurs no interest, while it’s at Rangers where the highest amount can be found, with The Gers owing £28 million at the end of last June. That figure has reduced since, with the club’s shareholders confirming a recent £9 million conversion of debt to shares.

In terms of interest paid (a definition which we’ve stretched to include that preference dividends), Celtic paid out the second-most in Scotland last year, though it was only a quarter of what Rangers’ debt cost them. In truth this isn’t really a full view of things either: Celtic’s whopping cash balance meant they earned over £3 million in interest from bank deposits, so their net interest costs were actually negative.

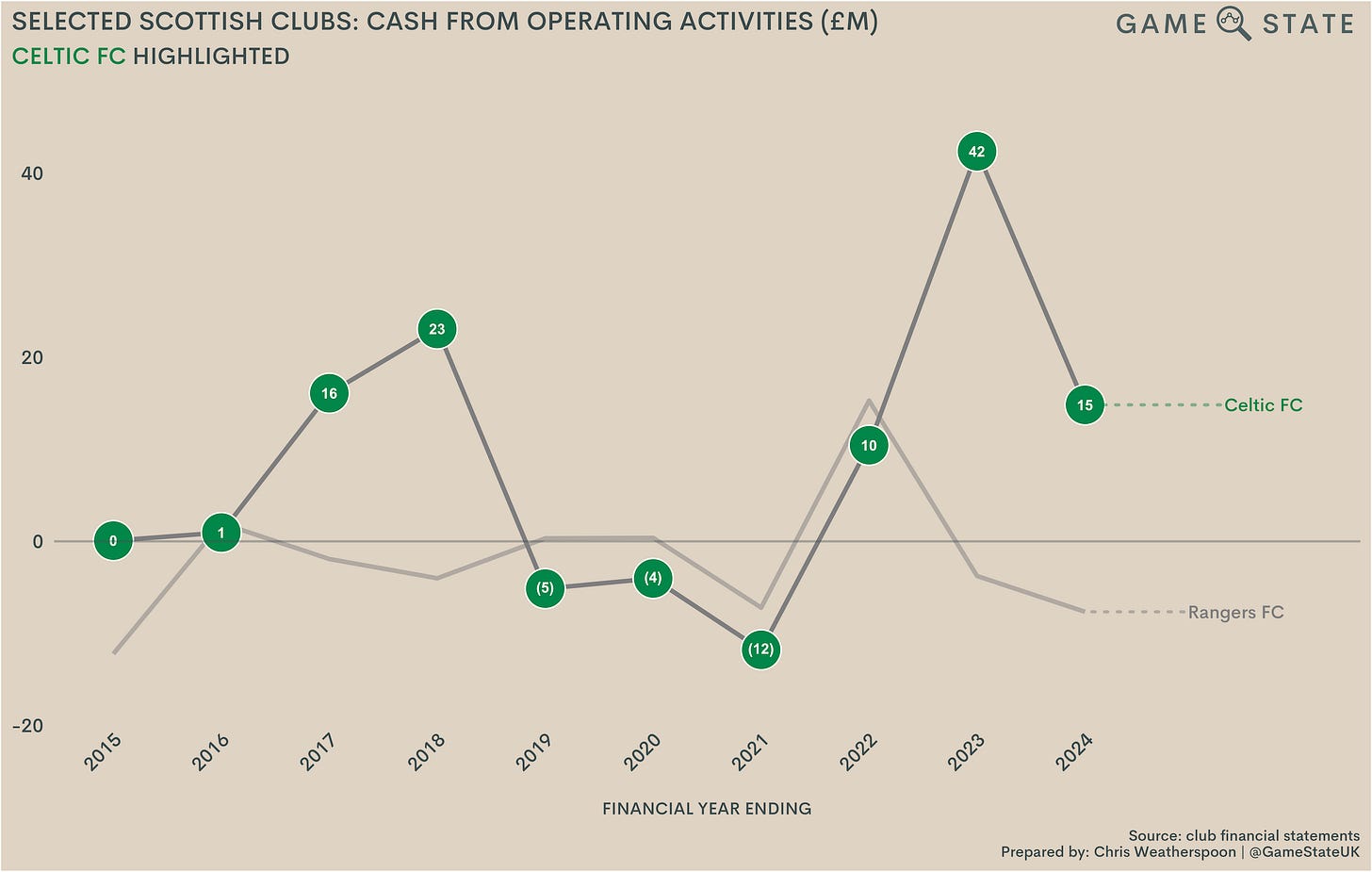

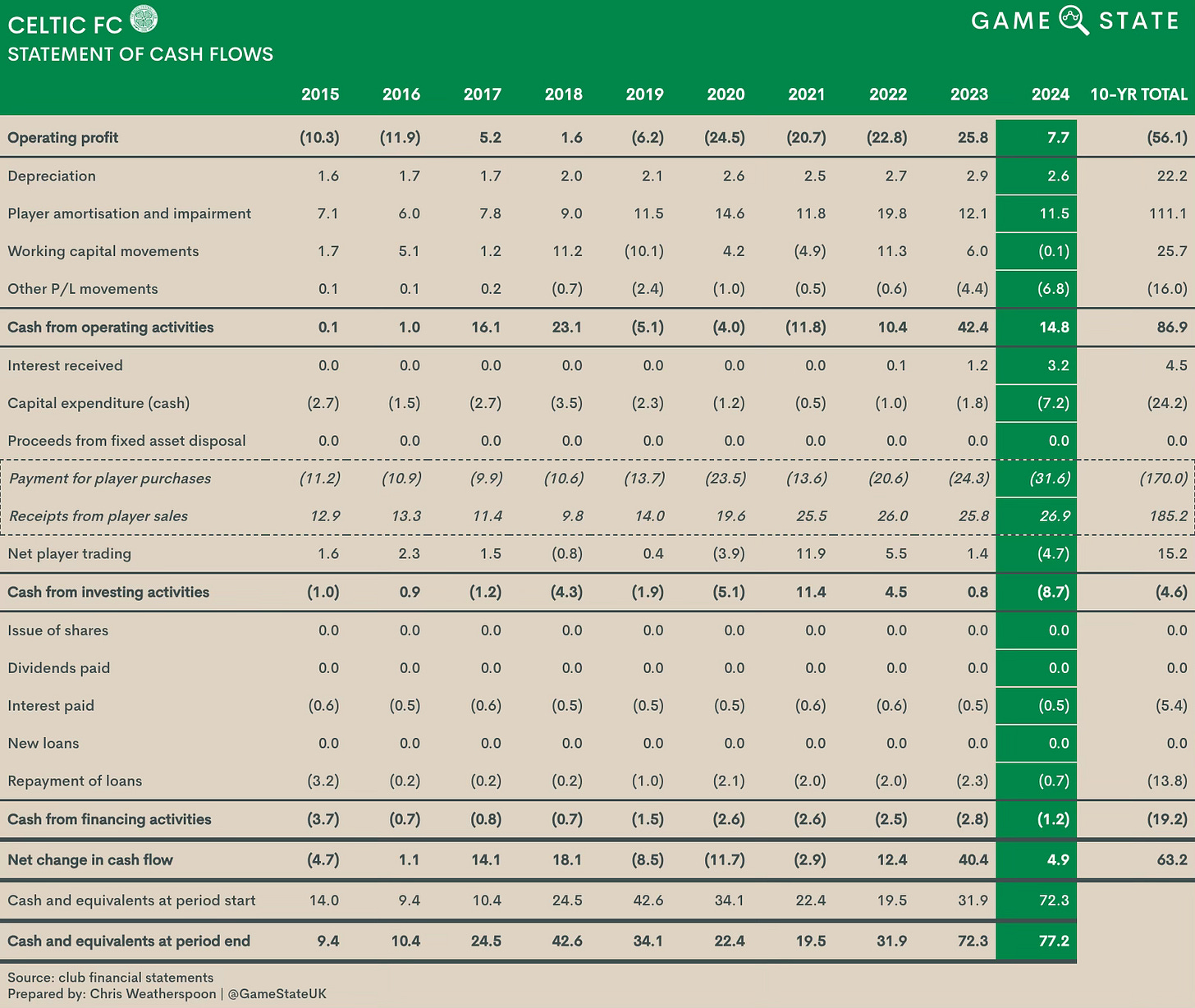

Cash flow

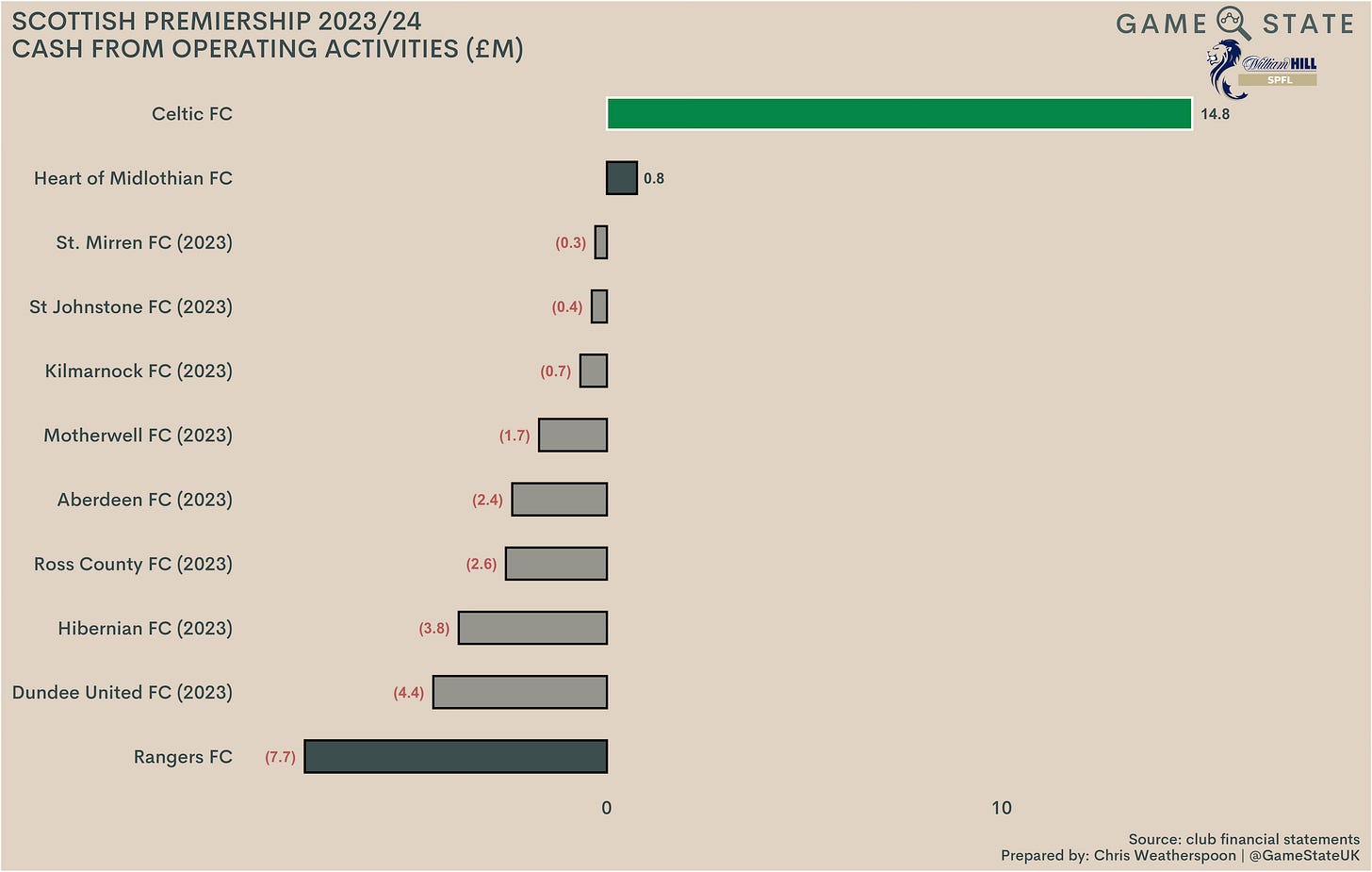

From a cash flow perspective, last season was the seventh time in the last decade Celtic have booked positive cash from operations. £15 million was the figure in 2024, down substantially on the £42 million of a year prior, but still a pretty healthy figure and one that confirms the club’s ability to stand on its own two feet - at least when Champions League football is present.

That £15 million positive operating cash flow was, by a long way, the best such result in the SPL, and represented a £23 million bettering of Rangers' £8 million cash losses from day-to-day activities. Aside from Celtic, only Hearts, at just £1 million, booked positive operating cash flow.

The impact of Champions League football is again starkly apparent here, with Celtic enjoyed positive cash flows for the last three years while Rangers have once again seen a drop-off.

Over the last decade, Celtic have received £102 million in cash inflows, split £87 million cash from operations and £15 million net receipts from player trading. In turn, that £102 million has been spent (or not spent) on:

Increasing the club’s bank balance by £63 million;

£24 million of capital expenditure on infrastructure projects;

£14 million in loan repayments; and

£1 million in net interest payments, inclusive of preference dividends.

The upshot of that is Celtic’s bank balance sat at £77 million at the end of June 2024, a huge figure for a football club and enough to pay off the club’s entire annual wage bill in one fell swoop.

That’s a curiously large amount of cash for a football club to be carrying, though those in charge have explained a couple of reasons for it. Non-executive chairman Peter Lawwell has pointed directly to the issue of Champions League football, or rather, the issues that would arise if Celtic weren’t to continue to compete in it, explaining in September 2023:

‘[Because of] the increasing gap between the sums able to be earned between the Champions League and the Europa League, it is vital that we retain a cash buffer in reserve. History tells us that we will not always qualify for the Champions League and the benefit of holding cash reserves affords us the optionality of managing through seasons where we participate in the Europa League with the ability to retain our squad as opposed to selling key players to bridge the income shortfall between both competitions.

As well, those cash reserves have been built up to enable Celtic to spend on capital projects without the need for debt financing. A key example is the redevelopment of the club’s Barrowfield training centre, work that has already commenced and formed a chunk of the £7 million capital expenditure in 2024.

That £7 million, which also included various maintenance projects at Celtic Park, was a significant increase on recent years, and more than double 2018’s most recent high. Celtic occupy a strange place in the football world in this regard. They boast a big stadium and need to ensure its modernity, and they also need to invest in their facilities to remain attractive to players that can help them compete better on the international stage. At the same time, their facilities outstrip nearly all of their domestic rivals and the more money they can put into improving the playing squad itself, the better the chances of them progressing in Europe.

In any case, that £7 million spend was double anyone else’s in Scotland last season, and the £24 million Celtic have spent on capex in the last decade is well ahead of most in the SPL.

Profit and Sustainability Rules (PSR)

The SPL doesn’t have any specific PSR/Financial Fair Play rules which its clubs must abide by and, even if it did, Celtic’s continued profitability would ensure they had no problems with compliance.

Where Celtic do have to ensure they remain within the rules is in regard to UEFA’s financial regulations, in the form of the governing bodies Football Earnings and Squad Cost rules (SCR). In the case of the former, the Football Earnings rule didn’t actually apply in 2023/24; of course, if it has, Celtic would have had no issues, as it’s a regulation focused on limiting club losses. For that reason there’s little point assessing the club’s position when it comes to 2024/25. Put simply, they’ll be fine.

They’ll also be fine in terms of SCR, but it’s worth assessing just how fine they both were and will be. Last season UEFA permitted clubs to spend 90 per cent of relevant income on relevant squad costs, being player and coaching staff salaries, transfer fee amortisation and impairment and agent fees.

We don’t have specifics on Celtic’s football-related salaries, but using a fairly standard guideline of 80 per cent allows us to calculate their SCR for 2023/24. Game State’s model projects that Celtic’s ratio was just 49 per cent last season, 41 per cent below UEFA’s allowed limit.

For this season, UEFA have reduced the permitted level to 80 per cent. That won’t be a problem for Celtic, particularly given their strong player trading in the summer, and Game State’s model estimates their SCR will actually drop to 46 per cent this season. In turn, that leaves them 34 per cent of headroom - a lot more than most will manage.

The future

At the time of writing, Celtic once more sit top of the SPL, unbeaten after 11 games having only dropped two points. More ominously for everyone else, The Bhoys have only shipped three league goals this season, two of those coming in a 2-2 draw with Aberdeen.

It is Aberdeen who joined The Hoops at the top of the table, with both sides unbeaten on 31 points; Rangers sit third, already nine points back and having enjoyed a chastening 0-3 loss at Celtic Park in early September.

In the transfer market, Celtic spent £31 million, breaking their transfer record twice on Idah and then Engels. Engels is believed to have cost £11 million (note that the table below draws from Transfermarkt.com values, some of which are understated), and has already bagged his first two Celtic goals. Last season’s star Matt O’Riley departed for £25 million to Brighton & Hove Albion but, as of yet, there’s little sign of his presence being too badly missed.

Most promising for Celtic this season is their solid start to the revamped Champions League. That 1-7 hammering in Dortmund wasn’t exactly fun, but beyond that they’ve picked up impressive results, and stand a very strong chance of qualifying for not only the first round play-off but the round of 16 too. With that would come more games and more money - and more opportunity to further increase the domestic advantage they’ve built in recent years.

Excellent piece. Really good. Small collection: the league is called the SPFL.